Commercial Property Values almost Triple Compared to Residential Values in Bell County for 2025

O'Connor discusses how commercial property values almost triple compared to residential values in Bell County for 2025.

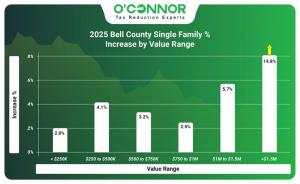

KILLEEN, TX, UNITED STATES, May 15, 2025 /EINPresswire.com/ -- Tax Appraisal District of Bell County has released proposed noticed values for property tax assessments in 2025. During the 2025 property tax reassessment in Bell County, about 38% of homes were overvalued — an improvement from 42% in 2024. While this reflects some progress, a significant portion of homes are still assessed above market value. Overall, residential property values rose by 3.6%, with high-value homes facing the greatest impact. In contrast, commercial properties experienced a sharper rise, with values growing by 9.9%.Bell County Residential Assessments Averaged by 3.6%

As reported by the Tax Appraisal District of Bell County, the graph displays property tax assessments by value range in Bell County. The graph illustrates that lower value homes saw minimal or low increases; however, high-value homes saw larger increases. Houses valued at over $1.5 million saw the largest increase of 14.8%, growing from $920 thousand to $1 million in 2025. Homes valued at $250k or less had the lowest growth of only 2.0%. Other notable increases was seen in houses valued between $1 million to $1.5 million with 5.7%.

In Bell County, property values per square foot increased with home size, with larger homes experiencing the greatest increases. Homes between 2,000 and 3,999 square feet saw a slight increase of 3.1%, slightly lower than houses measuring less than 2,000 square feet (4.0%). Meanwhile, those over 8,000 square feet increased the most by 13.1%. The total market value from 2024 to 2025 rose from $34 billion to $35.2 billion.

According to the Tax Appraisal District of Bell County, several homes according to the construction date faced declines in assessment values for 2025. Houses built between 1981 to 2000 and 2001 to 2020 both declined by 0.2%. The lowest value increase was seen in homes built between 1961 to 1980 with 0.8%. However, residences built in 2021 and above saw a high increase in assessments of 28.6%, growing from $3.6 billion to $4.7 billion.

Improvements in the housing market from 2024 to 2025

In 2025, the Tax Appraisal District of Bell County overvalued 38% of homes in the county compared to 42% in 2024. In the past year, only 2,352 houses were overvalued. This new report indicates an improvement in market values for homeowners; however, that is still a large number of homeowners who are assessed unfairly. Compared to 2024, 62% of houses or 3,855 accounts were valued at or below market in 2025.

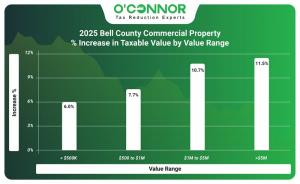

Commercial Property in Bell County Increased the Greatest in 2025

Commercial property tax assessments in Bell County show that as the value range increased so did the assessment increases. In other words, the higher the value of the properties, the greater the assessment increases. For properties valued at $5,000 or less, assessments only increased by 6%. In contrast, properties worth over $5 million increased the greatest by 11.5%, from $4.2 billion to $4.7 billion.

For the 2025 tax year, the Tax Appraisal District of Bell County raised the market values across all different types of commercial properties. The largest increases were seen in warehouses with 24.5% and with a 2025 notice market value of $1.5 billion. Apartments also had a notable increase of 10.2%, from $1.6 billion to $1.7 billion. Retail property experienced the lowest increase of 5.9%.

Commercial property assessments for 2025 by the Tax Appraisal District of Bell County increased across all construction years. Properties built in 2021 or later saw the largest rise, with a 76% increase, from $420.3 million to $739.8 million. On the other hand, property built between 1981 to 2000 grew slightly by 5.3%. The market value grew from $9.8 billion in 2024 to $10.7 billion in 2025.

Property Appraisals Out of Sync with Market Performance

The 2025 commercial property tax reassessment by the Tax Appraisal District of Bell County sharply contrasts with findings from Wall Street firm Green Street Real Estate Advisors. While Green Street reports a 21% decline in commercial property values since their 2022 peak, the Tax Appraisal District of Bell County claims these values have risen by more than 9.9% over the past year.

Apartment Buildings Averaged by 10.2% in Assessment Value for 2025

The graph shows that only high recent or contemporary apartments have increased greatly in value, while other categories declined or increased minimally. Apartments constructed in 2021 or later experienced the highest increase at 72.1%, rising from $191.8 million to $330 million. Conversely, apartments built before 1960 saw a decline of 3.4%, dropping from $39.4 million to $38.1 million. In the past year, the market value for apartments rose from $1.6 billion to $1.7 billion.

The Tax Appraisal District of Bell County raised the taxable value of apartment buildings by 10.2% overall. As of 2025, there are three apartment sub-types in Bell County: apartment gardens, regular apartments, and multi-family 9+ units. Regular apartments had the highest increase out of the three with 10.5%, followed by multi-family units with 8.7%, and apartment gardens with 8.0%.

Older Office Buildings in Bell County Experienced Greater Increases in 2025

According to the Tax Appraisal District of Bell County, property tax assessments for office buildings increased across all construction years in 2025, particularly for older property. The highest increase was seen in office property built before 1960 with 21.5%. Notably, the value assessment grew for property built between 1961 to 1980 by 8.3%. Compared to newer builds, property built in 2021 and later saw a slight increase of 4.8%.

In Bell County, two types of office buildings were valued for assessments in 2025: medical offices and regular office buildings. Property tax assessments for both medical and general office buildings in Bell County increased in 2025. Regular office buildings saw the largest increase of 7.5%, while medical office buildings increased by 5.7%. The market value on average increased by 6.3% between 2024 to 2025.

Contemporary Retail Properties Increased the Most in 2025

Property tax assessments for retail buildings in Bell County rose across the board, regardless of the year built. However, the graph displays a mixed correlation. The highest value increase was seen in retail property built in 2021 and later with 24.8% and with a 2025 notice market value of $92.7 million. Great property value increases was also seen in property built between 1961 to 1980 with 8.3%. The lowest value increase of 1.3% was seen in property constructed before 1960.

In Bell County, three retail property sub-types were assessed for their value and each increased in 2025. Single Tenant buildings saw the highest increase at 7.9%, following closely behind are neighborhood shopping centers with 5.8% and retail stores with 5.7%. On average, the market value grew by 5.9% in the past year, rising from $950.7 million to $1 billion.

Warehouse Tax Assessments Rose by 24.5% in 2025

All warehouse property owners in Bell County saw property tax increases, regardless of the year built. Warehouses built in 2021 or later faced a dramatic 137% increase, while those constructed between 1981 and 2000 experienced a slight rise of 5.6%. The warehouse market value from 2024 to 2025 grew from $1.2 billion to $1.5 billion.

The Tax Appraisal District of Bell County reported market value increases for two types of warehouse properties: regular and mini warehouses. Regular warehouses saw the largest increase, rising by 27%, while mini warehouses experienced a more modest increase of 10.3%.

The Tax Appraisal District of Bell County increased by 3.6%, while the Central Texas Metro home prices have increased minimally by 0.1% in the past year.

The Tax Appraisal District of Bell County 2025 Property Tax Revaluation

In 2025, property owners in Bell County, particularly commercial property owners, are seeing high increases in their tax assessments. While residential property values rose by 3.6% based on value range, square footage, and year built, commercial assessments by comparison almost tripled with 9.9%. Approximately 38% of residential properties continue to be overvalued, despite some cushion for householders from the previously elevated valuations. Bell County property owners are encouraged to appeal the high values from the appraisal district for a chance at a reduction.

Bell Property Owners Appeal with O’Connor

Texas property owners in Bell County have the legal right to appeal their property tax assessments. Whether it’s a residential or commercial property, the appeals process provides a chance to present evidence that the assessed value is too high. Working with a property tax consulting firm like O’Connor often results in a reduction. For nearly 50 years, O’Connor has helped property owners lower their tax burdens through proven, cost-effective strategies. In 2024 alone, O’Connor saved clients over $190 million in property taxes. Clients can enroll in O’Connor’s Property Tax Protection Program™ online in just 2–3 minutes. Once enrolled, O’Connor automatically protests property taxes every year, ensuring continuous efforts to minimize tax burdens without requiring additional action from the client.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Bounce Online Solidifies Position as One of South Africa's Leading Online DJ Equipment Retailers

One Click SEO Unveils One Click GEO & Aura: Pioneering Brand Visibility in the AI-First Search Economy

Arun Kumar Palathumpattu Thankappan Leads Public Sector Innovation with Amorphic by Cloudwick

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Handel

Mercosur to tylko wierzchołek góry lodowej. UE ma ponad 40 umów handlowych, które mogą destabilizować rynek rolny

Umowa handlowa między UE a krajami Mercosur może znacząco zaburzyć konkurencję na rynku rolnym i osłabić pozycję unijnych, w tym polskich, producentów – ostrzegają rolnicy i producenci żywności. Umowie sprzeciwia się część krajów unijnych, które domagają się klauzuli ochronnych oraz limitów importowych. – Problemem jest jednak nie tylko ta konkretna umowa. Chodzi o cały system wolnego handlu, który się kumuluje z dziesiątek innych porozumień – podkreśla Andrzej Gantner, wiceprezes Polskiej Federacji Producentów Żywności.

Firma

Dzięki zdalnej weryfikacji tożsamości z wykorzystaniem AI firmy zminimalizowały liczbę oszustw. Rozwiązania wykorzystuje głównie sektor finansowy

Z najnowszych danych Eurostatu wynika, że w 2024 roku 5,9 proc. polskich firm korzystało z rozwiązań z zakresu sztucznej inteligencji. W 2023 roku był to odsetek na poziomie 3,67 proc. Wciąż jednak jest to wynik poniżej średniej unijnej, która wyniosła 13,48 proc. Jednym z obszarów, który cieszy się coraz większym zainteresowaniem wśród przedsiębiorców, jest weryfikacja tożsamości przez AI, zwłaszcza w takich branżach jak bankowość, ubezpieczenia czy turystyka. Jej zastosowanie ma na celu głównie przeciwdziałać oszustwom i spełniać wymogi regulacyjne.

Prawo

Daniel Obajtek: Własne wydobycie i operacyjne magazyny to filary bezpieczeństwa. Zgoda na magazyny gazu poza krajem to rezygnacja z suwerenności energetycznej

Były prezes Orlenu ostrzega przed zmianami w ustawie o zapasach ropy naftowej, produktów naftowych i gazu ziemnego. Jego zdaniem przygotowana przez rząd nowelizacja tzw. ustawy magazynowej i ujednolicanie unijnej polityki energetycznej to zagrożenie dla bezpieczeństwa energetycznego Polski. W jego opinii tylko silna spółka narodowa, własne wydobycie, krajowe magazyny i zbilansowany miks energetyczny zapewnią Polsce bezpieczeństwo i konkurencyjność.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

![Nestlé w Polsce podsumowuje wpływ na krajową gospodarkę. Firma wygenerowała 0,6 proc. polskiego PKB [DEPESZA]](https://www.newseria.pl/files/1097841585/fabryka-nesquik_1,w_85,r_png,_small.png)

.gif)

|

| |

| |

|