Mexico Factory Automation Market 2025: Industry Trends, Size, Share, Growth, Opportunity and Forecast to 2033

Mexico factory automation market driven by Industry 4.0 adoption, industrial growth, robotics, government initiatives, and smart manufacturing technologies.

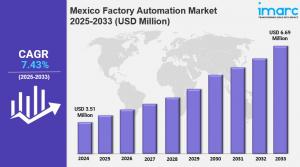

BROOKLYN, NY, UNITED STATES, July 11, 2025 /EINPresswire.com/ -- Market Overview 2025-2033The Mexico factory automation market size reached USD 3.51 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6.69 Million by 2033, exhibiting a growth rate (CAGR) of 7.43% during 2025-2033. The market is experiencing steady growth, driven by rising industrialization, government support for manufacturing, and the need for operational efficiency. Key trends include increased adoption of robotics and smart sensors, with major players focusing on energy-efficient solutions and advanced automation technologies.

Key Market Highlights:

✔️ Strong growth driven by industrial expansion and rising labor costs

✔️ Growing demand for smart manufacturing and IoT-based automation

✔️ Increased investment in energy-efficient and sustainable factory technologies

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-factory-automation-market/requestsample

Mexico Factory Automation Market Trends and Drivers:

As labor costs continue to rise, the Mexico factory automation market is experiencing a notable increase in adoption, with manufacturers increasingly turning to automated solutions to enhance operational efficiency and reduce overall expenses. This trend is driving significant changes across the country’s industrial landscape, as companies strive to maintain competitiveness in a global market where labor costs play a critical role. Manufacturers are investing in advanced technologies such as robotics, artificial intelligence (AI), and machine learning to streamline their production processes.

This shift towards automation is particularly evident in sectors like automotive and electronics, where precision and speed are paramount. By automating repetitive tasks, manufacturers can lower labor costs while simultaneously improving product quality and consistency. Consequently, the demand for factory automation solutions is projected to grow significantly, as businesses seek to implement more sophisticated systems capable of adapting to changing market demands and consumer preferences.

The rapid advancement of technology is another crucial factor shaping the Mexico factory automation market. The adoption of Industry 4.0 principles is gaining traction, with manufacturers leveraging the Internet of Things (IoT), big data analytics, and cloud computing to optimize their operations. These technologies facilitate real-time monitoring and data-driven decision-making, enabling companies to enhance productivity and minimize downtime.

IoT devices, in particular, are being integrated into manufacturing processes to enable predictive maintenance, which helps prevent equipment failures and extends the lifespan of machinery. As more companies recognize the advantages of these technologies, the demand for automated solutions that incorporate Industry 4.0 capabilities is expected to rise. This trend not only boosts operational efficiency but also positions Mexican manufacturers to compete more effectively on a global scale.

The Mexican government has been proactive in promoting the adoption of factory automation through various initiatives aimed at strengthening the manufacturing sector. Policies encouraging foreign direct investment (FDI) have led to the establishment of numerous manufacturing plants, especially in the automotive and electronics industries. These investments often focus on modernizing production facilities through automation technologies.

Additionally, government programs designed to enhance workforce skills in automation and technology are ensuring that the labor force is equipped to meet the demands of an increasingly automated industry. As these initiatives take root, they are expected to drive further investment in factory automation solutions, creating a robust ecosystem that supports innovation and growth in the manufacturing sector.

The Mexico factory automation market is witnessing transformative trends that are reshaping the manufacturing landscape. One of the most significant trends is the growing integration of smart technologies aligned with Industry 4.0 principles. As manufacturers seek to enhance operational efficiency, the adoption of IoT devices, AI, and machine learning is becoming standard practice. By 2025, a substantial percentage of manufacturing processes is anticipated to be automated, allowing for real-time data collection and analysis.

This shift optimizes production schedules and enables predictive maintenance, which reduces downtime and operational costs. Additionally, the demand for collaborative robots, or cobots, is increasing, as they can work alongside human operators to boost productivity while ensuring safety. Furthermore, the emphasis on sustainability is driving manufacturers to adopt energy-efficient automation solutions that minimize waste and reduce environmental impact. As these trends continue to evolve, the Mexico factory automation market is expected to expand, providing opportunities for innovation and competitive advantage in a global marketplace.

Checkout Now: https://www.imarcgroup.com/checkout?id=35741&method=980

Mexico Factory Automation Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Component:

• Sensors

• Controllers

• Switches and Relays

• Industrial Robots

• Drives

• Others

Breakup by System Type:

• Distributed Control System (DCS)

• Supervisory Control and Data Acquisition System (SCADA)

• Manufacturing Execution System (MES)

• Systems Instrumented System (SIS)

• Programmable Logic Controller (PLC)

• Human Machine Interface (HMI)

Breakup by Industry Vertical:

• Automotive Manufacturing

• Food and Beverage

• Oil and Gas Processing

• Mining

• Others

Breakup by Region:

• Northern Mexico

• Central Mexico

• Southern Mexico

• Others

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=35741&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Elena Anderson

IMARC Services Private Limited

+1 631-791-1145

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Global Youth Leaders Unite in Cape Town to Champion Compassion, Ubuntu, and Interfaith Action at Youth IF20

Captain Compliance Launches On-Prem AI Tools via OpenAI's GPT-OSS to Power Advanced Data Privacy & Regulatory Automation

Ferguson Law Firm’s Cody Dishon Secures Texas’ #1 Medical Malpractice Verdict and Earns Top Verdict Honor

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Ochrona środowiska

A. Bryłka (Konfederacja): Ograniczenie emisyjności nie musi się odbywać za pomocą celów klimatycznych. Są absurdalne, nierealne i niszczące europejską gospodarkę

W lipcu br. Komisja Europejska ogłosiła propozycję nowego celu klimatycznego, który zakłada ograniczenie emisji gazów cieplarnianych o 90 proc. do 2040 roku w porównaniu do stanu z 1990 roku. Został on zaproponowany bez zgody państw członkowskich, w przeciwieństwie do poprzednich celów na 2030 i 2050 rok. Polscy europarlamentarzyści uważają ochronę środowiska i zmiany w jej zakresie za potrzebne, jednak nie powinny się odbywać za pomocą nieosiągalnych celów klimatycznych.

Polityka

Dramatyczna sytuacja ludności w Strefie Gazy. Pilnie potrzebna dobrze zorganizowana pomoc humanitarna

Według danych organizacji Nutrition Cluster w Strefie Gazy w lipcu br. u prawie 12 tys. dzieci poniżej piątego roku życia stwierdzono ostre niedożywienie. To najwyższa miesięczna liczba odnotowana do tej pory. Mimo zniesienia całkowitej blokady Strefy Gazy sytuacja w dalszym ciągu jest dramatyczna, a z każdym dniem się pogarsza. Przedstawiciele Polskiej Akcji Humanitarnej uważają, że potrzebna jest natychmiastowa pomoc, która musi być dostosowana do aktualnych potrzeb poszkodowanych i wsparta przez stronę izraelską.

Polityka

Wśród Polaków rośnie zainteresowanie produktami emerytalnymi. Coraz chętniej wpłacają oszczędności na konta IKE i IKZE

Wzrosła liczba osób, które oszczędzają na cele emerytalne, jak również wartość zgromadzonych środków. Liczba uczestników systemu emerytalnego wyniosła w 2024 roku ponad 20,8 mln osób, a wartość aktywów – 307,5 mld zł – wynika z najnowszych danych Urzędu Komisji Nadzoru Finansowego (UKNF). Wyraźny wzrost odnotowano w przypadku rachunków IKE i IKZE, na których korzyść działają m.in. zachęty podatkowe. Wpłacane na nie oszczędności są inwestowane, a tym samym wspierają gospodarkę i mogą przynosić atrakcyjną stopę zwrotu.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|