Accounts Receivable Outsourcing Services Support Financial Clarity Across U.S. Healthcare

Accounts Receivable Outsourcing Services help healthcare providers reduce DSO, improve reporting, and scale operations.

MIAMI, FL, UNITED STATES, August 7, 2025 /EINPresswire.com/ -- Regulatory uncertainty, growing billing complexities, and a surge in denied claims are pushing healthcare organizations to reassess how they manage financial performance. In response, providers across pharmaceuticals, diagnostics, and telehealth are turning to Accounts Receivable Outsourcing Services to reduce operational friction, accelerate collections, and reinforce compliance efforts. These services bring clarity to receivables management, easing administrative strain while supporting consistent cash flow across care environments.The shift extends throughout the healthcare supply chain. Stakeholders are deploying outsourced AR models to handle increasing claim volumes, tighten reimbursement cycles, and correct legacy inefficiencies. Companies like IBN Technologies are enabling this momentum by delivering tailored solutions that improve process visibility, reduce bottlenecks, and support informed decision-making. For healthcare leaders focused on sustainability, outsourced receivables have become a strategic tool for gaining control without increasing internal workload.

Learn how to streamline reimbursement with expert support

Schedule a Free Consultation: https://www.ibntech.com/free-consultation-for-ap-ar-management/

Optimizing Financial Operations Amid Growing Healthcare Demands

As the financial burden on healthcare providers grows, effective receivables management becomes vital. With more patients responsible for direct payments, a growing backlog in payer reimbursements, and limited operational resources, health systems are turning to robust accounts receivable management system models to handle increased demand. These systems help providers increase visibility, improve forecasting, and reduce dependency on under-resourced internal teams.

1. Fragmented income sources complicating financial visibility

2. Irregular cash cycles affecting capital allocation

3. Insurance bottlenecks delaying payments and adjustments

4. Merchant platforms lacking synchronized reconciliation

5. Need for confidential, HIPAA-compliant financial infrastructure

In response to these recurring challenges, organizations are partnering with trusted accounts receivable outsourcing companies to provide seamless receivables support. These specialists understand the unique nuances of healthcare operations and deliver targeted services that ease internal workloads and protect revenue. By adopting streamlined models, facilities are empowered to maintain compliance while lowering operational costs and achieving faster reimbursements.

Integrated AR Delivery Enhances Financial Oversight

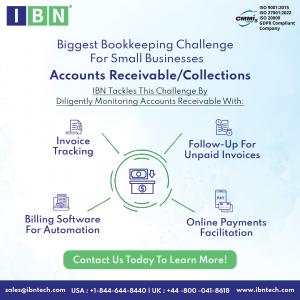

IBN Technologies offers a comprehensive range of accounts receivable outsourcing services to address the end-of-the-end financial operations of healthcare entities. Their structured offerings span from invoice generation and tracking to account reconciliation and regulatory documentation, tailored specifically to align with the financial demands of healthcare providers. Each stage of service is calibrated to improve control, reduce administrative complexity, and increase revenue recovery speed.

✅ Timely creation of billing statements for rapid revenue inflow

✅ Systematic follow-up to minimize aged account balances

✅ Regular ledger maintenance for error-free financial records

✅ Forecasting and planning tools to support strategic decisions

✅ Unified customer data for consistent invoice generation

✅ Accurate tracking and payment allocation to simplify accounting

✅ Detailed aging reports for proactive collections management

✅ Bank reconciliation processes that align with financial data integrity

✅ Compliance documentation that supports audits and transparency

✅ Month- and year-end close assistance for accurate reporting

✅ Global currency and taxation support via integrated accounts receivable systems

In Florida, this unified approach leverages automation, real-time analytics, and cloud-based tools to bring full transparency to receivables. With seamless ERP integration and customizable dashboards, healthcare organizations can improve responsiveness and decision-making through efficient financial workflows.

Purpose-Driven AR Services That Support Healthcare Sustainability

IBN Technologies brings a deep focus on accuracy and efficiency, delivering accounts receivable outsourcing services designed for healthcare-specific environments. Their adaptable models scale with client needs, allowing providers to reduce costs, reclaim working capital, and respond faster to regulatory changes.

✅ 26+ years of experience in financial process outsourcing

✅ Up to 70% cost reduction compared to internal AR teams

✅ Significantly reduced DSO, enabling faster accounts receivable financing

✅ GAAP-compliant processes ensuring regulatory preparedness

✅ Scalable solutions customized by provider size and structure

Demonstrating Measurable Impact Across Healthcare Clients

Healthcare providers in Florida engaging IBN Technologies for receivables transformation have reported notable success across multiple key performance areas.

• In one case, a diagnostic company in the U.S. reduced claim denials by 50%, allowing for quicker access to revenue and fewer resubmission efforts.

• Another provider achieved a 30% improvement in cash flow, alongside a 25% rise in timely invoice processing, leading to better resource allocation and less pressure on in-house teams.

These outcomes reflect the value of tailored support, improved communication with players, and a focus on clean claims and timely documentation. Through effective coordination and process visibility, healthcare providers are better equipped to meet both operational goals and patient service standards.

Future-Ready Healthcare Finance Through Outsourced AR Expertise

The financial structure of healthcare institutions continues to evolve, shaped by increasing patient responsibility, complex payer interactions, and changing compliance demands. As a result, accounts receivable outsourcing services have become central to ensuring financial resilience. Providers that adopt external support can mitigate risk, reduce days sales outstanding, and support internal teams with data-driven insights and well-defined workflows.

Reliable third-party support is becoming more than a short-term fix it is a critical investment in future viability. Expert-driven delivery models, industry-relevant experience, and performance transparency allow organizations to maintain agility while meeting compliance standards. IBN Technologies, with its proven history of success, continues to support healthcare clients seeking to improve cash flow, reduce administrative friction, and gain long-term control over their receivables function. As revenue cycles grow more complex and error tolerance shrinks, partnering with the right AR team is pivotal. These services are not just optimizing finance—they are helping to secure the financial future of healthcare itself.

Related Services:

Outsourced Finance and Accounting

https://www.ibntech.com/finance-and-accounting-services/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 26 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Texas State University’s Tana Randall Named 2025 CAHME/Joint Commission Fellow for Advancing Sustainable Health Care

Tecpinion to attend SBC Summit 2025 in Lisbon

Outsourced Accounts Payable Services Aid California Healthcare

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Polityka

D. Joński: Nie wiemy, co zrobi Rosja za dwa–trzy lata. Według duńskiego wywiadu może zaatakować kraje nadbałtyckie i musimy być na to gotowi

Zdecydowana większość krajów unijnych wskazuje na potrzebę wzmocnienia zdolności obronnych Europy w obliczu coraz bardziej złożonego geopolitycznego tła. Wywiady zachodnich państw wskazują, że Rosja może rozpocząć konfrontację z NATO jeszcze przed 2030 rokiem. Biała księga w sprawie obronności europejskiej „Gotowość 2030” zakłada m.in. ochronę granic lądowych, powietrznych i morskich UE, a sztandarowym projektem ma być Tarcza Wschód. – W budzeniu Europy duże zasługi ma polska prezydencja – ocenia europoseł Dariusz Joński.

Transport

Duże magazyny energii przyspieszą rozwój transportu niskoemisyjnego w Europie. Przyszłością może być wodór służący jako paliwo i nośnik energii

Zmiany w europejskim transporcie przyspieszają. Trendem jest elektromobilność, zwłaszcza w ramach logistyki „ostatniej mili”. Jednocześnie jednak udział samochodów w pełni elektrycznych w polskich firmach spadł z 18 do 12 proc., co wpisuje się w szerszy europejski trend spowolnienia elektromobilności. Główne bariery to ograniczona liczba publicznych stacji ładowania, wysoka cena pojazdów i brak dostępu do odpowiedniej infrastruktury. – Potrzebne są odpowiednio duże magazyny taniej energii. Przyszłością przede wszystkim jest wodór – ocenia Andrzej Gemra z Renault Group.

Infrastruktura

W Polsce w obiektach zabytkowych wciąż brakuje nowoczesnych rozwiązań przeciwpożarowych. Potrzebna jest większa elastyczność w stosowaniu przepisów

Pogodzenie interesów konserwatorów, projektantów, inwestorów, rzeczoznawców i służby ochrony pożarowej stanowi jedno z największych wyzwań w zakresie ochrony przeciwpożarowej obiektów konserwatorskich. Pożary zabytków takich jak m.in. katedra Notre-Dame w Paryżu przyczyniają się do wprowadzania nowatorskich rozwiązań technicznych w zakresie ochrony przeciwpożarowej. W Polsce obowiązuje już konieczność instalacji systemów detekcji. Inwestorzy często jednak rezygnują z realizacji projektów dotyczących obiektów zabytkowych z uwagi na zmieniające się i coraz bardziej restrykcyjne przepisy czy też względy ekonomiczne.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

![Nestlé w Polsce podsumowuje wpływ na krajową gospodarkę. Firma wygenerowała 0,6 proc. polskiego PKB [DEPESZA]](https://www.newseria.pl/files/1097841585/fabryka-nesquik_1,w_85,r_png,_small.png)

.gif)