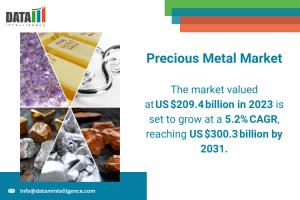

Precious Metals Market Set to Surpass $300 Billion by 2031 Amid Green Tech Surge | DataM Intelligence

Global Precious Metals Market to hit $300.3B by 2031, driven by green tech, electronics demand, and rising consumption across Asia-Pacific and beyond.

Market Growth Drivers:

Increasing Precious Metals Demand in the Electronics Industry

As the push for green technology and renewable energy accelerates, the electronics industry’s appetite for precious metals is soaring. Silver, in particular, plays a vital role in the production of photovoltaic cells for solar panels an essential component in the global transition to clean energy. This surge in silver usage not only underscores its strategic importance but also highlights how sustainability initiatives are reshaping material requirements across the sector.

Simultaneously, China’s ambitious drive to expand its share of global semiconductor manufacturing is further fueling demand for refined metals. In July 2021, the National IC Fund of China committed US$ 39 billion, allocating nearly 70% of that investment to front-end fabrication facilities. Beyond the National Fund’s US$ 73 billion support package, over fifteen city-level industrial-community funds totaling an additional US$ 25 billion have been established to bolster domestic semiconductor and electronics firms. As these substantial investments translate into new manufacturing capacity, the need for precious-metal refining will climb in lockstep with the production of semiconductors, electronic components, and finished devices

Market Restraints:

Environmental Footprint of Mining:

Mining operations for gold, platinum and other metals often involve extensive land disruption, water contamination and deforestation. Heightened scrutiny from regulators and pressure from civil-society groups are prompting stricter environmental controls, which can inflate operational costs and elongate project timelines.

Social and Governance Challenges:

Concerns over labor practices, community displacement and human-rights violations have placed a premium on ethical sourcing. Companies are increasingly subjected to reputational and legal risks if their supply chains fail to meet emerging “conflict-free” and “fair-labor” standards, potentially constraining market growth.

Get Detailed Premium Sample PDF: https://www.datamintelligence.com/download-sample/precious-metal-market

Market Segments

• By Type (Gold, Silver, Platinum, Palladium, Ruthenium, Rhodium, Iridium, Osmium, Others)

• By Application (Jewelry, Electronics, Automotive, Chemicals, Catalysts, Others)

• By Region (North America, Europe, South America, Asia Pacific, Middle East, and Africa)

Market Regional Insights:

Asia-Pacific: A Powerhouse of Consumption

Accounting for over one-third of global consumption, the Asia-Pacific region leads in both demand and production of precious metals. In China and India—where gold and silver carry deep cultural and ceremonial value—consumer buying remains robust for weddings, festivals and investments. Beyond cultural drivers, Japan and South Korea’s advanced electronics and automotive sectors fuel industrial demand for silver, palladium and platinum.

North America and Europe: Technology and Investment Hubs

In North America, stringent emissions regulations accelerate demand for catalytic-converter metals. Meanwhile, Europe’s green-energy directives spur deployment of solar installations and fuel-cell infrastructure, bolstering silver and platinum markets. Investor appetite for precious-metal-backed exchange-traded funds (ETFs) also endures as a hedge against macroeconomic volatility.

Latin America and Middle East & Africa

Rich mining belts in Latin America (notably Peru, Chile and Mexico) and Africa (South Africa and Zimbabwe) contribute substantially to global metal supplies. However, shifting political landscapes and regulatory reforms can lead to production volatility.

Competitive Landscape

Key global players driving innovation, sustainability and market penetration include:

• Newmont Corporation

• Barrick Gold Corporation

• Anglo American Platinum Limited

• Impala Platinum Holdings Limited

• Norilsk Nickel

• Wheaton Precious Metals

• Polyus Gold International Limited

• Kinross Gold Corporation

• Sibanye-Stillwater

• Royal Gold, Inc.

Market Highlights

Silvercorp Metals Inc. – OreCorp Limited (2023):

Silvercorp’s binding acquisition of all remaining OreCorp shares under an Australian scheme of arrangement positions the combined entity with a pro forma market cap of US$ 630 million, a diversified asset portfolio and exposure to a burgeoning West African jurisdiction.

A-Mark Precious Metals, Inc. – LPM Group Limited (2024):

A-Mark’s purchase of LPM, a leading Asian precious-metals merchant, is slated to close by February 2024, pending customary approvals. This move expands A-Mark’s footprint in fast-growing Asian markets.

Anglo American Platinum Limited (Amplats)

Anglo American plans to retain a 19.9% stake in Amplats following a demerger scheduled for June 2025. The move aims to manage share sales post-demerger and includes a $600 million special dividend from Amplats. This strategic overhaul is part of Anglo American's efforts to fend off a takeover approach from BHP and to refocus on core operations.

Related Report:

Solar Panel Market Size 2024-2031

Rare Earth Metals Market Size 2024-2031

Sai Kiran

DataM Intelligence 4market Research LLP

+1 877 441 4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Science-Backed Wellness Gains Momentum as Chicago Prepares to Host Major Health Conference This July

TEHACHAPI, CALIFORNIA REALTOR® CHRISTIE LEE WEISHAAR EARNS HER MILITARY RELOCATION PROFESSIONAL (MRP) CERTIFICATION

New Book on SAP Innovation with AI Explores How Generative AI Is Reshaping SAP Finance

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Polityka

Rozszerzenie UE wśród priorytetów duńskiej prezydencji. Akcesja nowych państw może mieć znaczenie dla bezpieczeństwa i gospodarki

Z badania Eurobarometru wynika, że nieco ponad połowa Europejczyków (53 proc.) popiera dalsze rozszerzenie UE o nowe kraje. Dania, która 1 lipca obejmuje po Polsce przewodnictwo w Radzie UE, zapowiada, że będzie to jeden z jej priorytetów na najbliższe półrocze, nazywając rozszerzenie „geopolityczną koniecznością” kluczową dla stabilizacji Europy.

Transport

Kończą się konsultacje Planu Społeczno-Klimatycznego. 2,4 mld euro trafi na sektor transportu po 2026 roku

Dobiegają końca konsultacje społeczne Planu Społeczno-Klimatycznego, tzw. KPO2, który ma być podstawą do wypłaty środków z nowego instrumentu finansowego Unii Europejskiej – Społecznego Funduszu Klimatycznego. Ministerstwo Funduszy i Polityki Regionalnej zapowiada, że mają one trafić m.in. na walkę z tzw. ubóstwem transportowym, łagodzenie skutków wprowadzenia ETS2 i unowocześnienie kolei, które stanowi ogromne wyzwanie.

Handel

Polski e-commerce rośnie w siłę. Konsumentów przyciągają przede wszystkim promocje

Rynek e-commerce w Polsce jest już wart ok. 152 mld zł. Rośnie zarówno częstotliwość zakupów, jak i średnia wartość koszyka – wynika z raportu Strategy&. Polacy doceniają wygodę zakupów przez internet, szybką dostawę i łatwy zwrot. Coraz częściej zwracają też uwagę na cenę i chętnie korzystają z promocji. To właśnie ten trend wykorzystuje Amazon.pl, organizując co roku festiwal z okazji Prime Day. W tym roku zaplanowano go po raz pierwszy aż na cztery dni: 8–11 lipca, a nie dwa jak w poprzednich latach.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

![Do 2029 roku rynek pracy skurczy się o milion pracowników. Przedsiębiorcy wskazują, jak zaktywizować cztery wykluczone dotąd zawodowo grupy [DEPESZA]](https://www.newseria.pl/files/1097841585/pracownicy-zdj2_1,w_85,_small.jpg)

.gif)

|

| |

| |

|