Confectionery Coating Market to reach USD 7.0 billion by 2035, driven by rising demand for shelf-stable sweet treats

Confectionery coating market growth is driven by demand for cost-effective, innovative solutions that enhance product appeal and shelf life for manufacturers.

NEWARK, DE, UNITED STATES, August 7, 2025 /EINPresswire.com/ -- The confectionery coating market is experiencing significant growth, driven by manufacturers seeking to address key challenges and capitalize on new opportunities. With a projected increase from USD 4.2 billion in 2025 to USD 7.0 billion by 2035, and a compound annual growth rate (CAGR) of 5.2%, these coatings offer a compelling solution for companies aiming to balance quality, cost, and consumer demand.

Manufacturers are increasingly turning to confectionery coatings as a strategic alternative to traditional chocolate. These coatings provide substantial cost savings, with some compound coatings reducing costs by up to 40% compared to pure chocolate, all while maintaining high levels of consumer acceptance. This efficiency extends to production, where coating lines can shorten production cycles by nearly 35%, enabling high-volume manufacturers to scale operations without compromising on quality or aesthetics.

Innovating for Consumer Appeal and Operational Efficiency

The market’s evolution is being shaped by a demand for premium, indulgent, and visually appealing confectionery products. Confectionery coatings are integral to meeting these demands. Advanced technologies, including compound formulations and natural colorants, enhance product aesthetics and shelf stability, making them a viable alternative to traditional chocolate coatings.

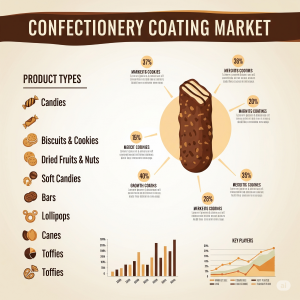

Innovation is also flourishing in flavor profiles and functional ingredients. While classic flavors like milk chocolate lead the market with a 38% share due to their broad appeal, manufacturers are also exploring premium and hybrid formats. This includes products with single-origin cocoa, reduced sugar, and added protein, catering to a new wave of health-conscious consumers. The wafers segment, which accounts for 43% of the market share, exemplifies this trend by providing a cost-effective, crispy base for a wide range of coated snacks and novelties.

Specialized and customized formulations are also gaining traction. Suppliers are offering tailored coating solutions for specific applications, moving beyond basic chocolate alternatives. This strategic collaboration between suppliers and manufacturers is accelerating the adoption of coatings in premium and artisanal products, highlighting their versatility and value in a competitive market.

A Global View: Regional Insights and Key Players

Growth is not uniform across the globe, with regional markets showing distinct characteristics and opportunities. China is projected to lead with a 6.8% CAGR, driven by large-scale manufacturing and a growing appetite for Western-style treats in major urban centers. India follows closely with a 6.5% CAGR, fueled by government support for food processing and the modernization of traditional sweets.

In the Americas, Brazil’s market is growing at a 5.8% CAGR, with a focus on sustainable innovations and tropical flavors. The USA market, expanding at a 5.2% CAGR, is a hub for advanced technologies, particularly in sugar-free and vegan coatings. Mexico, with a 5.0% CAGR, is successfully blending new coating technologies with traditional confections, using local ingredients like chili and cinnamon to create culturally relevant, export-ready products.

This regional landscape offers diverse opportunities for manufacturers to tailor their strategies. For example, a company targeting the USA can focus on advanced formulations and clean-label standards, while one in Mexico might prioritize enhancing the shelf stability and cultural relevance of its products.

Request Confectionery Coating Market Draft Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-10818

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Competitive Landscape and Future Outlook

The market's competitive landscape includes global giants and specialized regional players. Top key players such as Barry Callebaut AG, Cargill Incorporated, The Hershey Company, and Mars Incorporated are advancing their positions through investments in advanced coating technologies and sustainable sourcing. Other key players like Ferrero Group are focusing on premium coating development to meet the demand for high-quality alternatives in the luxury confection market.

Despite the opportunities, challenges remain, including ingredient cost volatility, health concerns, and the complexities of premium brand positioning. However, key trends are reshaping the market, including a shift toward natural ingredients, clean-label certifications, and ready-to-use coating solutions. Functional inclusions like protein and fiber are also emerging, reflecting the convergence of indulgence and health.

As global confectionery consumption increases and manufacturers prioritize taste innovation, visual appeal, and cost-effective solutions, the confectionery coating market is well-positioned for continued expansion. These coatings are not just an ingredient; they are a strategic solution for manufacturers aiming to innovate, differentiate, and thrive in a dynamic global market.

Explore Related Insights

Confectionery Fillings Market: https://www.futuremarketinsights.com/reports/confectionery-fillings-market

Chocolate Confectionery Market: https://www.futuremarketinsights.com/reports/chocolate-confectionery-market

Confectionery Ingredients Market: https://www.futuremarketinsights.com/reports/confectionery-ingredients-market

Editor's Note:

This release is based exclusively on verified and factual market content derived from industry analysis by Future Market Insights. No AI-generated statistics or speculative data have been introduced. For a detailed analysis of the confectionery coating market, including key players and regional insights, please refer to the full report.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Global Advanced Process Control (APC) Market Insight, Growth, Industry Trends | Reports and Data

Gas Engine Market to Grow at 3.8% CAGR, Reaching $6.0 Bn by 2031

New Music Alert Gospel Rock Artist Rikki Doolan Releases Anthemic Single You Got Somebody

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Konsument

Polacy nie korzystają z hossy trwającej na warszawskiej giełdzie. Na wzrostach zarabiają głównie inwestorzy zagraniczni

Od października 2022 roku na rynkach akcji trwa hossa, nie omija ona także warszawskiej giełdy. Mimo to inwestorzy indywidualni odpowiadają zaledwie za kilkanaście procent inwestycji, a o wzrostach decyduje i na nich zarabia głównie kapitał z zagranicy. Widać to również po napływach i odpływach do i z funduszy inwestycyjnych. Zdaniem Tomasza Koraba, prezesa EQUES Investment TFI, do przekonania Polaków do inwestowania na rodzimej giełdzie potrzeba zysków z akcji, informacji o tych zyskach docierającej do konsumentów oraz czasu.

Polityka

Obowiązek zapełniania magazynów gazu w UE przed sezonem zimowym ma zapewnić bezpieczeństwo dostaw. Wpłynie też na stabilizację cen

Unia Europejska przedłuży przepisy z 2022 roku dotyczące magazynowania gazu. Będą one obowiązywać do końca 2027 roku. Zobowiązują one państwa członkowskie do osiągnięcia określonego poziomu zapełnienia magazynów gazu przed sezonem zimowym. Magazyny gazu pokrywają 30 proc. zapotrzebowania Unii Europejskiej na niego w miesiącach zimowych. Nowe unijne przepisy mają zapewnić stabilne i przystępne cenowo dostawy.

Infrastruktura

Gminy zwlekają z uchwaleniem planów ogólnych zagospodarowania przestrzennego. Może to spowodować przesunięcie terminu ich wejścia w życie

Reforma systemu planowania i zagospodarowania przestrzennego rozpoczęła się we wrześniu 2023 roku wraz z wejściem w życie większości przepisów nowelizacji ustawy z 27 marca 2003 roku. Uwzględniono w niej plany ogólne gminy (POG) – nowe dokumenty planistyczne, za których przygotowanie mają odpowiadać samorządy. Rada Ministrów w kwietniu br. uchwaliła jednak ustawę o zmianie ustawy z 7 lipca 2023 roku, a jej celem jest zmiana terminu obowiązywania studiów uwarunkowań i kierunków zagospodarowania przestrzennego gmin na 30 czerwca 2026 roku. Wskazana data może nie być ostateczna z uwagi na to, że żadna z gmin nie uchwaliła jeszcze POG.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|