Accounts Payable Services See Uptick Amid Back-Office Strain

Discover how IBN Technologies’ accounts payable services empower businesses with efficient payment workflows and complete accounts receivable solutions.

MIAMI, FL, UNITED STATES, August 11, 2025 /EINPresswire.com/ -- Strained back-office functions and increased invoice complexity are driving a renewed focus on operational clarity and cost containment. Finance leaders are reassessing internal capacity in light of evolving vendor demands, compliance requirements, and invoice management challenges. In response, many are seeking structured Accounts Payable Services to improve transparency, reduce delays, and gain better oversight of financial workflows.Organizations that once relied on fragmented systems are now opting for integrated solutions that minimize processing errors and reduce the administrative burden on internal teams. Demand extends across business sizes, with both mid-market and enterprise-level firms pursuing services that offer accuracy, consistency, and financial governance. Support from providers such as companies like IBN Technologies plays a central role in enabling this transition. Their expertise in accounts payable operations allows finance departments to stay audit-ready, limit cost leakage, and maintain control over complex payment structures.

Improve operational flow through receivables management and collection accuracy

Get a Free Consultation: https://www.ibntech.com/free-consultation-for-ap-ar-management/

Industry Challenges Undermining In-House AP/AR Operations

The evolving finance landscape presents several persistent challenges for internal AP/AR teams:

1. Manual invoice handling delays approvals and payments

2. Lack of visibility into vendor payment cycles affects cash flow

3. Errors in reconciliation increase compliance risks

4. Fragmented systems create inconsistent reporting

5. Limited resources restrict timely follow-ups and ledger maintenance

Outsourced AP/AR Solutions Offer Reliable Support

IBN Technologies addresses these issues by offering businesses a fully-managed accounts payable system that integrates seamlessly with existing ERP platforms. By automating repetitive workflows and enforcing process compliance, the firm helps finance departments move away from reactive firefighting and toward proactive planning.

Its outsourced accounts payable services include invoice digitization, 3-way matching, payment processing, vendor communication, and reconciliation—all managed by a dedicated team with domain expertise. In parallel, IBN’s accounts receivable solution encompasses order-to-cash support, customer follow-ups, dispute management, and collections analysis, allowing businesses to keep receivables in check.

✅ Tailored receivables strategies aligned to factory billing cycles

✅ Customer service teams manage dispute resolution with a client-first approach

✅ Ledger reviews enhanced through live transaction tracking

✅ Cross-functional reporting tools aid faster business decisions

✅ Collection workflows include standardized vendor billing protocols

✅ Third-party review strengthens internal financial forecasting

✅ Daily summaries deliver timely payment status updates

✅ Remote AR professionals equipped with manufacturing knowledge

✅ Collections efforts supported by authenticated customer records

✅ Dedicated experts oversee end-to-end receivables operations

A hallmark of the company’s model is transparency. Clients benefit from customized dashboards, structured daily reports, and ongoing analytics. These real-time updates enable finance leaders to make informed decisions, reduce DSO (Days Sales Outstanding), and align vendor management with enterprise financial goals.

Whether clients operate in manufacturing, healthcare, logistics, or retail, the company tailors its accounts payable process to match industry-specific billing protocols and reporting obligations.

Receivables Performance Elevated in Ohio Manufacturing

Ohio-based manufacturers are enhancing cash flow predictability by partnering with external receivables specialists. Delegating collections and receivables management has allowed teams to transition from routine follow-ups to higher-level financial planning.

✅ Working capital improved by 30%, accelerating procurement and restocking processes

✅ On-time customer payments increased 25%, minimizing delinquencies and bad debt

✅ AR departments recovered 15 hours weekly for strategic reviews and internal controls

These improvements underscore how structured receivables oversight enhances financial operations across manufacturing setups. IBN Technologies offers outsourced accounts receivable services tailored to large-scale receivables management for Ohio’s industrial sector.

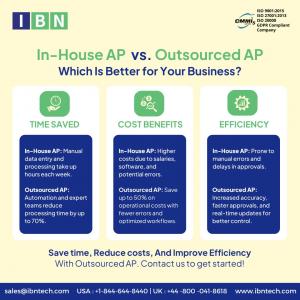

Why Outsourcing AP/AR Management Makes Business Sense

Outsourcing AP/AR functions to a trusted service partner offers numerous benefits:

1. Reduces operational costs by eliminating manual processes

2. Improves turnaround time through workflow automation

3. Enhances financial accuracy with real-time data and reconciliations

4. Frees internal staff for analysis and decision-making

5. Scales easily with business growth and seasonal demand

Transforming Finance Operations Through Strategic Partnership

As enterprises aim to streamline back-office operations and focus on core growth areas, IBN Technologies’ tailored accounts payable services stand out for their reliability, scalability, and transparency. The firm’s focus on delivering measurable financial results has made it a preferred partner for organizations seeking to eliminate inefficiencies and improve supplier relations.

With access to real-time tracking and trained offshore specialists, businesses report lower overhead costs and stronger financial controls across locations.

As financial workflows grow more complex, outsourcing is poised to become the go-to strategy for finance transformation. IBN Technologies remains committed to delivering forward-thinking accounts payable solutions that help businesses maintain agility, improve compliance, and strengthen liquidity.

Related Service:

1. AP and AR Automation Services: https://www.ibntech.com/ap-ar-automation/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 26 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Content Disarm and Reconstruction Market Reach USD 1.4 Billion by 2032 Growing at 18.3% CAGR Globally

Canyon State RV & Camper Shells LLC Expands Offerings with Decked Cargo Systems

From local to international: ESHK Hair Celebrates 20 Years of Creative Hairdressing with Anniversary Event in London

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Ochrona środowiska

A. Bryłka (Konfederacja): Ograniczenie emisyjności nie musi się odbywać za pomocą celów klimatycznych. Są absurdalne, nierealne i niszczące europejską gospodarkę

W lipcu br. Komisja Europejska ogłosiła propozycję nowego celu klimatycznego, który zakłada ograniczenie emisji gazów cieplarnianych o 90 proc. do 2040 roku w porównaniu do stanu z 1990 roku. Został on zaproponowany bez zgody państw członkowskich, w przeciwieństwie do poprzednich celów na 2030 i 2050 rok. Polscy europarlamentarzyści uważają ochronę środowiska i zmiany w jej zakresie za potrzebne, jednak nie powinny się odbywać za pomocą nieosiągalnych celów klimatycznych.

Polityka

Dramatyczna sytuacja ludności w Strefie Gazy. Pilnie potrzebna dobrze zorganizowana pomoc humanitarna

Według danych organizacji Nutrition Cluster w Strefie Gazy w lipcu br. u prawie 12 tys. dzieci poniżej piątego roku życia stwierdzono ostre niedożywienie. To najwyższa miesięczna liczba odnotowana do tej pory. Mimo zniesienia całkowitej blokady Strefy Gazy sytuacja w dalszym ciągu jest dramatyczna, a z każdym dniem się pogarsza. Przedstawiciele Polskiej Akcji Humanitarnej uważają, że potrzebna jest natychmiastowa pomoc, która musi być dostosowana do aktualnych potrzeb poszkodowanych i wsparta przez stronę izraelską.

Polityka

Wśród Polaków rośnie zainteresowanie produktami emerytalnymi. Coraz chętniej wpłacają oszczędności na konta IKE i IKZE

Wzrosła liczba osób, które oszczędzają na cele emerytalne, jak również wartość zgromadzonych środków. Liczba uczestników systemu emerytalnego wyniosła w 2024 roku ponad 20,8 mln osób, a wartość aktywów – 307,5 mld zł – wynika z najnowszych danych Urzędu Komisji Nadzoru Finansowego (UKNF). Wyraźny wzrost odnotowano w przypadku rachunków IKE i IKZE, na których korzyść działają m.in. zachęty podatkowe. Wpłacane na nie oszczędności są inwestowane, a tym samym wspierają gospodarkę i mogą przynosić atrakcyjną stopę zwrotu.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|