Automotive Electronics Market: Exclusive Report on the Latest Trends and Opportunities in the Future

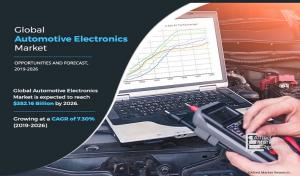

Automotive Electronics Market Expected to Reach $382.16 Billion by 2026

Download Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/A06036

The Automotive Electronics industry deals in equipping vehicles with digital and automatic controls. Factors such as the adoption of IoT and AI in automobiles, vehicles equipped with automated driving, the demand for in-vehicle safety features, increase in the demand for infotainment features drive the market of automotive electronics. On the other hand, low adoption of automotive electronics in newly industrialized countries and an increase in the overall cost of end-products due to the integration of automotive electronics hamper the market growth. Further, the investment in autonomous driving of vehicles in smart grids is expected to provide lucrative opportunities in the automotive electronics market.

Over the period automobile industry has witnessed automation in multiple functionalities such as power windows, camera parking assistance, integrated digital cockpit, and other features. The penetration of ADAS in an economical range of cars drives the market. In addition, the rise in competition in the automotive market has led manufacturers to offer infotainment features in an economical range of cars. Thus, a greater number of cars getting equipped with infotainment electronics increases the market for automotive electronics. Further, the advancement of IoT and AI has promoted the penetration of infotainment electronics in automobiles, driving the automotive electronics market share.

The passenger car segment was the highest contributor to the automotive electronics market growth in 2019, whereas HCV experienced the fastest growth with a CAGR of 9.0% during the forecast period. The innovation and standardization of aftermarket products are key factors in its future growth.

As per automotive electronics market trends, the Asia-Pacific was the major revenue generator in 2019 and is expected to maintain its dominance in the future. This is attributed to the rise in the industrial sector and its automation, which is expected to drive the automotive electronics market growth globally.

Get Customized Reports with you're Requirements: https://www.alliedmarketresearch.com/request-for-customization/A06036

Competitive Analysis:

The Automotive Electronics industry's key market players adopt various strategies such as product launch, product development, collaboration, partnership, and agreements to influence the market. It includes details about the key players in the market's strengths, product portfolio, market size and share analysis, operational results, and market positioning.

Some of the major key players in the global Automotive Electronics Market include,

NXP SEMICONDUCTORS N.V.

Aptiv PLC (Delphi Automotive PLC)

Hitachi, Ltd. (Hitachi Automotive Systems, Ltd.)

INFINEON TECHNOLOGIES AG

RENESAS ELECTRONICS CORPORATION

Continental AG

Robert Bosch

TEXAS INSTRUMENTS

STMICROELECTRONICS N.V.

NVIDIA Corporation

According to the automotive electronics market analysis, the Asia-Pacific is projected to experience rapid growth throughout the analysis period. China witnessed the highest demand for level sensors, due to the wide presence of semiconductor companies in the country and stringent government regulations associated with level sensors. Moreover, an enhancement in industrial autonomy and an increase in expenditure in emerging markets such as Latin America and the Middle East to meet the demand for exponentially growing economies in these countries have strengthened the market growth. Furthermore, technological advancements for cost-effective and high-precision applications in these nations offer lucrative automotive electronics market opportunities.

The automotive electronics market size is segmented based on vehicle type, component, application, distribution channel, and region. By vehicle type, it is categorized as passenger cars, LCVs, and HCVs. Based on its components, it is categorized into sensors, actuators, processors, microcontrollers, and other components. The application segment is divided into ADAS, infotainment, body electronics, safety systems, powertrain, and other applications. The distribution channel in the automotive electronics market is segmented into OEM and aftermarket.

Inquiry before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A06036

Key Findings of the Study:

- By vehicle type, the passenger car segment accounted for the highest share of the automotive electronics market forecast in 2019, with $87.39 billion, growing at a CAGR of 5.6% from 2019 to 2026.

- Based on components, the microcontrollers segment generated the highest revenue, accounting for $63.44 billion in 2019.

- By region, Asia-Pacific is expected to dominate the market, garnering an 8.2% share during the forecast period.

The companies follow various market strategies such as product launch, product development, collaboration, partnership, and others, leading to market growth. Nvidia launched a simulator that leverages cloud computing power to test autonomous vehicles. The software can simulate glare at sunset, snowstorms, poor road surfaces, and dangerous situations to test the vehicle's ability to react.

About Us:

Allied Market Research is a top provider of market intelligence that offers reports from leading technology publishers. Our in-depth market assessments in our research reports take into account significant technological advancements in the sector. In addition to other areas of expertise, AMR focuses on the analysis of high-tech systems and advanced production systems. We have a team of experts who compile thorough research reports and actively advise leading businesses to enhance their current procedures. Our experts have a wealth of knowledge on the topics they cover. Also, they use a variety of tools and techniques when gathering and analyzing data, including patented data sources.

David Correa

Allied Market Research

+ + 1 800-792-5285

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

The Automotive Experience Alliance Advances Strategies to Align Elevate and Future-Proof Auto Shows

ENSESO4Food and Primabis Partner to Deliver FSMA 204 Traceability in Latin America

Grand Opening of Simply You Medical Spa in Visalia, CA Brings 'Botox and Bubbles' to the Central Valley

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Konsument

Polacy nie korzystają z hossy trwającej na warszawskiej giełdzie. Na wzrostach zarabiają głównie inwestorzy zagraniczni

Od października 2022 roku na rynkach akcji trwa hossa, nie omija ona także warszawskiej giełdy. Mimo to inwestorzy indywidualni odpowiadają zaledwie za kilkanaście procent inwestycji, a o wzrostach decyduje i na nich zarabia głównie kapitał z zagranicy. Widać to również po napływach i odpływach do i z funduszy inwestycyjnych. Zdaniem Tomasza Koraba, prezesa EQUES Investment TFI, do przekonania Polaków do inwestowania na rodzimej giełdzie potrzeba zysków z akcji, informacji o tych zyskach docierającej do konsumentów oraz czasu.

Polityka

Obowiązek zapełniania magazynów gazu w UE przed sezonem zimowym ma zapewnić bezpieczeństwo dostaw. Wpłynie też na stabilizację cen

Unia Europejska przedłuży przepisy z 2022 roku dotyczące magazynowania gazu. Będą one obowiązywać do końca 2027 roku. Zobowiązują one państwa członkowskie do osiągnięcia określonego poziomu zapełnienia magazynów gazu przed sezonem zimowym. Magazyny gazu pokrywają 30 proc. zapotrzebowania Unii Europejskiej na niego w miesiącach zimowych. Nowe unijne przepisy mają zapewnić stabilne i przystępne cenowo dostawy.

Infrastruktura

Gminy zwlekają z uchwaleniem planów ogólnych zagospodarowania przestrzennego. Może to spowodować przesunięcie terminu ich wejścia w życie

Reforma systemu planowania i zagospodarowania przestrzennego rozpoczęła się we wrześniu 2023 roku wraz z wejściem w życie większości przepisów nowelizacji ustawy z 27 marca 2003 roku. Uwzględniono w niej plany ogólne gminy (POG) – nowe dokumenty planistyczne, za których przygotowanie mają odpowiadać samorządy. Rada Ministrów w kwietniu br. uchwaliła jednak ustawę o zmianie ustawy z 7 lipca 2023 roku, a jej celem jest zmiana terminu obowiązywania studiów uwarunkowań i kierunków zagospodarowania przestrzennego gmin na 30 czerwca 2026 roku. Wskazana data może nie być ostateczna z uwagi na to, że żadna z gmin nie uchwaliła jeszcze POG.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|