Brazoria County Property Owners Face Only Slight Relief From 2.9% Average Home Values in 2025

O'Connor discusses the Brazoria County property assessment increases that property owners are experiencing with home values averaging a 2.9% rise in 2025.

HOUSTON, TX, UNITED STATES, May 5, 2025 /EINPresswire.com/ -- According to Brazoria County Appraisal District (CAD), in 2025 the market value for residential property increased marginally by 2.9% giving property owners some wiggle room, but commercial property increased slightly higher by 3.4%Brazoria County Luxury Homes Increased by 17.4%

Properties valued above $1.5 million in 2025 witnessed a 17.4% growth, lower than the 34% growth in 2024, yet still significant. Despite the slight decrease in taxable value, the 17.4% increase signals a continuous upward trajectory in the luxury home market compared to lower income homes. For instance, homes valued between $1 million and $1.5 million also had a notable high increase of 9.3%. In comparison, homes valued between $250 to $500k only grew by 3.2%.

In 2025, Brazoria County underwent an aggregate 2.9% increase, from $38.618 billion to $39,755 billion. There is a clear correlation between the bigger the living area of a home, the higher the market value increases. Luxury homes exceeding 8,000 square feet increase by 21.6% with a 2025 notice market value of $221 million. Homes measuring between 6,000 to 7,999 also increased greatly by 11.6%. Conversely, smaller homes spanning 2,000 to 3,999 square feet saw a small increase of 3.1% from $22 billion to $23 billion.

There is a discernible correlation between market value increases and the date of construction in the 2025 property tax reappraisals conducted by Brazoria CAD. Homes built within the past five year saw the steep increase of 24.8%, while older homes increased by 1% or less and homes with no specified construction date only increased by 0.3%.

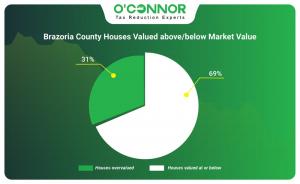

During 2025, Brazoria CAD overvalued 31% of residential properties, significantly lower than 64% of properties in 2024. In total, 2,281 residential properties were overvalued. In 2024, 36% of houses were valued at or below market values and this number increased to 69% in 2025.

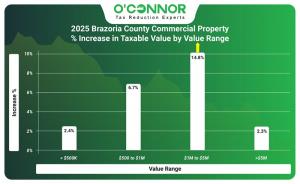

Commercial Property Values Rise 3.4% in Brazoria County Appraisal District

In the 2025 tax year, Brazoria County saw notable increases in commercial property assessments across all value categories. The most significant growth occurred among properties valued between $1 million and $5 million, which rose by 14.8%. In contrast, properties valued over $5 million experienced the smallest increase at just 2.3%, though they still represent a substantial $30 billion in total market value based on 2025 notices.

Commercial property values in Brazoria County have seen strong growth in value for 2025, with hotels leading the way — jumping 33.1% from $219 million to $291 million. Following closely behind is warehouses with a 24% increase in taxable value. In contrast, the valuation of land encountered the slightest increase in value, at 0.7%. These shifts could mean higher property tax bills for owners in the hospitality and industrial sectors, while Brazoria county land owners may see relatively stable assessments this year. The O’Connor Approach™, a breakthrough in the industry that separates intangible value associated with a hotel flag, may be particularly attractive to Brazoria hotels this year.

The commercial properties that were constructed in 2021 or later experienced the most significant recorded increase in value, with a gain of 29.8%. The lowest growth seen in property with a construction year, was commercial property built before 1960 with 8.8%. Property with no year-built category only increased by 0.8%. Other properties that have experienced substantial increases include those constructed between 1961 and 1980 (26%), as well as those constructed between 1981 and 2000 (15.5%).

Gap Between Brazoria County Appraisal District Valuations and Wall Street Market Outlook

A significant gap has emerged between the 2025 commercial property tax reassessment by Brazoria CAD and the analysis by Wall Street firm Green Street Real Estate. While Brazoria CAD reported a modest 3.4% increase in commercial property values, Green Street’s data pointed to a steep 21.0% decline.

Brazoria County Apartment Property Increase

In 2025, the total property tax valuations for apartment complexes in Brazoria County rose by 15.5%, reaching a reported market value of $2.521 billion. The most dramatic increase came from the “other” apartment complex category, which saw a staggering 397.5% jump—from $9 million to $44 million in just one year. Among year-built categories, properties constructed between 1961 and 1980 experienced the highest value appreciation at 27.5%.

In 2025, only two apartment sub-types were reported in Brazoria County, and both saw significant growth. Garden apartments experienced the largest increase, with values rising from $3 million to $4 million — a 20.9% jump. Multi-family apartments also posted a strong gain of 15.5%, reaching a 2025 notice market value of $2.517 billion.

Brazoria County Appraisal District Office Buildings On Average Grew by 19.8%

Brazoria CAD recorded the most notable increase in office property values for buildings with an assigned year built. Offices constructed in 2021 or later saw the largest jump, rising by 27.5%. Properties built between 1961–1980 and 2001–2020 also experienced similar growth, with increases of 22% and 22.4%, respectively. The same can be said for property built before 1960 (12.4%) and built between 1981 to 2000 (12.9%).

In Brazoria County, office buildings fall into two categories: medical offices and general office spaces. Among them, medical office buildings saw the largest increase in market value — rising 24.5% from $273 million to $340 million. General office buildings also experienced significant growth, with an 18% increase bringing their 2025 market value to $841 million.

Retail Tax Assessments Grow by 18.6% per Brazoria County Appraisal District

Retail property tax assessments in Brazoria County have increased across all construction year categories, though without a consistent pattern. The most significant jump occurred in retail buildings constructed in 2021 or later, which saw a 27% increase in assessed value — from $85 million to $109 million. Close behind were properties built between 1981 and 2000, which rose by 25.3%. In contrast, retail properties with no recorded construction date experienced the smallest increase, with values rising just 1.5% — the lowest growth rate in this analysis.

The property tax assessments for all retail property categories in Brazoria County increased in 2025. The neighborhood shopping center experienced the highest amount of assessed value, with a relatively high 32.2% growth rate in 2025 assessments. The retail properties categorized as single tenant have experienced the lowest increase, with a 10.5% increase.

Brazoria County Appraisal District Reported 24% Increase for Warehouse Tax Assessments in 2025

Property tax assessments for warehouse proprietors in Brazoria County saw an increase by an average of 24% between 2024 and 2025. Warehouses built before 1960 saw the lowest appreciation of 1.5% increase. Warehouse properties built in 2021 and later saw a tremendous market value jump of 76.2%, climbing from $44 million to $77 million in the past year.

Brazoria CAD reported an increase for mini warehouses, while regular warehouses declined in 2025. Mini warehouses increased by 24.7% and regular warehouses declined by 1.6%. The market value in the past year grew from $282 million to $350 million.

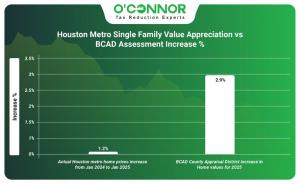

Tracking the Gap: Houston Metro Home Value Growth vs. County Assessments

In 2025, Brazoria CAD raised single-family home values by 2.9%, outpacing the 1.2% increase in home prices reported by the Houston Metro. This growing gap points to a widening divide between official property assessments and real market trends.

Top Takeaways from Brazoria CAD’s 2025 Property Assessments

Property owners in Brazoria County Appraisal District are experiencing a slight growth in property values, with residential averaging 2.9% and commercial averaging 3.4%. A clear gap exists between the CAD’s reported figures and actual market trends. Over the past year, Brazoria County home prices rose by just 1.2%, yet the CAD reported a 2.9% increase. The good news? Only 31% of homes were assessed above market value, while 69% were valued at or below market rates.

For Texas property owners — especially in Brazoria County — it’s crucial to understand your legal rights and the importance of reviewing your property’s assessed value. If your assessment seems inaccurate, gathering supporting evidence and filing an appeal can make a real difference. In fact, most protests lead to reductions. Whether going it alone or working with a property tax consulting firm, challenging your assessment is often a smart financial move.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

PFM Crypto Launches '2 Days Automated Cloud Mining' for Real BTC Output

Keith Landry, Canadian Author, Wins International Impact Book Award, Sparks Interest in Canada’s Chilling Family Murder

Shannon Stocker, Award-Winning Author, Brings Courage and Heart to Kentucky Book Festival Book Signing on June 14, 2025

Kalendarium

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Transport

Import materiałów budowlanych z Rosji zagrożeniem dla konkurencyjności europejskiego rynku. Konieczne są zmiany i egzekwowanie sankcji

Unia Europejska powinna zrewidować politykę celną na import materiałów budowlanych spoza państw członkowskich, w tym państw wschodnich – twierdzą uczestnicy konferencji „Bezpieczeństwo gospodarcze UE”. Obecnie Wspólnota nakłada na europejskich producentów coraz więcej ograniczeń, nie rewidując polityki celnej, co przekłada się na systematyczne osłabienie konkurencyjności przedsiębiorstw, spadek produkcji i zagrożenie dla miejsc pracy.

Konsument

Polacy odczuwają brak wiedzy na temat inwestowania. Może to sprzyjać podejmowaniu nieracjonalnych decyzji finansowych

Co trzeci Polak odczuwa brak wiedzy w obszarze inwestowania, a tylko co piąty chciałby pogłębić swoją wiedzę na ten temat – wynika z badania „Poziom wiedzy finansowej Polaków 2025”. Ci, którzy na własną rękę szukają informacji i porad, coraz częściej sięgają do blogów, portali, podcastów i wideo w internecie. Eksperci przestrzegają, że finansowych i inwestycyjnych porad udzielają nie tylko specjaliści w danej dziedzinie, więc potrzebna jest zasada ograniczonego zaufania.

Handel

Do 2030 roku liczba plastikowych opakowań w e-handlu modowym może się podwoić. Ich udział najszybciej rośnie w Polsce

Wraz ze wzrostem kanału e-commerce w branży modowej rośnie liczba wykorzystywanych opakowań, z których znaczną część wciąż stanowią te z plastiku. Do 2030 roku w Polsce e-sprzedawcy zużyją 147 mln plastikowych opakowań – wynika z badania przeprowadzonego na zlecenie DS Smith. Można zauważyć rosnący trend wśród marek modowych, które coraz częściej wybierają opakowania wykonane z papieru lub materiałów z recyklingu. To o tyle istotne, że polscy konsumenci odczuwają wyrzuty sumienia z powodu ilości plastiku, w którym dostarczane są ich zamówienia.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|