Open-Angle Glaucoma Market to Hit USD 9.39 Billion by 2032, Driven by CAGR 10.4% From 2025 to 2032

Open-Angle Glaucoma Market size is expected to grow at a CAGR of 6.5% from 2025 to 2032, reaching nearly USD 9.39 Billion by 2032.

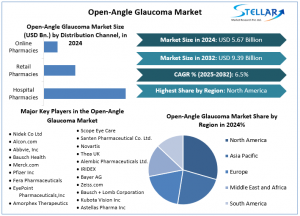

The Open-Angle Glaucoma Market was valued at USD 5.67 billion in 2024 and is expected to grow at a CAGR of 6.5% during the forecast period, reaching nearly USD 9.39 billion by 2032. The market is primarily driven by the increasing prevalence of glaucoma, a rapidly aging global population, and rising awareness of early diagnosis and treatment. Developments in new delivery systems for drugs, increased uptake of minimally invasive glaucoma surgeries (MIGS), and increased access to digital diagnostics will help to formulate the competitive landscape.

Open-Angle Glaucoma Market Overview

Open-Angle Glaucoma (OAG) is the most common form of glaucoma, representing over 80% of cases worldwide. OAG is characterized by progressive optic neuropathy and increased intraocular pressure (IOP), and is frequently asymptomatic until later stages of the disease, so regular screening and early detection are crucial in preventing irreversible vision loss. Treatment of OAG largely focuses on IOP reduction using pharmacologic and non-pharmacologic treatments. First-line treatments include prostaglandin analogues (PGAs), beta blockers, and fixed-dose combination (FDC) therapies. The introduction of sustained-release implants, AI-based diagnostic tools, and laser therapies is an increasingly established pathway of care for patient treatment.

In this press release, Stellar Market Research provides coverage of what will be incorporated into their extensive study to assess value chain optimization, changes in regulatory policies, and important macroeconomic factors affecting the Open-Angle Glaucoma Market. This study will include an assessment of current therapeutic pipelines, as well as clinical advancement trends, along with inter-regional investment patterns.

To know the most attractive segments, click here for a free sample of the report: https://www.stellarmr.com/report/req_sample/Open-Angle-Glaucoma-Market/1718

Open-Angle Glaucoma Market Dynamics

Drivers

The global burden of glaucoma is increasing steadily, with around 76 million people affected worldwide in 2024, and it is anticipated to exceed 110 million by 2040. With the aging population, especially in North America, Europe, and Asia-Pacific, the demand for glaucoma management over the long term is becoming ever more pronounced.

Emerging technology, including AI-assisted visual field analysis, non-invasive diagnostic techniques (such as OCT angiography), and favourable drug delivery methods (including punctal plugs and microdose applicators), will give greater precision to clinicians and improve patient compliance.

Action from policymakers and governments to promote early detection through national awareness initiatives is lifting awareness and early identification reverberations. In countries such as India and Brazil, government efforts to enhance the quality of ophthalmology infrastructure are helping narrow the gap in diagnosis.

Restraints

Patient adherence to treatment remains low amidst medical advancements, as early-stage glaucoma is predominantly asymptomatic, and there are side effects associated with the chronic use of medication prescribed. Moreover, the cost of newer therapies is higher than what patients or their insurance company may be used to in the developing economy, and because of limited insurance coverage, the uptake is restricted.

Clinical regulatory bottlenecks, including the lengthy drug development process for FDA and EMA approvals of new drugs and implants, can result in delays in market entry for new medications. And finally, there are global recalls due to contamination or side effects that cause disruptions in the supply chain.

Opportunities

Emerging markets in Southeast Asia, Latin America, and Africa are full of underutilized potential. Improvements to health care infrastructure and income levels are giving rise to populations more attuned to the health impacts of health care systems that can now access them. Pharmaceutical companies are working with local hospitals and making strides in patient engagement.

Innovations in AI-based image diagnostics, teleophthalmology and mobile health apps are fundamentally disrupting the way we monitor glaucoma, particularly in more remote areas. Ongoing progress is also being made toward sustained drug delivery systems such as biodegradable implants, and ocular ring inserts.

Challenges

A considerable percentage of cases of glaucoma remain undocumented because of general underdiagnosis founded by a lack of regular eye exams in lower-income countries. The identification of glaucoma can be less reliable because of diagnostic ambiguity, the lack of ophthalmologists to correctly identify issues, and public knowledge and awareness.

Manufacturers of treatment also face pressure not only to produce effective treatments but treatments which offer some flexibility for the patient in terms of dosing, labelling treatment, easy to monitor side-effects, and affordability. The balance between innovation and accessibility is challenging, particularly when tackling high-burden diseases with high burden regions and operation under resource-scarce conditions.

Open-Angle Glaucoma Market Segmentation

By Treatment Type

Prostaglandin Analogs (PGAs)

Beta Blockers

Alpha Adrenergic Agonists

Carbonic Anhydrase Inhibitors

Fixed-Dose Combinations (FDCs)

Others

PGAs are still driving the market share on account of proven efficacy and low systemic side effects. FDCs will be increasingly adopted in place of PGAs in order to improve compliance, which may be a concern as regulators also note the number of pills patients take and treatment complexity associated with regimens..

By Disease Type

Open-Angle Glaucoma (OAG)

Angle-Closure Glaucoma (ACG)

Others

Ocular hypertension and primary open-angle glaucoma account for the majority of market share, since both conditions are common and require lifelong management. If diagnosed early, medical management may be employed in advanced cases or surgical management.

By Distribution Channel

Hospital Pharmacies

Retail Pharmacies

Online Pharmacies

Retail pharmacies are leading the market, as there is an increasing number of outpatient treatment settings, and patients prefer "in-person" treatment where possible. Online channels are emerging and growing rapidly, mainly as patients are adopting and familiarising themselves with the digital marketplace and the convenience it brings, particularly in urban markets.

Open-Angle Glaucoma Market Regional Insights

North America

North America remains the largest region, benefiting from high healthcare expenditure and awareness, as well as the overall level of diagnostics available. The United States has over 3 million people with glaucoma, the second leading cause of blindness in the country. Tele-ophthalmology and AI-assisted screenings are improving access amongst rural and underserved groups.

Major pharmaceutical companies in the region, such as Alcon, AbbVie, & Bausch + Lomb, are firmly entrenched, with R&D pipelines focused on improving outcomes for individuals with previously difficult-to-manage chronic ophthalmologic conditions, and insurance coverage for these interventions.

Asia-Pacific

The Asia-Pacific region is experiencing very high growth and a relative CAGR of 9% over the forecast period. The rising geriatric populations of China, India, and Japan, and increasing government interest in the provision of retinal care are strong growth drivers in the region. Compounded by low manufacturing costs and favorable investment environments for medical devices and generics that are accessible to the population. AI-based screening models, such as Orbis International's initiatives, are expanding access for rural clinics and mobile health.

Europe

Europe is emphasizing early diagnosis, sustainability, and biosimilars. Countries such as Germany, the UK, and France are publicly pursuing national glaucoma registries and the uptake of digital health records to improve monitoring.

Government interest geared towards the entry of biosimilars and sustainable procurement processes is stimulating the uptake of a lower-cost treatment alternative.

To know the most attractive segments, click here for a free sample of the report: https://www.stellarmr.com/report/req_sample/Open-Angle-Glaucoma-Market/1718

Recent Developments

In January 2024, Orbis International announced a national AI-enabled glaucoma screening program in Vietnam to increase capacity in underserved areas.

In March 2024, Alcon announced new wavefront-shaping lens technology that can be used to potentially combine glaucoma treatment and presbyopia correction.

Companies are making many investments in long-acting implants, non-invasive lasers, and smart drug delivery platforms to improve outcomes and adherence.

Open-Angle Glaucoma Market Competitive Landscape

The Open-Angle Glaucoma Market is moderately consolidated, with global and regional players actively engaged in R&D, mergers, and strategic partnerships to expand their footprint.

Key Players Include:

Alcon

AbbVie Inc.

Bausch Health Companies Inc.

Novartis AG

Pfizer Inc.

Merck & Co., Inc.

Santen Pharmaceutical Co., Ltd.

EyePoint Pharmaceuticals, Inc.

Alembic Pharmaceuticals

Astellas Pharma Inc.

Bayer AG

IRIDEX Corporation

Zeiss Group

Thea Pharma, Inc.

LG Chem

Kubota Vision Inc.

Fera Pharmaceuticals

Amorphex Therapeutics

Scope Eye Care

These companies are focusing on pipeline development, expanding regional operations, and launching AI-integrated solutions to improve disease management and widen patient access.

Related Reports:

Biosimilar Market: https://www.stellarmr.com/report/biosimilar-market/2759

Red Clover Market: https://www.stellarmr.com/report/red-clover-market/2745

Liraglutide Market: https://www.stellarmr.com/report/liraglutide-market/2691

Veterinary Pain Management Market: https://www.stellarmr.com/report/veterinary-pain-management-market/2682

Vertigo Treatment Market: https://www.stellarmr.com/report/vertigo-treatment-market/2681

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

sales@stellarmr.com

Lumawant Godage

Stellar Market Research

+91 96073 65656

email us here

Visit us on social media:

LinkedIn

Instagram

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Perekonomian Indonesia Melaju, Rasa Optimistis Meredup: 'Vibecession' di Depan Mata

Wilson Partners to Host 'Fit to Fund' Event, Empowering Cambridge Start-ups to Become Investor-Ready

The Non-Hormonal Niche: Contraceptive Sponge Market to Reach US$ 265.2 M by 2035 Amidst Shifting Preferences

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Finanse

K. Gawkowski: Polska w cyfrowej transformacji gospodarki awansowała do pierwszej ligi w Europie. 2,8 mld zł z KPO jeszcze ten proces przyspieszy

Uruchomiony na początku lipca przez Ministerstwo Cyfryzacji i BGK program „KPO: Pożyczka na cyfryzację” cieszy się dużym zainteresowaniem. Samorządy, uczelnie oraz firmy mogą wnioskować o wsparcie finansowe dla inwestycji w transformację cyfrową, m.in. modernizację infrastruktury czy cyberbezpieczeństwo. W sumie na ten cel trafi 2,8 mld zł (650 mln euro). Ze względu na krótki czas naboru obie instytucje organizują w poszczególnych województwach warsztaty dla wnioskodawców, które mają rozwiać ich wątpliwości przy przygotowywaniu wniosków.

Prawo

Koszty certyfikacji wyrobów medycznych sięgają milionów euro. Pacjenci mogą stracić dostęp do wyrobów ratujących życie

Od 2027 roku wszystkie firmy produkujące wyroby medyczne w Unii Europejskiej będą musiały posiadać certyfikat zgodności z rozporządzeniem MDR (Medical Devices Regulation). Nowe przepisy wprowadzają dużo ostrzejsze wymagania w zakresie dokumentacji, badań klinicznych oraz procedur certyfikacyjnych. Branża ostrzega, że część małych i średnich producentów nie zdąży się dostosować. Problemem jest także wysoki koszt i długi czas uzyskiwania certyfikatów. W konsekwencji z rynku mogą zniknąć urządzenia ratujące życie.

Infrastruktura

Nowe przepisy o ochronie ludności cywilnej wprowadzają obowiązkowe elastyczne zbiorniki na wodę. Mają one służyć w razie suszy, pożarów czy wybuchu wojny

Samorządy będą musiały posiadać m.in. elastyczne zbiorniki na wodę pitną i przenośne magazyny wody przeciwpożarowej. To element odpowiedniego przygotowania zasobów na wypadek sytuacji kryzysowych, kataklizmów czy wybuchu konfliktu, wprowadzony nowymi przepisami o ochronie ludności. Eksperci podkreślają, że tego typu rozwiązania to innowacyjne produkty, które nie tylko ułatwiają logistykę w sytuacjach kryzysowych, ale także mogą znacząco skrócić czas reakcji służb ratunkowych.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|