Auto Glass Moldings Market to Reach USD 5.8 Billion by 2035 Driven by OEM Integration and Precision Sealing Innovation

Rising demand for aerodynamic designs, durable EPDM solutions, and first-fit OEM installations fuels steady global growth

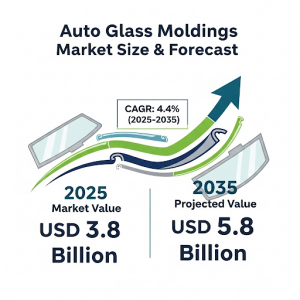

NEWARK, DE, UNITED STATES, August 20, 2025 /EINPresswire.com/ -- The global auto glass moldings market is projected to expand from USD 3.8 billion in 2025 to USD 5.8 billion by 2035, registering a CAGR of 4.4% during the forecast period. This steady growth is fueled by increasing vehicle production volumes, rising windshield replacement demand, and the automotive industry’s pursuit of aerodynamic designs that depend on precision sealing solutions.

Market Snapshot at a Glance

• 2025 Market Value: USD 3.8 billion

• 2035 Forecast Value: USD 5.8 billion

• CAGR (2025–2035): 4.4%

• Top Product Segment: Windshield moldings – 38% share (2025)

• Leading Material: EPDM rubber – 46% share (2025)

• Top End Use: Passenger cars – 70% share (2025)

• Key Growth Market: India – 6.0% CAGR

Strategic Role of Auto Glass Moldings Across Automotive Value Chains

Though modest in size, the auto glass moldings market plays a critical role across several parent automotive markets. It represents 5–7% of the global automotive glass market due to its indispensable role in sealing, and approximately 1–2% of the overall automotive components market. Within exterior parts, its share rises to 3–4%, as moldings directly influence weatherproofing and aesthetic design continuity. In the aftermarket, replacement-driven demand ensures a 2–3% contribution.

Growth Anchored by Advanced Materials and OEM Integration

The material shift toward EPDM rubber, thermoplastics, and UV-resistant compounds is central to market expansion. EPDM rubber alone is expected to capture 46% market share by 2025, favored for its resilience against UV rays, ozone, and extreme temperatures. Manufacturers are adopting co-extrusion and flocking technologies to extend durability, reduce noise, and improve fit precision.

At the OEM level, first-fit installations are projected to account for 75% of sales in 2025, underscoring the importance of seamless integration during initial vehicle assembly. Automakers are increasingly partnering with molding manufacturers to develop lightweight, high-performance solutions that comply with evolving aerodynamic and safety regulations.

Key Segment Insights

• Windshield Moldings – 38% share by 2025: Essential for sealing, preventing air and water leakage, and enhancing aerodynamic efficiency. Their adoption is rising in modern vehicle models with panoramic windshields and sleek rooflines.

• Passenger Cars – 70% share by 2025: High global passenger car production continues to drive molding demand, particularly for improved noise insulation and design aesthetics.

• OEM First Fit – 75% share by 2025: Growing preference for factory-installed moldings ensures long-term performance and compatibility.

Global Market Dynamics

Asia Pacific remains the dominant production hub, supported by China’s electric vehicle expansion and India’s fast-growing passenger car segment. North America and Europe continue to lead the aftermarket, driven by replacement demand, stringent regulatory compliance, and consumer expectations for quiet, aerodynamic vehicles.

Key market drivers include:

• Rising global vehicle production volumes

• Demand for aerodynamic vehicle profiles and frameless glass designs

• Growing consumer focus on cabin comfort, noise reduction, and energy efficiency

• Increased use of recyclable and eco-friendly molding materials

Regional and Country-Level Growth Outlook

• India (6.0% CAGR): Growth is led by expanding compact and mid-size car production, demand for cost-efficient moldings, and extrusion facility investments. UV- and dust-resistant solutions are in high demand due to the country’s climate.

• China (5.1% CAGR): EV production drives need for advanced moldings that improve insulation and reduce drag. Close integration with the auto glass sector enhances supply efficiency.

• United States (4.2% CAGR): Strong SUV and truck production sustains demand. Focus areas include recyclable molding compounds and multifunctional aftermarket profiles.

• Japan (3.9% CAGR): Precision-engineered one-piece moldings support compact and hybrid vehicles with ultra-low tolerance standards.

• Germany (3.6% CAGR): Premium OEMs emphasize flush-mounted glass systems and advanced thermoplastic elastomers for EV and hybrid platforms.

Manufacturer Landscape

The industry is moderately consolidated, with leading players advancing through OEM partnerships and material innovation:

• TOYODA GOSEI Co., Ltd. – Specializing in high-precision rubber and plastic moldings.

• Cooper Standard Automotive – Offering lightweight weatherstrips and glass run channels.

• HWASEUNG – Advancing EPDM-based moldings for acoustic and environmental resistance.

• FlexiTrim (Meteor-creative), Hebei Shida Seal Group, and Bharat Seats Ltd. – Supporting regional OEM and aftermarket demand with customized sealing systems.

Recent Developments

• January 2025: Kaizen Glass Solutions introduced an on-site ADAS calibration training program for auto glass technicians, enabling in-house service for sensor-equipped windshields.

• April 2025: AGC Inc. launched its FeelInGlass® HUD band at CES, embedding a micro-LED display into laminated windshields.

Future Outlook for Manufacturers

For manufacturers, the path forward centers on precision fit, lightweight innovation, and eco-friendly materials. Passenger cars, SUVs, and electric vehicles are increasingly requiring moldings that enhance both structural integrity and visual continuity. OEM partnerships will remain critical, while aftermarket suppliers must deliver solutions aligned with replacement cycles, evolving safety standards, and consumer preferences for quiet, comfortable driving experiences.

Report Coverage

The market analysis spans over 40 countries and provides forecasts across product types (windshield, quarter, window, sunroof), materials (EPDM, PVC, TPO, silicone rubber, others), end-use (passenger cars, LCVs, HCVs), and sales channels (first fit, aftermarket). Regional coverage includes North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Request Auto Glass Moldings Market Draft Report -

https://www.futuremarketinsights.com/reports/sample/rep-gb-22378

For more on their methodology and market coverage, visit

https://www.futuremarketinsights.com/about-us

Explore Related Insights

Automotive Electric Actuator Market:

https://www.futuremarketinsights.com/reports/automotive-electric-actuator-market

Automotive Spring Market:

https://www.futuremarketinsights.com/reports/automotive-spring-market

Automotive Cowl Screen Market:

https://www.futuremarketinsights.com/reports/automotive-cowl-screen-market

Automotive Ultracapacitor Market:

https://www.futuremarketinsights.com/reports/automotive-ultracapacitor-market

Automotive Airbag Controller Unit Market:

https://www.futuremarketinsights.com/reports/automotive-airbag-controller-unit-market

Editor’s Note:

This press release is based exclusively on market research insights into the global auto glass moldings market from 2025 to 2035. All figures, forecasts, and company references are drawn from the latest available data on industry performance, product adoption, material preferences, and regional market growth.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

A' International Education Technology and E-Learning Design Awards Call for Entries

Gas Insulated Switchgear Market Set for Steady Growth, Hitting $35.2 Billion by 2032

Back-to-School for Sales Teams: Why 'Gut-Driven' Selling Isn’t Working

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Prawo

Kolejne polskie miasta chcą być przyjazne dzieciom. Planują stworzyć najmłodszym dobre warunki do rozwoju

Cztery miasta w Polsce posiadają tytuł Miasta Przyjaznego Dzieciom nadany przez UNICEF Polska. Dziewięć kolejnych miast czeka na certyfikację, a w ostatnich miesiącach do programu zgłosiło się kilka następnych. Na całym świecie inicjatywa została przyjęta już w ponad 4 tys. samorządów, a w Hiszpanii objęła połowę dziecięcej populacji miast. Program UNICEF-u ma na celu zachęcenie włodarzy do traktowania najmłodszych obywateli w sposób podmiotowy, respektowania ich praw i zaproszenia ich do współdecydowania o przyszłości.

Przemysł

W ciągu roku w Polsce ubyło 500 przedsiębiorstw odzieżowo-tekstylnych. Problemem są spadki zamówień z Europy Zachodniej i wzrost kosztów

Wartość rynku odzieżowego w Polsce wynosi 66,9 mld zł, z czego 10 mld zł to wartość krajowej produkcji – wynika z danych PIOT. Od czasu pandemii branża mierzy się z szeregiem wyzwań, wśród których najpoważniejsze to wzrost kosztów pracy i produkcji, przerwane łańcuchy dostaw i spadek zamówień – zarówno w kraju, jak i za granicą, a także wzrost nieuczciwej konkurencji na rynku, czyli głównie importu z Chin. Skala wyzwań sprawia, że w ubiegłym roku z rynku zniknęło 500 firm. Producenci odzieży apelują do rządu o wsparcie.

Handel

D. Obajtek: Orlen powinien być o 30–40 proc. większą spółką. Byłoby to z korzyścią dla konsumentów

Orlen jest największym polskim przedsiębiorstwem. Jego przychody ze sprzedaży w 2024 roku wyniosły blisko 295 mln zł, a rok wcześniej – ponad 372 mln – wynika z raportu Rzeczpospolitej „Lista 500”. W ubiegłorocznym rankingu Fortune 500 uwzględniającym największe korporacje znalazł się na 216. miejscu na świecie i 44. w Europie. Według Daniela Obajtka, europosła PiS-u i byłego prezesa Orlenu, spółka powinna jeszcze urosnąć, tym samym gwarantując konsumentom szereg korzyści, a także przyspieszać inwestycje m.in. w obszarze petrochemii i energetyki zero- oraz niskoemisyjnej.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|