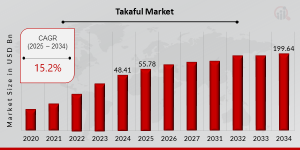

Takaful Market Projected for 15.2% CAGR, Reaching 199.64 Billion by 2034

Takaful Market Research Report By, Product Type, Distribution Channel, Coverage Type, Customer Type, Regional

WA, UNITED STATES, April 14, 2025 /EINPresswire.com/ -- The Global Takaful market has experienced substantial development in recent years and is expected to witness accelerated growth in the coming decade. In 2024, the market size was valued at USD 48.41 billion and is projected to grow from USD 55.78 billion in 2025 to an impressive USD 199.64 billion by 2034, registering a compound annual growth rate (CAGR) of 15.2% during the forecast period (2025–2034). The surge in demand for Shariah-compliant insurance solutions, growing Muslim population, and increasing awareness of Islamic finance principles are key drivers fueling market expansion.Key Drivers of Market Growth

Rising Demand for Shariah-Compliant Financial Products

Consumers in Islamic countries and beyond are increasingly seeking financial solutions that align with their religious and ethical beliefs. Takaful offers a cooperative insurance model that complies with Islamic law, attracting a broad and growing customer base.

Growth in Muslim Population and Islamic Finance Adoption

The expansion of the global Muslim population and the increasing adoption of Islamic finance practices are directly boosting the demand for Takaful products. Countries in the Middle East, Southeast Asia, and parts of Africa are witnessing robust growth in the sector.

Government Support and Regulatory Initiatives

Several governments across Islamic economies are actively promoting Takaful through favorable policies and regulatory frameworks. Dedicated Takaful windows, tax incentives, and mandatory participation in Takaful schemes in some regions are supporting industry expansion.

Product Diversification and Innovation

The market is evolving with a range of offerings including family Takaful, general Takaful, and micro-Takaful products. Innovation in product design tailored to modern consumer needs is contributing to market penetration and customer engagement.

Rising Awareness and Financial Inclusion

Increased efforts by governments, NGOs, and financial institutions to educate populations about Takaful principles are enhancing awareness. Takaful is also playing a key role in promoting financial inclusion, especially in underbanked communities.

Digital Transformation in Takaful Services

Technology is playing a crucial role in simplifying access to Takaful products. Online platforms, mobile applications, and AI-powered underwriting are enhancing customer experiences and operational efficiency.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/24163

Key Companies in the Global Takaful Market Include

• Maybank Islamic Berhad

• Dar Al Takaful

• Salama Cooperative Insurance Company

• RHB Islamic Bank Berhad

• Zurich Takaful Malaysia

• CIMB Islamic Bank

• Etiqa Takaful

• Amanah Takaful

• Bank Islam Malaysia Berhad

• AXA Affin General Takaful

• Salaam Takaful

• Great Eastern Takaful Berhad

• Takaful Malaysia Keluarga Berhad

• Al Hilal Takaful

• Al Rajhi Takaful

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/takaful-market-24163

Market Segmentation

To offer an in-depth perspective, the Global Takaful market is segmented based on product type, distribution channel, end-user, and region.

1. By Product Type

• Family Takaful: Long-term protection including life and savings products designed for individuals and families.

• General Takaful: Non-life coverage including motor, property, health, and travel insurance.

• Micro-Takaful: Affordable Takaful products designed to cater to low-income and rural populations.

2. By Distribution Channel

• Agents and Brokers: Traditional sales channels offering personalized advisory and policy servicing.

• Bancatakaful: Takaful policies distributed through Islamic banks and financial institutions.

• Online Platforms: Digital portals and mobile apps offering convenient access and management of Takaful plans.

• Direct Sales: Takaful providers selling policies directly to consumers through in-house channels.

3. By End-User

• Individuals: Retail customers seeking Shariah-compliant insurance solutions for personal and family protection.

• SMEs: Small and medium-sized enterprises requiring Takaful coverage for assets, employees, and operations.

• Large Enterprises: Corporate clients purchasing group Takaful policies and specialized risk coverage.

• Government Institutions: Public sector entities implementing mandatory Takaful schemes in healthcare and pensions.

4. By Region

• Middle East & North Africa (MENA): The largest market with high penetration of Islamic finance and supportive regulatory environments.

• Southeast Asia: A rapidly growing market led by Malaysia and Indonesia, with strong demand for both family and general Takaful.

• South Asia: Emerging opportunities driven by increasing financial inclusion and Islamic finance awareness.

• Sub-Saharan Africa: Early-stage growth fueled by demographic trends and infrastructure development.

• Others: Includes Europe and North America, where niche demand for ethical and Shariah-compliant products is expanding.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24163

The Global Takaful market is on a trajectory of sustained growth, driven by cultural alignment, rising consumer awareness, and government support for Islamic finance. As market players invest in innovation, digital capabilities, and customer education, the Takaful sector is expected to evolve into a dynamic and inclusive component of the global insurance industry in the years ahead.

Related Report:

balanced funds market

https://www.marketresearchfuture.com/reports/balanced-funds-market-23875

bank kiosk market

https://www.marketresearchfuture.com/reports/bank-kiosk-market-22832

banking credit analytic market

https://www.marketresearchfuture.com/reports/banking-credit-analytic-market-31247

banking encryption software market

https://www.marketresearchfuture.com/reports/banking-encryption-software-market-29232

banking market

https://www.marketresearchfuture.com/reports/banking-market-23852

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Bounce Online Solidifies Position as One of South Africa's Leading Online DJ Equipment Retailers

One Click SEO Unveils One Click GEO & Aura: Pioneering Brand Visibility in the AI-First Search Economy

Arun Kumar Palathumpattu Thankappan Leads Public Sector Innovation with Amorphic by Cloudwick

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Handel

Mercosur to tylko wierzchołek góry lodowej. UE ma ponad 40 umów handlowych, które mogą destabilizować rynek rolny

Umowa handlowa między UE a krajami Mercosur może znacząco zaburzyć konkurencję na rynku rolnym i osłabić pozycję unijnych, w tym polskich, producentów – ostrzegają rolnicy i producenci żywności. Umowie sprzeciwia się część krajów unijnych, które domagają się klauzuli ochronnych oraz limitów importowych. – Problemem jest jednak nie tylko ta konkretna umowa. Chodzi o cały system wolnego handlu, który się kumuluje z dziesiątek innych porozumień – podkreśla Andrzej Gantner, wiceprezes Polskiej Federacji Producentów Żywności.

Firma

Dzięki zdalnej weryfikacji tożsamości z wykorzystaniem AI firmy zminimalizowały liczbę oszustw. Rozwiązania wykorzystuje głównie sektor finansowy

Z najnowszych danych Eurostatu wynika, że w 2024 roku 5,9 proc. polskich firm korzystało z rozwiązań z zakresu sztucznej inteligencji. W 2023 roku był to odsetek na poziomie 3,67 proc. Wciąż jednak jest to wynik poniżej średniej unijnej, która wyniosła 13,48 proc. Jednym z obszarów, który cieszy się coraz większym zainteresowaniem wśród przedsiębiorców, jest weryfikacja tożsamości przez AI, zwłaszcza w takich branżach jak bankowość, ubezpieczenia czy turystyka. Jej zastosowanie ma na celu głównie przeciwdziałać oszustwom i spełniać wymogi regulacyjne.

Prawo

Daniel Obajtek: Własne wydobycie i operacyjne magazyny to filary bezpieczeństwa. Zgoda na magazyny gazu poza krajem to rezygnacja z suwerenności energetycznej

Były prezes Orlenu ostrzega przed zmianami w ustawie o zapasach ropy naftowej, produktów naftowych i gazu ziemnego. Jego zdaniem przygotowana przez rząd nowelizacja tzw. ustawy magazynowej i ujednolicanie unijnej polityki energetycznej to zagrożenie dla bezpieczeństwa energetycznego Polski. W jego opinii tylko silna spółka narodowa, własne wydobycie, krajowe magazyny i zbilansowany miks energetyczny zapewnią Polsce bezpieczeństwo i konkurencyjność.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

![Nestlé w Polsce podsumowuje wpływ na krajową gospodarkę. Firma wygenerowała 0,6 proc. polskiego PKB [DEPESZA]](https://www.newseria.pl/files/1097841585/fabryka-nesquik_1,w_85,r_png,_small.png)

.gif)

|

| |

| |

|