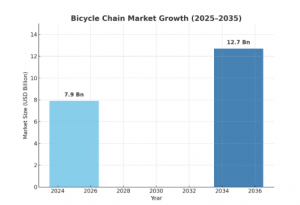

Bicycle Chain Market to Hit USD 12.7 Billion by 2035 Driven by Urban Mobility and Drivetrain Innovations

Bicycle chain market poised for steady growth through 2035, driven by rising bike adoption and drivetrain innovations.

A surge in cycling activity, prompted by a growing emphasis on healthy living and eco-conscious commuting, has led to greater production and innovation in bicycle drivetrain systems. Chains remain a critical component in both traditional and electric bicycles, and their design and material composition continue to evolve to meet the needs of performance cyclists and everyday riders alike. The expansion of the mid- and high-end bicycle market—particularly in North America, Europe, and Asia-Pacific—has further spurred demand for precision-engineered, corrosion-resistant, and low-maintenance chain products.

Get Ahead with Our Report: Request Your Sample Now!

https://www.futuremarketinsights.com/reports/sample/rep-gb-10535

Key Takeaways for the Bicycle Chain Market

The bicycle chain market is being propelled by increasing awareness of cycling as an efficient, low-cost, and environmentally friendly mode of transport. Consumers are demanding bicycles that offer smooth gear transitions and low maintenance, encouraging manufacturers to develop innovative chain technologies such as rust-proof coatings, hollow pin designs, and optimized link geometry. Lightweight chains and those with higher tensile strength are particularly favored in the performance cycling and mountain biking segments. Additionally, the growth of urban cycling culture is pushing OEMs to offer customized chain options for different terrain types and usage scenarios.

In the electric bicycle segment, chains are experiencing design enhancements to handle higher torque outputs and variable power assistance, differentiating them from standard chains used in traditional bicycles. E-bike adoption is rising across all age groups, especially in Europe and East Asia, where consumers are seeking durable and long-lasting chain systems that complement integrated motor systems. The aftermarket for bicycle chains is also expanding rapidly, supported by increasing consumer interest in upgrading or replacing worn drivetrain components for enhanced performance and longevity.

Emerging Trends in the Global Market

One of the notable trends in the bicycle chain market is the growing focus on sustainable and recyclable materials. Manufacturers are exploring chain materials that are environmentally friendly, corrosion-resistant, and lightweight. There is also a growing trend toward fully enclosed chain systems, particularly in commuter and cargo bikes, which offer added protection, lower maintenance requirements, and extended chain life. These systems are gaining popularity in markets where bicycles are used for daily transportation and delivery services.

The integration of smart components is another emerging trend. Although still in the early stages, some manufacturers are developing chains with embedded wear sensors that alert users or service providers when the chain requires maintenance or replacement. Such innovations align with the broader trend of connected cycling and are particularly relevant in the context of fleet management and shared mobility services. The integration of chains with belt drive technologies is also being explored, especially in high-end urban bicycles, offering quieter operation and reduced maintenance.

Significant Developments and Market Opportunities

Several significant developments are shaping the global bicycle chain market, including increased R&D investments by key players aimed at improving chain efficiency and durability. The rise of cycling events, adventure sports, and the professional biking scene is creating demand for high-performance chains that can withstand extreme conditions, whether in racing, mountain biking, or touring. Companies are expanding their product lines to cater to both professional cyclists and recreational users, offering products that balance weight, performance, and longevity.

Opportunities also lie in catering to the growing demand from developing countries, where cycling is becoming more popular as an affordable and accessible means of transportation. Rising urbanization and fuel cost inflation in countries such as India, Brazil, and Indonesia are boosting the appeal of bicycles, creating a favorable market for affordable and reliable chain products. Furthermore, as cities invest in sustainable mobility infrastructure, local manufacturing of bicycle components, including chains, is expected to grow, supported by public-private initiatives and incentives.

Recent Developments in the Market

Recent developments in the bicycle chain market include the introduction of ultra-lightweight chains specifically engineered for carbon-framed bicycles, as well as the use of DLC (diamond-like carbon) and Teflon coatings to enhance longevity and performance. Major manufacturers are focusing on producing chains with improved lube retention and minimal elongation, which are critical for ensuring gear compatibility and drivetrain efficiency over extended periods.

There has also been a wave of strategic collaborations between component manufacturers and OEM bicycle brands to deliver integrated drivetrain solutions. Some companies are developing modular systems that allow for easy chain replacement and tool-free maintenance, appealing to both casual riders and professional service providers. The aftermarket is also witnessing a boom in premium and specialized chains for niche cycling communities, including gravel riders, endurance cyclists, and bikepackers.

Detailed Market Study: Full Report and Analysis

https://www.futuremarketinsights.com/reports/bicycle-chain-market

Competition Outlook

The global bicycle chain market is moderately fragmented and highly competitive, with a mix of established international players and regional manufacturers. Companies are competing on parameters such as tensile strength, weight, durability, corrosion resistance, and pricing. Innovation in chain design, quick link mechanisms, and material composition remains a key strategy to gain market share, especially in performance and e-bike segments.

Key Players

Key players in the global bicycle chain market include Shimano Inc., SRAM LLC, KMC Chain Industrial Co. Ltd., Taya Chain Co. Ltd., Wippermann jr GmbH, Izumi Chain Co. Ltd., Renold PLC, and Yaban Chain Industrial Co. Ltd. These players are investing in research and innovation to offer premium-quality chains for competitive cycling, urban mobility, and leisure biking. Several brands are also strengthening their distribution networks and entering strategic partnerships with local assemblers and retailers to improve market penetration in emerging economies.

Key Segmentations

The bicycle chain market can be segmented based on product type, application, end-user, material, and region. By product type, the market includes single-speed chains and multi-speed chains, with multi-speed chains dominating due to their widespread use in geared bicycles. By application, the segments include mountain bikes, road bikes, hybrid bikes, and e-bikes, with e-bikes registering the fastest growth. End-users include OEMs and aftermarket buyers, both contributing significantly to revenue generation. By material, the market is segmented into stainless steel, carbon steel, and others, with stainless steel preferred for its strength and resistance properties. Regionally, Asia-Pacific leads the market due to high production capacity and consumption, followed by Europe and North America.

Automotive Chassis System Industry Analysis

Bicycle Market Size and Share Forecast Outlook 2025 to 2035

https://www.futuremarketinsights.com/reports/bicycle-market

Bicycle Light Market Forecast and Outlook from 2025 to 2035

https://www.futuremarketinsights.com/reports/bicycle-light-market

Bicycle Components Aftermarket Forecast and Outlook from 2025 to 2035

https://www.futuremarketinsights.com/reports/bicycle-components-market

Ankush Nikam

Future Market Insights, Inc.

+91 90966 84197

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Resource Design & Build, LLC Completes Renovation at 6477 Old Shadburn Ferry Road

Naples Soccer Academy Welcomes Peter Giannopoulos as Director of Security

Dino Days A Dinosaur Themed Train Ride Sept. 13th & 14th Phillipsburg, NJ

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Konsument

Polacy nie korzystają z hossy trwającej na warszawskiej giełdzie. Na wzrostach zarabiają głównie inwestorzy zagraniczni

Od października 2022 roku na rynkach akcji trwa hossa, nie omija ona także warszawskiej giełdy. Mimo to inwestorzy indywidualni odpowiadają zaledwie za kilkanaście procent inwestycji, a o wzrostach decyduje i na nich zarabia głównie kapitał z zagranicy. Widać to również po napływach i odpływach do i z funduszy inwestycyjnych. Zdaniem Tomasza Koraba, prezesa EQUES Investment TFI, do przekonania Polaków do inwestowania na rodzimej giełdzie potrzeba zysków z akcji, informacji o tych zyskach docierającej do konsumentów oraz czasu.

Polityka

Obowiązek zapełniania magazynów gazu w UE przed sezonem zimowym ma zapewnić bezpieczeństwo dostaw. Wpłynie też na stabilizację cen

Unia Europejska przedłuży przepisy z 2022 roku dotyczące magazynowania gazu. Będą one obowiązywać do końca 2027 roku. Zobowiązują one państwa członkowskie do osiągnięcia określonego poziomu zapełnienia magazynów gazu przed sezonem zimowym. Magazyny gazu pokrywają 30 proc. zapotrzebowania Unii Europejskiej na niego w miesiącach zimowych. Nowe unijne przepisy mają zapewnić stabilne i przystępne cenowo dostawy.

Infrastruktura

Gminy zwlekają z uchwaleniem planów ogólnych zagospodarowania przestrzennego. Może to spowodować przesunięcie terminu ich wejścia w życie

Reforma systemu planowania i zagospodarowania przestrzennego rozpoczęła się we wrześniu 2023 roku wraz z wejściem w życie większości przepisów nowelizacji ustawy z 27 marca 2003 roku. Uwzględniono w niej plany ogólne gminy (POG) – nowe dokumenty planistyczne, za których przygotowanie mają odpowiadać samorządy. Rada Ministrów w kwietniu br. uchwaliła jednak ustawę o zmianie ustawy z 7 lipca 2023 roku, a jej celem jest zmiana terminu obowiązywania studiów uwarunkowań i kierunków zagospodarowania przestrzennego gmin na 30 czerwca 2026 roku. Wskazana data może nie być ostateczna z uwagi na to, że żadna z gmin nie uchwaliła jeszcze POG.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|