Carbon Capture, Utilization, and Storage (CCUS) Market Growth Fueled by Rising CO₂ Levels and Net-Zero Targets

Governments’ strict climate rules and net-zero goals are boosting CCUS adoption in heavy industries such as power, cement, and steel production.

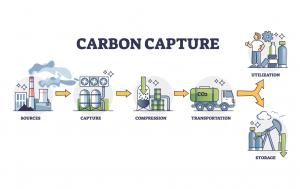

NEW YORK, NY, UNITED STATES, August 16, 2025 /EINPresswire.com/ -- In a recent analysis by DataM Intelligence analysis, the global carbon capture, utilization, and storage market reached a valuation of US$ 4.5 billion in 2024 and is projected to grow at a CAGR of 25% between 2025 and 2032.The rapid acceleration of atmospheric carbon dioxide levels has become a critical global concern, intensifying the call for swift and effective climate mitigation measures. According to NOAA’s Global Monitoring Lab 2024, the global average CO₂ concentration hit an all-time high of 422.8 ppm, registering a record annual jump of 3.75 ppm. At Mauna Loa Observatory, concentrations reached 424.61 ppm, underscoring the persistent upward trend. The rise is largely driven by human activity, particularly fossil fuel combustion, which generated approximately 37.4 billion tons of CO₂ in 2024, more than triple the annual average of the 1960s.

Download Latest Edition Sample Report (Corporate Emails get Priority Access): https://www.datamintelligence.com/download-sample/carbon-capture-utilization-and-storage-market

With CO₂ levels now about 50% higher than pre-industrial benchmarks, the urgency to reduce emissions is driving rapid adoption of CCUS, which is increasingly recognized as a critical solution for achieving global climate goals.

Rising Commitments to Net-Zero Emissions

The global momentum toward net-zero targets is creating unprecedented opportunities for CCUS deployment. Countries and corporations are not only setting ambitious carbon neutrality goals but also actively backing them with policy incentives, investment flows, and technology integration strategies.

Industry forecasts indicate that for the world to remain on track toward mid-century net-zero objectives, the volume of CO₂ captured annually will need to grow exponentially from current levels. This will involve moving from a few dozen million tonnes captured each year today to close to a billion tonnes by the early 2030s, with further multi-gigatonne capacity required by 2050. Such growth is reflected in the expanding development pipeline, with more than 700 projects currently in various planning and execution phases, collectively aiming for over 435 million tonnes of annual capture capacity and around 615 million tonnes of storage capacity by the end of this decade.

In addition, frameworks such as the European Union’s Emissions Trading System (ETS) are strengthening CCUS economics by making emissions more costly and phasing out free allowances by 2026. Major corporations are aligning with this shift. For example, in 2024, Mitsubishi Heavy Industries launched its “MISSION NET ZERO” strategy, pledging to achieve carbon neutrality by 2040 and positioning CCUS as a key driver in that transition.

CCUS Market Surges but Faces Major Investment Gap

As of 2023, around 45 commercial CCUS facilities were in operation globally, serving industrial processing, fuel transformation, and power generation sectors. While adoption rates were historically slower than anticipated, recent years have seen significant acceleration. In 2023 alone, announced capture capacity for 2030 rose by 35%, and planned storage capacity increased by 70%.

Despite this momentum, current capacity commitments amount to less than two-thirds of what is needed to remain on track for a 2050 net-zero pathway, leaving substantial scope for expansion. The World Economic Forum (2024) reports that the global CCUS pipeline has grown to 628 projects, marking a 15increase from the previous year, with investments having tripled since 2022 to reach US$ 6.4 billion.

This growth is driven by the pressing need to tackle escalating global CO₂ emissions. In 2024, fossil fuel combustion alone generated approximately 37.4 billion metric tonnes (Gt) of CO₂. If all announced CCUS projects are completed on schedule and operate at full capacity, they could collectively capture over 430 million metric tonnes (Mt) annually by 2030. While the current project pipeline is stronger than ever, with captured CO₂ either securely stored or repurposed into products such as fuels and chemicals, significantly higher levels of investment will still be necessary to meet long-term climate goals.

While the expansion of CCUS capacity is encouraging, bridging the gap to net-zero will require coordinated global action, stronger policy frameworks, and accelerated capital flows into large-scale deployment. Aligning industrial strategies, regulatory incentives, and cross-border CO₂ transport infrastructure will be critical to ensuring the sector’s ability to deliver on its climate mitigation potential.

Looking for in-depth insights? Grab the full report: https://www.datamintelligence.com/buy-now-page?report=carbon-capture-utilization-and-storage-market

Why Choose This Global Carbon Capture, Utilization, and Storage (CCUS) Market Report?

• Latest Data & Forecasts: Comprehensive projections through 2032, covering capture technologies, utilization pathways, storage options, and adoption trends across industries.

• Regulatory Intelligence: Actionable insights on climate policies, carbon pricing systems, and emissions reduction programs (including Paris Agreement, EU ETS, U.S. Inflation Reduction Act, 45Q tax credits, and national net-zero strategies).

• Competitive Benchmarking: Analysis of strategies from major players such as Shell, ExxonMobil, Mitsubishi Heavy Industries, Aker Carbon Capture, and Air Products, alongside profiles of emerging innovators.

• Emerging Market Focus: In-depth coverage of high-growth regions including Asia-Pacific, the Middle East, and North America, highlighting industrial hubs, storage site development, and cross-border CO₂ transport opportunities.

• Actionable Strategies: Identification of business opportunities in direct air capture (DAC), bioenergy with CCS (BECCS), and integration into hard-to-abate industries to maximize ROI.

• Pricing & Cost Insights: Detailed examination of cost structures across capture, compression, transport, and storage, along with technology cost curve trends and carbon credit pricing dynamics.

• Expert Perspectives: Guidance from specialists in carbon management, emissions reduction, and sustainable industrial transformation.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights-all in one place.

Competitive Landscape

Sustainability Impact Analysis

KOL / Stakeholder Insights

Unmet Needs & Positioning, Pricing & Market Access Snapshots

Market Volatility & Emerging Risks Analysis

Quarterly Industry Report Updated

Live Market & Pricing Trends

Consumer Behavior & Demand Analysis

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Related Report:

Cognitive Collaboration Market

Cognitive Assessment and Training Market

Sai Kumar

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Evan Hirsch and ShopGoodwill.com® Partner to Bring Thrift to the Runway at New York Fashion Week

Licensed Travel Agency Visago.ae Launches Faster Dubai Visa Online Service

Healing Us book launch at Kean University draws massive support and sparks national debate on mental health, addiction

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Konsument

Polacy nie korzystają z hossy trwającej na warszawskiej giełdzie. Na wzrostach zarabiają głównie inwestorzy zagraniczni

Od października 2022 roku na rynkach akcji trwa hossa, nie omija ona także warszawskiej giełdy. Mimo to inwestorzy indywidualni odpowiadają zaledwie za kilkanaście procent inwestycji, a o wzrostach decyduje i na nich zarabia głównie kapitał z zagranicy. Widać to również po napływach i odpływach do i z funduszy inwestycyjnych. Zdaniem Tomasza Koraba, prezesa EQUES Investment TFI, do przekonania Polaków do inwestowania na rodzimej giełdzie potrzeba zysków z akcji, informacji o tych zyskach docierającej do konsumentów oraz czasu.

Polityka

Obowiązek zapełniania magazynów gazu w UE przed sezonem zimowym ma zapewnić bezpieczeństwo dostaw. Wpłynie też na stabilizację cen

Unia Europejska przedłuży przepisy z 2022 roku dotyczące magazynowania gazu. Będą one obowiązywać do końca 2027 roku. Zobowiązują one państwa członkowskie do osiągnięcia określonego poziomu zapełnienia magazynów gazu przed sezonem zimowym. Magazyny gazu pokrywają 30 proc. zapotrzebowania Unii Europejskiej na niego w miesiącach zimowych. Nowe unijne przepisy mają zapewnić stabilne i przystępne cenowo dostawy.

Infrastruktura

Gminy zwlekają z uchwaleniem planów ogólnych zagospodarowania przestrzennego. Może to spowodować przesunięcie terminu ich wejścia w życie

Reforma systemu planowania i zagospodarowania przestrzennego rozpoczęła się we wrześniu 2023 roku wraz z wejściem w życie większości przepisów nowelizacji ustawy z 27 marca 2003 roku. Uwzględniono w niej plany ogólne gminy (POG) – nowe dokumenty planistyczne, za których przygotowanie mają odpowiadać samorządy. Rada Ministrów w kwietniu br. uchwaliła jednak ustawę o zmianie ustawy z 7 lipca 2023 roku, a jej celem jest zmiana terminu obowiązywania studiów uwarunkowań i kierunków zagospodarowania przestrzennego gmin na 30 czerwca 2026 roku. Wskazana data może nie być ostateczna z uwagi na to, że żadna z gmin nie uchwaliła jeszcze POG.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|