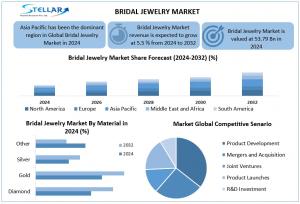

Bridal Jewelry Market Size Projected To Reach USD 66.33 Billion by 2032, at a CAGR of 5.5% To Forecast 2032

Global Bridal Jewelry Market was valued at USD 53.79 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2032

"Bridal Jewelry: Where timeless tradition meets modern elegance" aptly summarizes the experience surrounding wedding Jewelry. The connection of cultural identity with an experience that is modern day facilitates an important representation of love, heritage, and individuality, both functionally and symbolically behind which brides can announce their sophistication and meaning on their wedding day."

Bridal jewelry refers to ornamental pieces such as rings, necklaces, bracelets, and earrings worn by brides during wedding ceremonies. These pieces often hold cultural significance, are symbols of commitment and prosperity, and enhance the bride’s personal style. Modern trends emphasize customization, ethical sourcing, and timeless elegance, transforming bridal jewelry from traditional sets into meaningful investments.

The global bridal jewelry market is witnessing a robust transformation. Demand for bespoke, premium, and symbolic jewelry is surging as consumers seek personalized statements that reflect love stories and values. However, counterfeit jewelry and volatile gold prices present ongoing challenges.

About the Bridal Jewelry Market

Bridal jewelry is among the most lucrative sectors of the fine jewelry market. In regions such as India, the Middle East, and East Asia where ceremonial value is strong, combined with continuing increases in marriage rates and rising wealth, the luxury and significance of the materials used in wedding jewelry remains intact. New technology such as 3D printing, lab-grown diamonds, and AI-enhanced design are also re-inventing this category through co-creation, providing consumers the opportunity to produce pieces that fit their design aesthetics, ethics, and cost - bringing artisanal design and contemporary practice together.

Discover In-Depth Insights: Get Your Free Sample of Our Latest Report Today@ https://www.stellarmr.com/report/req_sample/bridal-jewelry-market/2635

Strategic Collaborations and Innovations Shaping Bridal Jewelry Market

Bridal jewelry refers to decorative items like rings, necklaces, bracelets, and earrings that can be worn by brides at wedding ceremonies. Jewelry items such as rings often have cultural significance, as well as acting as tokens of commitment and prosperity, while others are also chosen to flatters the bride’s personal style. Current jewelry trends focus on customizability, sustainability, and timelessness, thereby transforming traditional bridal jewelry, normally in sets, into a valuable investment with meaning. The bridal jewelry segment of the global jewelry market is undergoing gigantic transformations. As the consumer demand is for custom, high-quality jewelry with a story, they want to showcase love and that they matter to them in today's reproduction jewelry world of fake jewelry for their wedding or special day. Additionally, the jewelry market continues to face challenges regarding counterfeiting of branded jewelry and volatile gold prices.

The jewelry market segment benefits from strategic partnerships across the value chain in jewelry from raw material providers to design studios and retail environments. Working with ethical diamond suppliers, technology providers, and leading brands to develop lab-grown options to return to transparent pricing and customizable options are great starts to expand customer reach and find affordability.

Of these partnerships, engagement in the e-commerce sector and customer experience will be transformative to consumers shopping for wedding and special jewelry. Brands are heavily investing in digital showrooms, augmented reality for try-ons, virtual consultations, and streaming or socially engaging temporal strategies. These investments, as well as personalized interactions and smart logistics options, can help the jewelry sector target younger audiences of Millennials and Zoomers, and eliminate traditional brick-and-mortar retail requirement.

Bridal Rings and Necklaces Dominate Bridal Jewelry Market Share

Based on type, the market is segmented into rings, necklaces, bracelets, and earrings.

Bridal rings represent the most purchased product category at nearly 35% of the market due to their symbolic value associated to engagements and weddings. Although precious stones such as diamonds, sapphires, and emeralds are currently adopted by new bridal trends, platinum and white gold are favored due to their durability and refinement.

Necklaces are next in line at 30% of bridal jewelry due to their traditional and ceremonial uses especially in South Asia and the Middle East. However beautiful necklaces made of gold, diamonds, or gemstones are still considered traditional wedding jewelry and a key part of the bridal trousseau.

Earrings (approximately 20%) and bracelets (approximately 15%) are generally considered important elegant balance to complete the bridal look, as they are generally chosen for the bridal gown however schemingly selected.

Based on distribution channel the bridal jewelry market is segmented by online, chain stores, and others, which include independent designers and independents and is seeing substantial changes in consumer behavior. Online retail is now the largest share of total sales at 28%, and is the fastest-growing segment. Canadians are increasingly drawn to online shopping for bridal jewelry in particular because of the convenience, price transparency, and many different designs available with small- and mid-size independent businesses. This split in the market captures consumers' desire for customization and jewelry that carries unique meanings with respect to different people's tastes and values. Companies in the bridal jewelry market are seizing on this change and are starting to utilize technology in the way of Augmented Reality (AR) tools or virtual concierge style services that allow the consumer to visualize how a piece will look in real time, receive recommendations in a personalized manner, and enjoy a higher level of the shopping experience. The digital disruption of the bridal jewelry retail sector has led to a more accessible shopping experience, but is also changing the way Canadians interact with luxury and sentimental purchases.

Chain retailers carry greater than 50% of market share with brand assurances, warranties, and consultations; chain retailers attract business particularly in saturated/mature markets, such as North America and Europe. Independent designers and independent boutiques (22%) have been able to carve out a small position in niche and high-end markets. In general, independent designers propose handcrafted and custom pieces, often of artistic or cultural value.

Discover In-Depth Insights: Get Your Free Sample of Our Latest Report Today@ https://www.stellarmr.com/report/req_sample/bridal-jewelry-market/2635

Asia-Pacific Leads Global Bridal Jewelry Market with 40% Market Share

The Asia-Pacific region is the largest and fastest growing market for bridal jewelry and expected to hold over 40% of the market share until at least 2032. India is the main market, where gold jewelry plays an essential part in marriage, and a continued demand based on cultural factors, traditions, and rising income levels. Both China and Southeast Asia have increasing demand for diamonds and a modern bride's experience.

North America accounts for nearly 25-28% of the global share for bridal jewelry. The growth of the industry is largely driven by high consumer spending, preference for lab grown diamonds over real diamonds, and the consumer demand for sustainability. Companies like Blue Nile and James Allen implementing digital-first brand strategies instead of traditional retail-centered strategies are impacting the industry and consumer buying habits.

Europe accounts for nearly 20% of the global market for bridal jewelry. Growth in Europe is driven mainly by strong heritage brands and strong fashion-minded consumers, increasing consumption of non-traditional bridal product styles. Companies in Germany, France, and the UK are the leading contributors to this market size.

Middle East & Africa is a high demand market for gold jewelry (especially in the GCC), with the combination of customs and very big weddings contributing to addressing the demands in this market. South America is experiencing moderate demand growth, attributed to continuing urbanization and rising levels of middle-class incomes in countries like Brazil and Argentina.

Mergers and Acquisitions Redefine Competitive Landscape

Tiffany & Co. has increased its global reach since January 2021, thanks to their sustainable sourcing efforts and, as of mid-2022, blockchain-based diamond traceability systems designed to provide greater transparency and customer confidence. Tiffany's parent company is LVMH.

Also, in Asia, Chow Tai Fook took its market position further since 2020 by increasing their internal operations down the supply chain, investing in omnichannel strategies as an update from traditional retail, upgrading from smart retail stores in 2019 through mixes of digital and brick-and-mortar stores until now.

In August 2022, Signet Jewelers completed the acquisition of Blue Nile for $360 million with the goal of better integrating their mostly305 brick-and-mortar strategy with Blue Nile's digital strategy so that could offer a best-in-class omni-channel bridal jewelry experience.

In 2023, Pandora launched new bridal lines made from 100% recycled silver and gold, along with piloting AI tools for selecting customizations in selected European and North American markets to create a unique bridal jewelry purchase experience.

Recent Developments

In May 2023, Cartier unveiled its digital hub for bridal clients that provides interactive design consultations with master artisans, thereby enhancing luxury personalization in the online environment.

Tanishq, a Tata Group company, has officially launched in the UAE market in late 2022, followed by its expansion to North America in early 2023 with bridal collections that are created for each region's culture, also taking into consideration local customization preferences.

In 2022, BlueStone launched its Augmented Reality (AR) try-on technology, allowing clients to virtually try on some bridal jewelry as a way not only to increase personalization but also notably allow them to reduce their return rates.

In Q1 of 2023, Malabar Gold & Diamonds launched its blockchain-backed ethical sourcing platform that is singled out as game changing towards transparency and responsible practices while procuring gold at all of their global operations.

In mid-2023, Swarovski partnered with major digital influencers to launch a limited-edition bridal collection that was created by AI with the goal of attracting Gen Z consumers through its tech-oriented, trend-driven innovation.

Related Reports:

Luxury Jewelry Market: https://www.stellarmr.com/report/req_sample/Luxury-Jewelry-Market/1835

Pearl Jewelry Market: https://www.stellarmr.com/report/Pearl-Jewelry-Market/1882

Hair Extension Market: https://www.stellarmr.com/report/Hair-Extension-Market/2084

Hair Color Spray Market: https://www.stellarmr.com/report/Hair-Color-Spray-Market/2083

Diaper Rash Cream Market: https://www.stellarmr.com/report/Diaper-Rash-Cream-Market/2043

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

sales@stellarmr.com

Lumawant Godage

Stellar Market Research

+91 9607365656

email us here

Visit us on social media:

LinkedIn

Instagram

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Surgical Instruments Packaging Market to Hit USD 51,349 Million by 2035, Driven by Sterility & Safety Demands | FMI

Global Construction Toys Market Set For 8.6% Growth, Reaching $16.45 Billion By 2029

Corporate Training Market Analysis: Key Trends, Share, Growth Drivers, And Forecast 2025-2034

Kalendarium

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Handel

Branża materiałów budowlanych ostrzega przed rosnącym importem ze Wschodu. Rząd zapowiada działania w tym kierunku

Polscy przedstawiciele branży materiałów budowlanych są zaniepokojeni skalą importu wyrobów spoza Unii Europejskiej. Postępujące uzależnienie europejskiego rynku od dostaw z krajów o niższych standardach środowiskowych, pracowniczych i jakościowych skutkuje nie tylko osłabieniem jego konkurencyjności, spadkiem krajowej produkcji i redukcją miejsc pracy, ale również ucieczką emisji CO2. Branża apeluje więc o wprowadzenie zmian w zakresie handlu, w tym o wyrównanie stawek celnych na materiały budowlane. Rząd zapowiada podjęcie działań, które będą wspierać krajową branżę.

Ochrona środowiska

Rusza ważna inwestycja w Ustce. Nowa baza będzie zapleczem serwisowym dla morskich farm wiatrowych [AUDIO]

Wystartowały prace przy budowie bazy operacyjno-serwisowej w Ustce. Inwestycja będzie zapleczem dla obsługi morskiej farmy wiatrowej, którą PGE buduje na Bałtyku wraz z duńską firmą Ørsted. Uruchomienie Baltica 2 zaplanowane jest na 2027 rok. Baza ma także potencjał, by obsługiwać kolejne projekty morskie PGE. Będzie mieć znaczenie nie tylko dla rozwoju offshore w Polsce, lecz także dla samego regionu.

Handel

Rynek nieprzygotowany do wdrożenia systemu kaucyjnego. Może się opóźnić nawet o kilka miesięcy

Zdaniem przedstawicieli Polskiej Federacji Producentów Żywności Polska nie jest jeszcze przygotowana na wprowadzenie systemu kaucyjnego 1 października br. Za główny powód opóźnień podają brak licencji, które mogą powodować potężne straty finansowe. Eksperci wskazują, że system może ruszyć z kilkumiesięcznym opóźnieniem, co spowoduje chaos zarówno wśród konsumentów, jak i w handlu.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

![Rusza ważna inwestycja w Ustce. Nowa baza będzie zapleczem serwisowym dla morskich farm wiatrowych [AUDIO]](https://www.newseria.pl/files/1097841585/dsc-4621small_1,w_85,_small.jpg)

.gif)

|

| |

| |

|