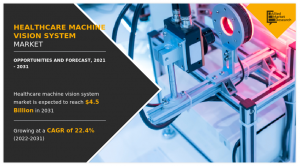

Healthcare Machine Vision System Market Projected to Garner Significant Revenues By 2031

Healthcare Machine Vision System Market Expected to Reach $4.5 Billion by 2031 — Allied Market Research

Get a PDF brochure for Industrial Insights and Business Intelligence @ https://www.alliedmarketresearch.com/request-sample/A11322

A machine vision system, also known as a computer vision system, is a computer-operated device that employs video cameras, digital signal processing, and analog-to-digital conversion based on applications. Machine vision can provide operational guidance to devices to perform acts based on the processing of images. For instance, machine vision can analyze health metrics to help users make better medical decisions. Furthermore, machine vision technology is widely applicable in the surgical and pharmaceutical sectors, owing to the increase in penetration of rapid prototyping technology and 3D modeling, which, in turn, has driven the demand for medical imaging such as CT and MRI.

The surge in the adoption of artificial intelligence (AI)-based technology & big data in healthcare, along with the rising demand for automation in healthcare applications and the increase in the adoption of personalized medicines, are some of the factors that drive the demand for machine vision systems in the healthcare sector. However, the shortage of skilled professionals is acting as a key deterrent factor in the market, which hampers early adoption in developing countries. Conversely, the adoption of cloud-based healthcare solutions is expected to provide lucrative opportunities for the expansion of the global healthcare machine vision industry during the forecast period.

According to the healthcare machine vision system market analysis, the smart camera segment was the highest contributor to the healthcare machine vision system industry in 2021. The smart camera and MV camera with host PC segments collectively accounted for around 85.2% market share in 2021.

The surge in cloud-based solutions fuels the growth of the smart camera segment, thereby strengthening the global machine vision system market growth.

Get a Customized Research Report @ https://www.alliedmarketresearch.com/request-for-customization/A11322

The COVID-19 outbreak has significantly impacted the global machine vision system in the healthcare sector. The surge in the adoption of advanced medical equipment in healthcare facilities across the world has propelled the growth of the healthcare machine vision system market trends. However, delays caused in production due to a lack of skilled technicians and raw material unavailability hampered the demand for machine vision technology. Furthermore, the pandemic forced various governments across the globe to adopt AI-based technology in the healthcare sector. Hence, the healthcare machine vision systems market is expected to witness prominent growth post-pandemic.

Region-wise, Asia-Pacific holds a significant share of the healthcare machine vision system industry. Asia-Pacific accommodates a major population of the globe. The adoption of vision-guided robotics systems in the healthcare sector is expected to propel the healthcare machine vision system market share in this region. Technological advancements in machine vision technology by prime vendors such as Teledyne DALSA Inc., OZRAY, and Machine Vision Lighting Inc., in Japan and South Korea, are anticipated to drive the healthcare machine vision system market growth in Asia-Pacific.

The key players profiled in the report include Baumer, Cognex Corporation, FLIR Systems, Inc., Basler, Keyence, Omron Corporation, Teledyne Group, TKH Group, and Sony Corporation. Market players have adopted various strategies such as product launch, collaboration & partnership, joint venture, and acquisition to strengthen their foothold in the healthcare machine vision system market.

Enquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A11322

About Us:

Allied Market Research is a top provider of market intelligence that offers reports from leading technology publishers. Our in-depth market assessments in our research reports take into account significant technological advancements in the sector. In addition to other areas of expertise, AMR focuses on the analysis of high-tech systems and advanced production systems. We have a team of experts who compile thorough research reports and actively advise leading businesses to enhance their current procedures. Our experts have a wealth of knowledge on the topics they cover. Also, they use a variety of tools and techniques when gathering and analyzing data, including patented data sources.

David Correa

Allied Market Research

+ + 1 800-792-5285

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Mexoryl SX (Ecamsule) Market Growth Drivers and Emerging Opportunities, 2031

Japan’s TOPIX Hits Historic High on Strong Earnings and U.S. Tariff Relief

Japan’s TOPIX Hits Historic High on Strong Earnings and U.S. Tariff Relief

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Farmacja

Nowy pakiet farmaceutyczny ma wyrównać szanse pacjentów w całej Unii. W Polsce na niektóre leki czeka się ponad dwa lata dłużej niż w Niemczech

Jeszcze pod przewodnictwem Polski Rada UE uzgodniła stanowisko w sprawie pakietu farmaceutycznego – największej reformy prawa lekowego od 20 lat. Ma on skrócić różnice w dostępie do terapii między krajami członkowskimi, które dziś sięgają nawet dwóch–trzech lat. W Unii Europejskiej wciąż brakuje terapii na ponad 6 tys. chorób rzadkich, a niedobory obejmują również leki ratujące życie. Nowe przepisy mają zapewnić szybszy dostęp do leków, wzmocnić konkurencyjność branży oraz zabezpieczyć dostawy.

Handel

Wzrost wydobycia ropy naftowej nie wpłynie na spadek cen surowca. Kierowcy jesienią zapłacą więcej za olej napędowy

Sierpień jest trzecim z rzędu miesiącem, gdy osiem krajów OPEC+ zwiększa podaż ropy naftowej na globalnym rynku; we wrześniu nastąpi kolejna zwyżka. Kraje OPEC, zwłaszcza Arabia Saudyjska, chcą w ten sposób odzyskać udziały w rynku utracone na skutek zmniejszenia wydobycia od 2022 roku, głównie na rzecz amerykańskich producentów. Nie należy się jednak spodziewać spadku cen ropy, gdyż popyt powinien być wysoki, a pod znakiem zapytania stoi dostępność ropy z Rosji. Nie zmienia to faktu, że jesienią ceny paliw na stacjach zazwyczaj rosną, a w największym stopniu podwyżki dotyczyć będą diesla.

Nauka

Szacowanie rzeczywistej liczby użytkowników miast dużym wyzwaniem. Statystycy wykorzystują dane z nowoczesnych źródeł

Różnica między liczbą rezydentów a rzeczywistą liczbą osób codziennie przebywających w Warszawie może sięgać nawet niemal pół miliona. Rozbieżności są dostrzegalne przede wszystkim w dużych miastach i ich obszarach funkcjonalnych. Precyzyjne dane populacyjne są tymczasem niezbędne w kształtowaniu usług społecznych i zdrowotnych, edukacyjnych, opiekuńczych, a także w planowaniu inwestycji infrastrukturalnych. W statystyce coraz częściej dane z oficjalnych źródeł, takich jak Zakład Ubezpieczeń Społecznych, są uzupełniane o te pochodzące od operatorów sieci komórkowych czy kart płatniczych.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|