IBN Technologies' Accounts Receivable Services Enhance Operational Efficiency Across the U.S. Healthcare Sector

IBN Technologies boosts U.S. healthcare providers' cash flow through streamlined accounts receivable services.

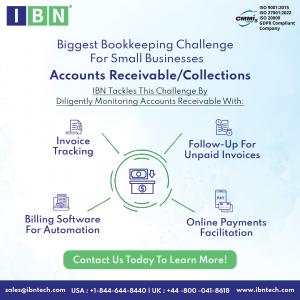

MIAMI, FL, UNITED STATES, July 4, 2025 /EINPresswire.com/ -- Amid widespread challenges such as payment delays, rising patient debt, and complex insurance claim processes, healthcare providers across the United States are turning to accounts receivable services. With the increasing prevalence of high-deductible health plans and escalating compliance demands, these services play a critical role in expediting collections, minimizing denials, and improving cash flow. By easing administrative workloads, accounts receivable systems empower healthcare providers to devote more time to patient care, establishing itself as a vital component of today’s healthcare operations.Firms like accounts receivable companies such as IBN Technologies are expanding nationally in response to the increasing demand for efficient accounts receivable (AR) solutions. With in-depth expertise in account receivable outsourcing, IBN Technologies enables healthcare providers to optimize collections, streamline billing processes, and minimize claim denials. Their customized solutions support healthcare facilities in delivering top-tier care while maintaining financial stability. Backed by a comprehensive array of AR services, IBN Technologies has emerged as a trusted partner for providers navigating the complexities of modern billing environments, resulting in enhanced operational efficiency and improved cash flow.

Initiate Your Financial Transformation Today!

Schedule a Complimentary Consultation: https://www.ibntech.com/free-consultation-for-ap-ar-management/

AR Services Reshape Financial Health of the U.S. Healthcare Industry

As financial pressures grow, the importance of managing account receivables has escalated for healthcare providers nationwide. A demand for personalized accounts receivable solutions is rising due to administrative burdens, higher patient responsibilities, and payment delays. These services assist organizations in maintaining financial equilibrium, reducing internal strain, and improving revenue cycles.

• Delayed reimbursements from insurers disrupt cash flow.

• Increased patient payment responsibility results in elevated outstanding balances.

• Frequent claim denials require meticulous follow-up and corrections.

• Complex billing frameworks and evolving regulations heighten administrative demands.

• Limited real-time visibility into receivables delays critical financial decisions.

Across sectors, organizations are effectively addressing challenges like complicated billing and delayed reimbursements by leveraging expert account receivable outsourcing and professional consultation. These services streamline processes, eliminate excessive paperwork, and optimize financial operations. With IBN Technologies’ all-encompassing AR management solutions, organizations across the country can manage receivables with precision and control.

“Financial stability depends on efficient receivables management. By offering customized AR solutions, we assist businesses in streamlining their processes and ensuring prompt payments, fostering sustained growth and operational success,” stated Ajay Mehta, CEO of IBN Technologies.

IBN Technologies: Elevating Receivables Management for Business Growth

IBN Technologies offers a robust suite of accounts receivable services aimed at strengthening cash flow and simplifying financial operations. Their core services include:

✅Invoice Data Capture & Validation – Automates invoice detail extraction and verification to reduce manual errors and ensure accuracy.

✅PO-Based Matching – Reconciles purchase orders with invoices for smoother operations and fewer discrepancies.

✅Payment Processing – Facilitates timely payments through automated reminders and alerts, helping avoid penalties.

✅Vendor Management – Enhances communication and tracking with vendors, improving transparency and partnerships.

✅Workflow Standardization – Implements uniform approval structures and policies to increase efficiency across multiple locations.

Amid growing receivable challenges, organizations nationwide are seeking professional providers to streamline finances and enhance collections. IBN Technologies delivers personalized AR strategies that reduce internal workloads, boost cash flow, and ensure operational resilience. With a commitment to value-driven services, the company supports organizations in achieving business scalability and financial clarity.

Key Benefits of IBN Technologies' AR Services

IBN Technologies’ comprehensive accounts receivable offerings bring measurable improvements in financial processes and liquidity for clients across various sectors:

✅Optimized Customer/Vendor Database Management – Ensures up-to-date, accurate records for smooth transactions.

✅Improved Collection Rates & Decreased Bad Debt – Strengthens financial health through strategic recovery efforts.

✅Timely GL Updates & GAAP-Compliant Adjustments – Supports accurate reporting and compliance with financial standards.

✅Reliable Projections via AR/AP Aging Reports – Enhances data-driven decision-making with precise accounts receivable report insights.

✅Automated Document Handling & Workflow Management – Reduces manual efforts and increases operational productivity.

Proven Results of Accounts Receivable Services

IBN Technologies’ AR services have consistently delivered significant results for clients.

Healthcare providers utilizing these solutions saw claim denial rates drop by up to 50%, enabling faster reimbursements and lower administrative load.

Organizations have also reported improved cash flow and overall financial performance due to refined receivable handling and reduced manual intervention.

The Nationwide Shift Toward AR Outsourcing

With increasing financial complexities, U.S. organizations are turning to specialized accounts receivable financing services to maintain fiscal stability. As operational standards evolve and business environments become more demanding, effective AR management is key to ensuring reliable cash flow and sustainable practices.

To navigate shifting compliance requirements, payment delays, and claim rejections, businesses are relying more on experienced service providers such as IBN Technologies. To stay competitive, organizations must embrace advanced receivable workflows incorporating real-time data access, automation, and process standardization.

IBN Technologies continues to lead by providing strategic, scalable AR solutions that help businesses reduce inefficiencies, prevent revenue loss, and strengthen long-term financial outcomes.

Related Services:

Outsourced Finance and Accounting

https://www.ibntech.com/finance-and-accounting-services/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

DRAM Market Expected to Hit $10.2 Billion by 2032, Registers Steady 5.4% CAGR From 2022 to 2032

Zinc Ion Batteries Market Expected to Hit $467.1 Million by 2032, Heats Up with 4.2% CAGR

Evaluating Gutter Guards for South Louisiana Homes: Investment Insights and Seasonal Benefits

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Bankowość

Rośnie liczba i wartość udzielonych konsumentom kredytów gotówkowych. Gorzej mają się kredyty ratalne oraz te udzielane firmom

Rynek kredytowy w Polsce co do zasady rośnie, choć nierównomiernie. Z danych Biura Informacji Kredytowej wynika, że najlepiej rozwija się segment kredytów gotówkowych dla konsumentów. Wartościowo wzrosła też kwota udzielonych limitów w kartach kredytowych. Według prognoz BIK w całym roku wzrośnie wartość zarówno udzielonych kredytów mieszkaniowych, jak i gotówkowych, choć tych pierwszych poniżej inflacji. Wcześniejsze cięcia stóp procentowych przez RPP nie zmieniły tej prognozy.

Transport

37,5 proc. środków z Planu Społeczno-Klimatycznego trafi na walkę z ubóstwem transportowym. Organizacje branżowe apelują o zmianę priorytetowych projektów [DEPESZA]

Ministerstwo Funduszy i Polityki Regionalnej z końcem czerwca zakończyło konsultacje Planu Społeczno-Klimatycznego, który otwiera drogę do pozyskania 65 mld zł (11,4 mld euro) z unijnego Społecznego Funduszu Klimatycznego. Polska będzie jego największym beneficjentem, a 37,5 proc. budżetu zostanie przeznaczone na bezpośrednie wsparcie osób narażonych na ubóstwo transportowe. Organizacje branżowe oceniają jednak, że walka z tym zjawiskiem może się okazać nieskuteczna. W toku konsultacji zgłosiły swoje zastrzeżenia co do priorytetów w wydatkach i sposobu wsparcia inwestycji w transport rowerowy.

Prawo

Firmy będą mogły przetestować krótszy tydzień pracy z rządowym wsparciem. Nabór wniosków ruszy w sierpniu

Ministerstwo Rodziny, Pracy i Polityki Społecznej uruchamia pilotaż krótszego tygodnia pracy. Zainteresowane wzięciem w nim udziału firmy będą się mogły ubiegać o wsparcie finansowe ze strony rządu. Politycy Nowej Lewicy, którzy są pomysłodawcami testu tego rozwiązania, przekonują, że finalnie zyskają na nim wszyscy, zarówno pracownicy, jak i pracodawcy, a ostrzeżenia o spodziewanych problemach gospodarki są mocno przesadzone.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

![37,5 proc. środków z Planu Społeczno-Klimatycznego trafi na walkę z ubóstwem transportowym. Organizacje branżowe apelują o zmianę priorytetowych projektów [DEPESZA]](https://www.newseria.pl/files/1097841585/rower3,w_85,_small.jpg)

.gif)

|

| |

| |

|