Flight Simulator Market Forecast (2025–2032): USD 7.83 Billion Valuation with 4.55% CAGR

Key companies operating in the flight simulator market include CAE Inc., The Boeing Company, Thales Group, Indra Sistemas S.A., HALVESAN & others.

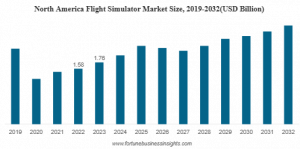

NY, UNITED STATES, June 2, 2025 /EINPresswire.com/ -- The global flight simulator market was valued at USD 4.89 billion in 2023 and is expected to grow from USD 5.48 billion in 2024 to USD 7.83 billion by 2032, registering a CAGR of 4.55% during the forecast period. In 2023, North America emerged as the leading region, capturing 35.99% of the market share.A mechanical and electrical device that replicates the experience of flying an aircraft is a flight-stimulator. This device is used for advanced technology, such as motion systems, accurate flight dynamics, and computer-generated graphics, to develop a highly interactive training and immersive training experience.

This information is provided by Fortune Business Insights™ in its research report titled “Flight Simulator Market Size, Share, Forecast, and 2024-2032.”

Get A Free Sample PDF Brochure:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/flight-simulator-market-102592

List of Key Players Mentioned in the Report:

• CAE Inc. (Canada)

• FlightSafety International Inc. (U.S.)

• L3Harris Technologies Inc. (U.S.)

• The Boeing Company (U.S.)

• Thales Group (France)

• TRU Simulation + Training Inc. (U.S.)

• Raytheon Technologies Corporation (U.S.)

• Indra Sistemas S.A. (Spain)

• Aero Simulation Inc. (U.S.)

• HALVESAN (Turkey)

Industry Segmentation:

Increasing Demand for Full Flight Simulators Segment and High-Skilled Pilots to Dominate Market Growth

On the basis of type, the market is categorized into Flight Training Devices (FTD) and Full Flight Simulator (FFS). FFS can replicate a series of a specific aircraft cockpit and a specific type or model. FFS is anticipated to dominate the market share and is projected to be a rapidly growing segment during the projected period owing to increased demand for high-skilled pilots.

UAV Simulator is Projected to Command the Market Due to Rising Demand for Drone Pilots

Based on platform, the market is divided into fixed wing simulator, rotary wing simulator, and UAV simulator A fixed-wing simulator is a device designed to replicate the flight characteristics and systems of fixed-wing aircraft. The fixed wing simulator segment is expected to have the highest market share due to the expanding fleet of aircraft and increasing air traffic.

Commercial Segment to Lead Due to Growing Demand for Aircraft Simulators from Pilot Training Organizations

According to application, the market is segmented into military and commercial. The commercial segment leads the market is predicted to be the rapidly growing segment due to the increasing demand for aircraft simulators from pilot training organizations globally.

Report Coverage:

The report offers:

• Major growth drivers, restraining factors, opportunities, and potential challenges for the market.

• Comprehensive insights into regional developments.

• List of major industry players.

• Key strategies adopted by the market players.

• Latest industry developments such as product launches, partnerships, mergers, and acquisitions.

Speak To Analyst:

https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/flight-simulator-market-102592

Drivers and Restraints:

Growing Demand for Simulators from the Defense Sector to Drive the Market Growth

Simulators offer realistic combat training, which allows military pilots to enhance their skills and stimulate various combat scenarios. They deliver the dynamics of tactical scenarios, aircraft operation, and weapon systems, which allow military pilots to develop and refine their combat skills, such as air-to-ground attacks, air-to-air engagements, and precision targeting, in a controlled and safe environment.

The production and development of aircraft simulators need a lot of financial investments. Moreover, simulators need to be updated daily to meet the changing standards in aviation, which adds to the investment costs, thereby hindering the flight simulator market growth.

Regional Insights:

North America to Dominate the Market Owing to the Presence of Major OEMs

North America led the flight simulator market share in 2022, and its growth is attributed to the presence of major OEMs. The training business is one of the biggest acquisitions in the market and approximately doubles CAE’s core military training business in the U.S.

Europe witnessed the second-largest share in the base year. Focusing on safety and risk mitigation, the demand is increasing for aircraft simulators for cost-effective training.

Ask For Customization:

https://www.fortunebusinessinsights.com/enquiry/customization/flight-simulator-market-102592

Competitive Landscape:

Leading Players Focus on Product Innovations, UAV Simulators, Mergers & Acquisitions, and Emerging Markets

The key players in the market are FlightSafety International Inc., CAE Inc., the Boeing Company, L3Harris Technologies Inc., Thales Group, and others. Prominent players focus on emerging markets, technological advancements, mergers & acquisitions, UAV simulators, and product innovations to grow their market share.

Key Industry Development:

• May 2023 – Lilium N.V., a Germany-based innovator in all-electric vertical take-off and landing (eVTOL) jets, announced a strategic partnership with FlightSafety International Inc. (FSI). As part of the agreement, FSI will design and deliver advanced flight training devices featuring immersive and mixed-reality experiences tailored specifically for the Lilium Jet.

• October 2022 – TRU Simulation + Training Inc. revealed the sale of a full-flight simulator (FFS) to the Royal Flying Doctor Service (Queensland Section). The simulator, which will undergo Level D qualification, is engineered for adaptability and will support comprehensive training for the RFDS's entire Beechcraft King Air fleet, including the King Air 260, 350, and 360 models.

Read Related Insights:

Sustainable Aviation Fuel (SAF) Market Size, Share, 2032

Green Airport Market Size, Trends, Growth, 2032

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Michelin-Trained Chef Reimagines Intimate Luxury Dining

Marisol Diaz Features on the Cover of Ejecutiva Magazine

The Tax Business Summit — A Game-Changer for Tax Pros, Business Owners and Entrepreneurs

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Handel

Mercosur to tylko wierzchołek góry lodowej. UE ma ponad 40 umów handlowych, które mogą destabilizować rynek rolny

Umowa handlowa między UE a krajami Mercosur może znacząco zaburzyć konkurencję na rynku rolnym i osłabić pozycję unijnych, w tym polskich, producentów – ostrzegają rolnicy i producenci żywności. Umowie sprzeciwia się część krajów unijnych, które domagają się klauzuli ochronnych oraz limitów importowych. – Problemem jest jednak nie tylko ta konkretna umowa. Chodzi o cały system wolnego handlu, który się kumuluje z dziesiątek innych porozumień – podkreśla Andrzej Gantner, wiceprezes Polskiej Federacji Producentów Żywności.

Firma

Dzięki zdalnej weryfikacji tożsamości z wykorzystaniem AI firmy zminimalizowały liczbę oszustw. Rozwiązania wykorzystuje głównie sektor finansowy

Z najnowszych danych Eurostatu wynika, że w 2024 roku 5,9 proc. polskich firm korzystało z rozwiązań z zakresu sztucznej inteligencji. W 2023 roku był to odsetek na poziomie 3,67 proc. Wciąż jednak jest to wynik poniżej średniej unijnej, która wyniosła 13,48 proc. Jednym z obszarów, który cieszy się coraz większym zainteresowaniem wśród przedsiębiorców, jest weryfikacja tożsamości przez AI, zwłaszcza w takich branżach jak bankowość, ubezpieczenia czy turystyka. Jej zastosowanie ma na celu głównie przeciwdziałać oszustwom i spełniać wymogi regulacyjne.

Prawo

Daniel Obajtek: Własne wydobycie i operacyjne magazyny to filary bezpieczeństwa. Zgoda na magazyny gazu poza krajem to rezygnacja z suwerenności energetycznej

Były prezes Orlenu ostrzega przed zmianami w ustawie o zapasach ropy naftowej, produktów naftowych i gazu ziemnego. Jego zdaniem przygotowana przez rząd nowelizacja tzw. ustawy magazynowej i ujednolicanie unijnej polityki energetycznej to zagrożenie dla bezpieczeństwa energetycznego Polski. W jego opinii tylko silna spółka narodowa, własne wydobycie, krajowe magazyny i zbilansowany miks energetyczny zapewnią Polsce bezpieczeństwo i konkurencyjność.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

![Nestlé w Polsce podsumowuje wpływ na krajową gospodarkę. Firma wygenerowała 0,6 proc. polskiego PKB [DEPESZA]](https://www.newseria.pl/files/1097841585/fabryka-nesquik_1,w_85,r_png,_small.png)

.gif)

|

| |

| |

|