Titanium Powder Market is Expected to Grow USD 6.8 Billion by 2035, Driven by Aerospace & Additive Manufacturing | FMI

UK titanium powder market grows at 14.1% CAGR, driven by aerospace, defense, and biomedical demand, boosting additive manufacturing adoption.

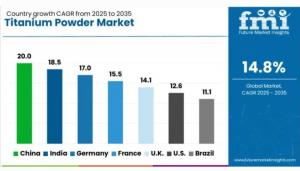

NEWARK, DE, UNITED STATES, August 20, 2025 /EINPresswire.com/ -- The global Titanium Powder Market is on the brink of a transformational decade, forecasted to grow from USD 1.7 billion in 2025 to USD 6.8 billion by 2035, advancing at a robust CAGR of 14.8%. The surge is underpinned by cost reductions from plasma atomization, expanded recycling of aerospace-grade scrap, and growing adoption across aerospace, defense, medical, and automotive sectors. For manufacturers seeking high-performance, lightweight, and corrosion-resistant materials, titanium powder represents a pivotal enabler of next-generation engineering and design.

A Market Redefined by Performance and Scale

Titanium powder’s unique properties—exceptional strength-to-weight ratio, biocompatibility, and resilience under extreme conditions—are placing it at the center of innovation. In 2025, the leading product segment, alloyed powders, will represent 54.6% of the market share, driven by their tensile strength, fatigue resistance, and compatibility with additive manufacturing.

Equally dominant is Grade 5 titanium powder (Ti-6Al-4V), projected to hold 47.3% of revenue share in 2025, reflecting its role as the material of choice for aerospace structures, medical implants, and high-performance automotive components.

With aerospace and defense consuming 52.1% of market revenue in 2025, titanium powder is a critical supply chain material for turbine parts, structural assemblies, and mission-critical defense hardware. Other applications are steadily expanding: automotive (20–25%), medical (15%), industrial and petrochemical (10%), and consumer electronics (5–8%)**, highlighting its versatile adoption across industries.

Why Manufacturers Are Turning to Titanium Powder

The industry’s shift toward additive manufacturing has amplified titanium powder’s importance. Manufacturers can now produce near-net-shape parts using powder bed fusion and directed energy deposition, dramatically reducing waste while shortening lead times. For OEMs and tier suppliers, titanium powder is the solution to:

• Achieving lightweight durability for aerospace structures and automotive parts.

• Meeting biocompatibility demands in customized implants and surgical devices.

• Ensuring corrosion resistance for petrochemical and marine equipment.

• Streamlining logistics by enabling on-demand, localized manufacturing.

Additionally, sustainability strategies are aligning with titanium powder’s recyclability and lower material wastage. As circular supply chains gain traction, regional recycling partnerships and powder-as-a-service models are emerging, offering manufacturers cost predictability, quality assurance, and traceable feedstock.

Geographic Outlook: Fastest Growth in BRICS and OECD Nations

The titanium powder market is not evenly distributed—its growth is being shaped by regional strengths and investments:

• China is the fastest-growing market, with a 20.0% CAGR, driven by domestic aerospace-grade production and advanced 3D printing adoption.

• India follows at 18.5% CAGR, fueled by orthopedic implants, defense-grade parts, and standardized atomization technologies.

• Germany records 17.0% CAGR, with titanium usage accelerating in automotive turbo systems, industrial turbines, and additive manufacturing hubs.

• France (15.5%) and the United Kingdom (14.1%) continue to scale adoption in aerospace, maritime, and biomedical applications.

For global manufacturers, these regional markets highlight not only demand growth but also opportunities for partnerships and localized supply chains.

Competitive Landscape: Tiered Innovation and Alliances

The market is shaped by Tier 1, Tier 2, and Tier 3 suppliers:

• Tier 1 leaders—such as AP&C, Sandvik, Praxair S.T. Technology, Kymera International, and Tronox Inc.—offer vertically integrated, high-purity powders optimized for aerospace and defense. Their investments in spherical powder production for laser and electron beam fusion systems set industry benchmarks.

• Tier 2 suppliers focus on industrial and automotive adoption, delivering cost-effective powders for MIM, thermal spraying, and tooling applications.

• Tier 3 participants serve niche markets, R&D labs, and prototyping environments, often acting as entry points for smaller manufacturers.

Recent developments underscore the market’s momentum: On June 19, 2024, PyroGenesis Canada Inc. secured its second titanium powder order from a Spanish aerospace client for its NexGen™ plasma atomization system—a step toward long-term supply contracts.

Challenges Ahead: Cost and Handling

Despite strong demand, titanium powder adoption faces constraints. Its production remains energy-intensive, with atomization, clean-room conditions, and alloying driving up costs. Storage requires inert environments, and recycling efficiency is often limited by contamination risks. For cost-sensitive sectors, these factors create barriers to entry.

However, economies of scale, coupled with innovative powder recycling and material-as-a-service models, are steadily reducing costs. Manufacturers that invest early in titanium powder adoption are positioned to capture premium markets while competitors hesitate.

Request Titanium Powder Market Draft Report:

https://www.futuremarketinsights.com/reports/sample/rep-gb-23000

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Future Outlook: Meeting Manufacturers’ Needs

Looking ahead to 2035, titanium powder’s role will be defined by customization, scalability, and sustainability:

• Customized grades: Manufacturers are increasingly demanding tailored powder chemistries to meet application-specific requirements, particularly in aerospace and medical device manufacturing.

• Material-as-a-service ecosystems: Offering powder sampling, reuse analytics, and replenishment services, these ecosystems lower barriers for new entrants.

• Strategic alliances: Collaborations between powder producers, recyclers, and machine builders will ensure integrated supply chains with closed-loop traceability.

• Expansion in additive manufacturing: As aerospace, defense, and medical device firms push boundaries, titanium powder’s compatibility with advanced 3D printing platforms will define its continued dominance.

Related Insights from Future Market Insights (FMI)

Titanium Tetrachloride (TiCl4) Market - https://www.futuremarketinsights.com/reports/titanium-chloride-market

Titanium Nitride Coating Market - https://www.futuremarketinsights.com/reports/titanium-nitride-coating-market

Titanium Aluminides (TiAl) Market - https://www.futuremarketinsights.com/reports/titanium-alumindes-market

Editor’s Note:

The Titanium Powder Market is gaining momentum with its expanding role in aerospace, automotive, and additive manufacturing. Driven by lightweight strength and corrosion resistance, demand is set to accelerate globally. Innovation in 3D printing and advanced metallurgy will define its future growth trajectory.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

A' International Education Technology and E-Learning Design Awards Call for Entries

Gas Insulated Switchgear Market Set for Steady Growth, Hitting $35.2 Billion by 2032

Back-to-School for Sales Teams: Why 'Gut-Driven' Selling Isn’t Working

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Prawo

Kolejne polskie miasta chcą być przyjazne dzieciom. Planują stworzyć najmłodszym dobre warunki do rozwoju

Cztery miasta w Polsce posiadają tytuł Miasta Przyjaznego Dzieciom nadany przez UNICEF Polska. Dziewięć kolejnych miast czeka na certyfikację, a w ostatnich miesiącach do programu zgłosiło się kilka następnych. Na całym świecie inicjatywa została przyjęta już w ponad 4 tys. samorządów, a w Hiszpanii objęła połowę dziecięcej populacji miast. Program UNICEF-u ma na celu zachęcenie włodarzy do traktowania najmłodszych obywateli w sposób podmiotowy, respektowania ich praw i zaproszenia ich do współdecydowania o przyszłości.

Przemysł

W ciągu roku w Polsce ubyło 500 przedsiębiorstw odzieżowo-tekstylnych. Problemem są spadki zamówień z Europy Zachodniej i wzrost kosztów

Wartość rynku odzieżowego w Polsce wynosi 66,9 mld zł, z czego 10 mld zł to wartość krajowej produkcji – wynika z danych PIOT. Od czasu pandemii branża mierzy się z szeregiem wyzwań, wśród których najpoważniejsze to wzrost kosztów pracy i produkcji, przerwane łańcuchy dostaw i spadek zamówień – zarówno w kraju, jak i za granicą, a także wzrost nieuczciwej konkurencji na rynku, czyli głównie importu z Chin. Skala wyzwań sprawia, że w ubiegłym roku z rynku zniknęło 500 firm. Producenci odzieży apelują do rządu o wsparcie.

Handel

D. Obajtek: Orlen powinien być o 30–40 proc. większą spółką. Byłoby to z korzyścią dla konsumentów

Orlen jest największym polskim przedsiębiorstwem. Jego przychody ze sprzedaży w 2024 roku wyniosły blisko 295 mln zł, a rok wcześniej – ponad 372 mln – wynika z raportu Rzeczpospolitej „Lista 500”. W ubiegłorocznym rankingu Fortune 500 uwzględniającym największe korporacje znalazł się na 216. miejscu na świecie i 44. w Europie. Według Daniela Obajtka, europosła PiS-u i byłego prezesa Orlenu, spółka powinna jeszcze urosnąć, tym samym gwarantując konsumentom szereg korzyści, a także przyspieszać inwestycje m.in. w obszarze petrochemii i energetyki zero- oraz niskoemisyjnej.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|