Insect-Based Snacks Market to Hit USD 380.9 Million by 2035 Amid Rising Demand for High-Protein Alternatives

Global insect-based snacks market to grow steadily, driven by sustainable protein demand. Key players focus on crickets, online sales, and adult consumers.

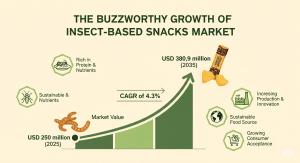

NEWARK, DELAWARE, INDIA, August 5, 2025 /EINPresswire.com/ -- The global insect-based snacks market is projected to reach USD 380.9 million by 2035, growing from USD 250 million in 2025 at a Compound Annual Growth Rate (CAGR) of 4.3%. This steady growth points to a market with significant potential, driven by rising interest in high-protein, sustainable alternatives.

However, for manufacturers to fully capitalize on this opportunity, they must strategically address key challenges, including cultural resistance, regulatory hurdles, and the need for consumer education. The market is not just about a niche product; it is a solution to the growing demand for sustainable and nutritious food sources, and this press release is tailored to help manufacturers understand how to position themselves for success.

Building a Sustainable Future: Solutions for Manufacturers

For manufacturers looking to enter or expand within this market, success hinges on a solution-focused approach that tackles current inhibitions and leverages key consumer trends. The data provides a clear roadmap for achieving this.

1. Emphasize Cricket-Based Formulations: Crickets are the dominant insect type, expected to account for 40% of the market share in 2025. Their versatility, high protein content, and nutritional value make them the ideal ingredient for a wide range of snack products, particularly protein bars, which are the leading product type with a 27.5% market share. Manufacturers can focus their R&D on developing powdered cricket flours for use in familiar formats like baked goods, extruded snacks, and bars. This approach can help overcome cultural resistance by concealing the insect form while delivering on the nutritional and sustainability benefits that consumers are seeking. Brands like Small Giants and EXO Protein have already demonstrated success with cricket-based products, offering a proven model for new entrants.

2. Leverage Direct-to-Consumer and Online Channels: With online retail projected to dominate distribution with a 36% market share in 2025, manufacturers have a powerful tool to overcome traditional retail barriers. Online platforms and direct-to-consumer (D2C) models allow brands to directly engage with their core audience of health-conscious and eco-aware adults, who make up 44% of the end-user market. This channel facilitates brand storytelling, allows for greater transparency with QR-code sourcing, and enables the promotion of sustainability certifications. Furthermore, the rise of subscription-based models and targeted marketing campaigns can help build brand loyalty and consumer trust. This digital-first strategy is crucial for a product category that relies heavily on consumer education and targeted outreach.

3. Champion Regulatory Clarity and Consumer Education: One of the most significant challenges facing the market is inconsistent regulatory approvals and cultural resistance. Manufacturers can address this head-on by actively engaging in consumer education and advocating for clear regulatory frameworks. The success of Nutrinsect in Italy, which received official approval to use cricket flour, and the streamlined processes in the United Kingdom, demonstrate that regulatory clarity is a major catalyst for growth. Manufacturers should prioritize transparent labeling, including allergen information, to build consumer trust. By sharing the environmental benefits of insect protein and positioning their products as a high-protein, low-footprint alternative, manufacturers can help normalize insect consumption and move beyond the “yuck factor.”

Regional Insights and Key Players

The market’s growth is highly dependent on regional dynamics. The United Kingdom stands out with a projected 4.9% CAGR, driven by a favorable regulatory environment and a growing interest in sustainable snacks. This makes the UK a prime market for manufacturers to test and scale new products. In contrast, the United States has a slower growth rate of 2.6%, largely due to a more cautious regulatory landscape and higher consumer resistance. However, within the US, growth is concentrated among fitness enthusiasts and sustainability-conscious consumers, suggesting an opportunity for manufacturers to target these niche groups through online and specialty retail channels.

Markets in India (3.5% CAGR) and China (3.2% CAGR) show steady, gradual expansion. In India, growth is tied to the wellness and functional snack segments, with a focus on institutional nutrition and cultural adaptation of flavors. In China, where some insects are traditionally consumed, manufacturers are launching products like silkworm crisps and beetle jerky, targeting health-oriented youth and premium snack lines.

Leading players like Ÿnsect and Jimini’s are defining the market by offering diverse product lines and focusing on both ingredient supply and consumer-facing snacks. Ÿnsect is a key ingredient supplier, providing powdered cricket and mealworm ingredients to other food brands, while Jimini’s has built a strong brand through its cricket-chip lines and direct-to-consumer platforms. The strategic acquisition of specialty startups by larger food ingredient firms is a trend to watch, suggesting a move toward market consolidation and broader mainstream acceptance in the coming years.

The insect-based snacks market offers a compelling value proposition for manufacturers—a path to meet the growing demand for sustainable, healthy protein. Success in this evolving market requires a focus on innovation, transparency, and a strategic understanding of both global and regional consumer landscapes. By addressing the key challenges with solution-focused strategies, manufacturers can secure a leadership position and help shape the future of food.

Request Insect-Based Snacks Market Draft Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-22457

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Explore Related Insights

Pet Snacks and Treats Market: https://www.futuremarketinsights.com/reports/pet-snacks-and-treats-market

Extruded Snacks Market: https://www.futuremarketinsights.com/reports/extruded-snacks-market

Pet Food and Supplement Market: https://www.futuremarketinsights.com/reports/pet-food-and-supplement-market

Editor’s Note:

This release is based exclusively on verified and factual market content derived from industry analysis by Future Market Insights. No AI-generated statistics or speculative data have been introduced. This press release is based on a market analysis report on the global insect-based snacks market. All data and figures are sourced directly from the provided content.

Rahul Singh

Future Market Insights Inc.

347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

‘Ain’t Done Just Yet’ Brings Laughter, Tears, And Bucket List Dreams to Kickstarter

CHOICE HRA Provisions Removed from One Big Beautiful Bill Act in Final Senate Revisions

Loukas Tzitzis Selected as Top Leader of the Year in AI and Cybersecurity by IAOTP

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Handel

1 października ruszy w Polsce system kaucyjny. Część sieci handlowych może nie zdążyć z przygotowaniami przed tym terminem

Producenci, sklepy i operatorzy systemu kaucyjnego mają niespełna dwa miesiące na finalizację przygotowań do jego startu. Wówczas na rynku pojawią się napoje w specjalnie oznakowanych opakowaniach, a jednostki handlu powinny być gotowe na ich odbieranie. Część z nich jest już do tego przygotowana, część ostrzega przed ewentualnymi opóźnieniami. Jednym z ważniejszych aspektów przygotowań na te dwa miesiące jest uregulowanie współpracy między operatorami, których będzie siedmiu, co oznacza de facto siedem różnych systemów kaucyjnych.

Ochrona środowiska

KE proponuje nowy cel klimatyczny. Według europosłów wydaje się niemożliwy do realizacji

Komisja Europejska zaproponowała zmianę unijnego prawa o klimacie, wskazując nowy cel klimatyczny na 2040 roku, czyli redukcję emisji gazów cieplarnianych o 90 proc. w porównaniu do 1990 rok. Jesienią odniosą się do tego kraje członkowskie i Parlament Europejski, ale już dziś słychać wiele negatywnych głosów. Zdaniem polskich europarlamentarzystów już dotychczas ustanowione cele nie zostaną osiągnięte, a europejska gospodarka i jej konkurencyjność ucierpi na dążeniu do ich realizacji względem m.in. Stanów Zjednoczonych czy Chin.

Handel

Amerykańskie indeksy mają za sobą kolejny wzrostowy miesiąc. Druga połowa roku na rynkach akcji może być nerwowa

Lipiec zazwyczaj jest pozytywnym miesiącem na rynkach akcji i tegoroczny nie był wyjątkiem. Amerykańskie indeksy zakończyły go na plusie, podobnie jak większość europejskich. Rynki Starego Kontynentu nie przyciągają jednak już kapitału z taką intensywnością jak w pierwszej części roku. Z drugiej strony wyceny za oceanem po kolejnych rekordach są już bardzo wysokie, a wpływ nowego porządku celnego narzuconego przez Donalda Trumpa – na razie trudny do przewidzenia. W najbliższym czasie na rynkach można się spodziewać jeszcze większej zmienności i nerwowości, ale dopóki spółki pokazują dobre wyniki, przesłanek do zmiany trendu na spadkowy nie ma.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

![Nestlé w Polsce podsumowuje wpływ na krajową gospodarkę. Firma wygenerowała 0,6 proc. polskiego PKB [DEPESZA]](https://www.newseria.pl/files/1097841585/fabryka-nesquik_1,w_85,r_png,_small.png)

.gif)

|

| |

| |

|