Streamlined Accounts Payable Services Support U.S. Manufacturers in Overcoming Market Challenges

IBN Technologies helps U.S. manufacturers boost Account Payable services accuracy, speed, and compliance for stronger financial outcomes.

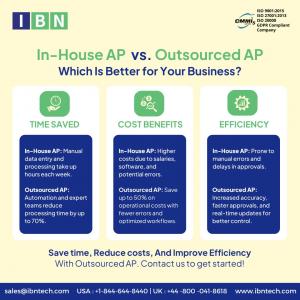

MIAMI, FL, UNITED STATES, July 4, 2025 /EINPresswire.com/ -- Amid rising production expenses and persistent disruptions in supply chains, U.S. manufacturing companies are increasingly adopting Accounts Payable Services to gain greater oversight of expenses and vendor dealings. These outsourced solutions offer improved efficiency in processing invoices, minimize inaccuracies, and guarantee timely disbursements within intricate supplier networks. Moreover, they provide actionable cash flow data that equips manufacturers with the ability to respond quickly to financial demands. As economic volatility persists, optimizing Accounts Payable Services is now central to maintaining financial stability within the manufacturing industry.To address this growing necessity, many accounts payable outsource providers have introduced industry-specific offerings to meet manufacturers’ unique requirements. These services enhance reliability, reduce turnaround time, and ensure regulatory alignment through optimized invoice practices, improved supplier coordination, and secure payment scheduling. Leveraging external expertise and structured solutions allows companies to streamline operations, mitigate financial discrepancies, and strengthen liquidity. Firms like IBN Technologies are now emerging as vital resources, with more organizations seeking support from experienced accounts payable companies to maintain operational continuity and long-term financial success.

Begin Your Financial Transformation Today

Schedule a Free Consultation: https://www.ibntech.com/free-consultation-for-ap-ar-management/

Key Obstacles in Managing Manufacturing Accounts Payable

For manufacturing entities, effective AP execution is essential to safeguard financial health and ensure continuous workflow. Nevertheless, several enduring issues hinder performance—from outdated integrations to delays in processing approvals. Challenges such as low visibility into obligations, heightened error potential, and constant regulatory demands affect AP reliability.

Frequent concerns include:

1. Limited in-house resources for handling multifaceted AP functions.

2. Escalating expenses tied to manual data input and delayed invoice processing.

3. Errors leading to missed or late vendor payments.

4. Insufficient clarity on vendor liabilities and overall cash positioning.

5. Difficulties in ensuring compliance and maintaining precise financial statements.

6. Scalability issues restricting adaptability and business expansion.

To navigate these complications, manufacturers are increasingly partnering with accounts payable solution providers to modernize and automate financial systems. IBN Technologies delivers end-to-end AP support customized to the manufacturing sector, focusing on increased accuracy, streamlined execution, and comprehensive compliance management.

“Operational excellence begins with financial clarity—refining Accounts Payable Services enables organizations to shift focus toward growth while entrusting complex functions to dependable professionals,” said Ajay Mehta, CEO of IBN Technologies.

IBN Technologies’ Specialized AP Offerings for the Manufacturing Industry

In the demanding industrial landscape, dependable AP execution is key to maintaining control over finances. Manufacturers are increasingly outsourcing key tasks like payment management, vendor engagement, and invoice processing to external specialists. IBN Technologies provides an extensive suite of Accounts Payable Services that reduce risk, boost accuracy, and ensure timely execution across workflows.

Core service features include:

✅ Invoice Processing and Verification

Seamless transition from receipt to approval, improving turnaround time and minimizing processing errors that impact cash flow.

✅ Vendor Liaison and Coordination

Proactive management of supplier communication to ensure on-time payments and quick conflict resolution.

✅ Payment Processing and Execution

Full-scale handling of payment operations—checks, ACH, and wires—aligned with contract terms and payment schedules.

✅ AP Ledger Reconciliation

Frequent reviews of payable accounts to uphold reporting accuracy and support financial integrity.

✅ Regulatory Reporting and Compliance

Robust tools to support tax filing, audit readiness, and alignment with regulatory standards to ensure financial accountability.

Strategic Benefits of AP Outsourcing for Manufacturers

A finely tuned AP system is essential for both operational effectiveness and fiscal reliability. Collaborating with an established firm like IBN Technologies enables companies to eliminate process inefficiencies, enhance liquidity, and maintain reporting accuracy.

Notable accounts payable benefits include:

✅ Shortened processing cycles and minimized error frequency.

✅ Enhanced liquidity through prompt vendor payments.

✅ Up-to-date ledgers supporting reliable financial reporting.

✅ Better visibility via comprehensive aging summaries.

✅ Increased productivity from structured and automated flows.

Turning over AP operations to skilled professionals ensures high performance, lower risk, and reliable results. IBN Technologies delivers the consistency required for businesses to maintain financial control and support both finance professionals and remote AP teams through scalable processes.

Real-World Impact: AP Improvements Across Sectors

IBN Technologies continues to drive financial transformation for small and mid-sized companies through custom accounts payable and receivable solutions. Their expertise delivers measurable operational gains and efficiency improvements.

Case studies include:

• A retail SME based in the U.S. improved its processing speed by 85% and achieved savings of $50,000 annually through refined AP management with IBN Technologies.

• An Illinois-based manufacturer reported a 92% improvement in accuracy, resulting in stronger supplier relationships and more effective operations.

• A packaging company in Ohio cut its payment cycle time by 60% and significantly reduced late fees by implementing automated AP workflows.

Adapting to the Future: AP Solutions Led by Remote Experts

Manufacturers facing fluctuating markets and cost increases continue to demand advanced Accounts Payable Services to stay competitive. Streamlined systems not only improve capital flow but also boost vendor trust, reduce payment errors, and reinforce compliance across the board.

Organizations are placing their trust in established partners like IBN Technologies to help them meet modern expectations. Through consistent billing, accurate disbursements, and efficient platform integration, IBN Technologies empowers financial departments—including remote AP leadership—to evolve their accounts payable workflow process and achieve sustainable performance in an ever-changing economic climate.

Related Services:

Outsourced Finance and Accounting

https://www.ibntech.com/finance-and-accounting-services/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

DRAM Market Expected to Hit $10.2 Billion by 2032, Registers Steady 5.4% CAGR From 2022 to 2032

Zinc Ion Batteries Market Expected to Hit $467.1 Million by 2032, Heats Up with 4.2% CAGR

Evaluating Gutter Guards for South Louisiana Homes: Investment Insights and Seasonal Benefits

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Bankowość

Rośnie liczba i wartość udzielonych konsumentom kredytów gotówkowych. Gorzej mają się kredyty ratalne oraz te udzielane firmom

Rynek kredytowy w Polsce co do zasady rośnie, choć nierównomiernie. Z danych Biura Informacji Kredytowej wynika, że najlepiej rozwija się segment kredytów gotówkowych dla konsumentów. Wartościowo wzrosła też kwota udzielonych limitów w kartach kredytowych. Według prognoz BIK w całym roku wzrośnie wartość zarówno udzielonych kredytów mieszkaniowych, jak i gotówkowych, choć tych pierwszych poniżej inflacji. Wcześniejsze cięcia stóp procentowych przez RPP nie zmieniły tej prognozy.

Transport

37,5 proc. środków z Planu Społeczno-Klimatycznego trafi na walkę z ubóstwem transportowym. Organizacje branżowe apelują o zmianę priorytetowych projektów [DEPESZA]

Ministerstwo Funduszy i Polityki Regionalnej z końcem czerwca zakończyło konsultacje Planu Społeczno-Klimatycznego, który otwiera drogę do pozyskania 65 mld zł (11,4 mld euro) z unijnego Społecznego Funduszu Klimatycznego. Polska będzie jego największym beneficjentem, a 37,5 proc. budżetu zostanie przeznaczone na bezpośrednie wsparcie osób narażonych na ubóstwo transportowe. Organizacje branżowe oceniają jednak, że walka z tym zjawiskiem może się okazać nieskuteczna. W toku konsultacji zgłosiły swoje zastrzeżenia co do priorytetów w wydatkach i sposobu wsparcia inwestycji w transport rowerowy.

Prawo

Firmy będą mogły przetestować krótszy tydzień pracy z rządowym wsparciem. Nabór wniosków ruszy w sierpniu

Ministerstwo Rodziny, Pracy i Polityki Społecznej uruchamia pilotaż krótszego tygodnia pracy. Zainteresowane wzięciem w nim udziału firmy będą się mogły ubiegać o wsparcie finansowe ze strony rządu. Politycy Nowej Lewicy, którzy są pomysłodawcami testu tego rozwiązania, przekonują, że finalnie zyskają na nim wszyscy, zarówno pracownicy, jak i pracodawcy, a ostrzeżenia o spodziewanych problemach gospodarki są mocno przesadzone.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

![37,5 proc. środków z Planu Społeczno-Klimatycznego trafi na walkę z ubóstwem transportowym. Organizacje branżowe apelują o zmianę priorytetowych projektów [DEPESZA]](https://www.newseria.pl/files/1097841585/rower3,w_85,_small.jpg)

.gif)

|

| |

| |

|