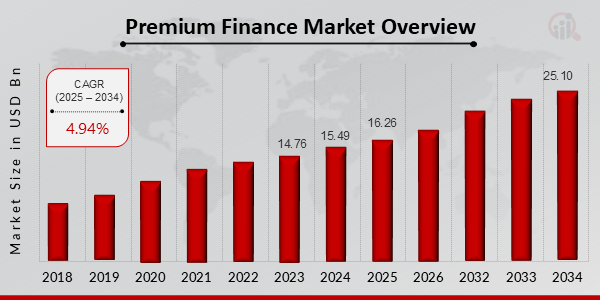

Premium Finance Market to Hit $25.10 Billion By 2034, Flexible Solutions for High-Value Insurance

Premium Finance Market is poised for sustained growth as individuals and businesses around the world continue to prioritize risk management.

The Premium Finance Market plays a pivotal role in enhancing accessibility to insurance products by providing policyholders with flexible financing options. This market refers to the service of lending funds to individuals or businesses to pay their insurance premiums, which are then repaid in installments over time. As insurance costs rise due to inflation, economic uncertainty, and increasing coverage demands, premium financing helps alleviate upfront financial burdens for policyholders. Businesses and high-net-worth individuals especially benefit from this solution when purchasing large or complex policies such as life insurance, commercial property insurance, or professional liability coverage. With growing awareness of risk management and the rising global demand for comprehensive insurance plans, the premium finance industry is experiencing steady expansion across various geographies and customer segments.

Get Exclusive Sample of the Research Report at -

https://www.marketresearchfuture.com/sample_request/24850

The market segmentation of the premium finance sector is generally based on type, application, end-user, and region. By type, the market is categorized into commercial insurance premium financing and life insurance premium financing. Commercial insurance premium financing remains the dominant segment, widely used by businesses to manage cash flow and spread the cost of policies such as workers’ compensation, liability, and fleet insurance. On the other hand, life insurance premium financing caters primarily to high-net-worth individuals seeking wealth preservation and estate planning solutions. By application, the market serves both individual consumers and corporate clients, each with distinct needs and payment capacities. End-users include small and medium-sized enterprises (SMEs), large enterprises, and individual policyholders. SMEs are increasingly adopting premium financing to reduce upfront expenditures, while large enterprises often use it for budget optimization and tax planning purposes. This segmentation highlights the market’s versatility in serving diverse needs within the insurance and financial services ecosystems.

The market dynamics shaping the premium finance industry are influenced by a variety of drivers, challenges, trends, and opportunities. One of the primary growth drivers is the rising cost of insurance premiums globally, prompting both individuals and businesses to seek alternative financing options. Another key driver is the growing complexity of insurance products, which often require higher upfront investments. Technological advancements such as AI, blockchain, and digital underwriting have enhanced the efficiency and transparency of premium financing solutions, encouraging wider adoption. However, the industry faces challenges including stringent regulatory requirements, potential credit risks, and limited awareness among smaller businesses and first-time insurance buyers. Additionally, economic fluctuations and rising interest rates can affect borrowing patterns and profit margins. Nonetheless, the increasing penetration of insurance in emerging economies and the digital transformation of financial services present vast opportunities for market expansion. Providers who prioritize personalized offerings, seamless digital experiences, and regulatory compliance are well-positioned for long-term success.

Buy this Premium Research Report at -

https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24850

Recent developments in the Premium Finance Market illustrate a trend towards innovation, strategic partnerships, and market expansion. Many companies are investing in digital transformation initiatives to improve service speed, customer onboarding, and risk analysis. For example, several premium finance firms have launched mobile apps and cloud-based platforms for instant policy quoting and payment scheduling. Partnerships between insurers and finance providers are becoming more common, as insurers seek to embed financing options directly within their sales platforms. This embedded finance model streamlines the purchase process for policyholders and boosts retention for insurers. Additionally, market players are focusing on data security and compliance with financial regulations such as GDPR and AML (anti-money laundering) laws, especially when operating across international borders. Mergers and acquisitions are also occurring as larger players seek to enhance their capabilities or enter new regional markets through strategic buyouts of niche or regional providers.

From a regional analysis perspective, the Premium Finance Market exhibits robust growth across major regions including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America remains the largest market due to its well-established insurance sector, high insurance penetration, and advanced financial infrastructure. In the United States and Canada, premium financing is widely accepted, especially in the commercial and life insurance segments. Europe follows closely, supported by strong regulatory frameworks and a mature insurance industry. Countries such as the UK, Germany, and France are notable contributors, with finance firms integrating advanced digital platforms to meet client expectations. The Asia-Pacific region is witnessing rapid growth due to rising disposable incomes, increasing insurance awareness, and the digitalization of financial services. India, China, Japan, and Australia are key markets, with SMEs and individuals actively seeking financing options to manage premium payments. Latin America and the Middle East & Africa are also emerging as promising regions for premium finance adoption. In these regions, expanding insurance coverage and growing support from governments and financial institutions are encouraging consumers to opt for flexible financing models.

Browse In-depth Market Research Report -

https://www.marketresearchfuture.com/reports/premium-finance-market-24850

Key Companies in the Premium Finance Market Include

• Aon

• Brown Brown

• Marsh

• Acrisure

• Berkshire Hathaway

• Lockton

• USI Insurance Services

• Hub International

• Assurant

• Alliant Insurance Services

• Willis Towers Watson

• Gallagher

• Arthur J. GallagherneparaWTW

• NFP

The Premium Finance Market is poised for sustained growth as individuals and businesses around the world continue to prioritize risk management and financial flexibility. By making insurance more accessible and manageable, premium financing not only enhances policyholder satisfaction but also contributes to the overall resilience of the financial system. With continued innovation, strategic collaborations, and expansion into underpenetrated markets, premium finance providers are well-equipped to meet the evolving demands of the global insurance landscape. As the world moves further toward digital transformation and financial inclusion, the premium finance industry will play a central role in shaping the future of insured financial planning.

Explore MRFR’s Related Ongoing Coverage In ICT Domain -

Data Centers Facility Market -

https://www.marketresearchfuture.com/reports/data-centers-facility-market-35733

Creative Software Market -

https://www.marketresearchfuture.com/reports/creative-software-market-35741

Encryption Management Solution Market -

https://www.marketresearchfuture.com/reports/encryption-management-solution-market-35736

Enterprise Mobility In Energy Sector Industry Market

Fiber Web Hosting Service Market

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Contact US:

Market Research Future

(Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

Website: https://www.wiseguyreports.com/

Website: https://www.wantstats.com/

Sagar Kadam

Market Research Future

+ +1 628-258-0071

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Commemorating Three Decades of ERA Environmental Software Solutions

Israeli startups to compete for $1M prize from Startup World Cup

Rony Jabour to Speak on Workplace Safety at NSC Congress & Expo 2025 in Denver

Kalendarium

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Prawo

Rząd zapowiada nową strategię wspierającą polski kapitał. Rodzimym firmom przyda się promocja ze strony instytucji państwowych

Premier Donald Tusk podczas otwarcia wiosennej odsłony Europejskiego Forum Nowych Idei zapowiedział nową politykę gospodarczą, opartą na odbudowie i repolonizacji krajowej gospodarki. Przy wyborze wykonawców w państwowych inwestycjach mają być promowane polskie firmy, a zadaniem administracji ma być dbanie o interes narodowy. – Wydaje mi się, że powinniśmy jednak przede wszystkim patrzeć na to, kto i jak skutecznie będzie wspierał polskie firmy, inwestycje, bo to jest to, czego potrzebujemy – ocenia dr Henryka Bochniarz, przewodnicząca Rady Głównej Konfederacji Lewiatan.

Finanse

Członek RPP spodziewa się obniżki stóp procentowych już w maju, może nawet o 50 pb. Potem dyskusja o kolejnej obniżce możliwa w lipcu

Nie najlepsze dane z gospodarki w I kwartale roku oraz inflacja o połowę niższa niż w chwili ostatniej obniżki stóp – to zdaniem Ludwika Koteckiego, członka RPP, wystarczająco mocne powody przemawiające za cięciem kosztu pieniądza już na majowym posiedzeniu. W grze może być nawet 50 punktów bazowych na początek, a do końca roku dwa razy tyle. Podwyższona niepewność w globalnej gospodarce spowodowana polityką administracji w Waszyngtonie to dodatkowy czynnik, który powinien wesprzeć decyzję o poluzowaniu polityki pieniężnej.

Prawo

Trwają prace nad nową ustawą o Rzeczniku MŚP. Urząd zyska nowe kompetencje

Zgodnie z procedowaną ustawą Rzecznik Małych i Średnich Przedsiębiorców stanie się Rzecznikiem Praw Przedsiębiorców i zyska nowe uprawnienia. Wśród nich najważniejsze to możliwość reprezentowania wszystkich przedsiębiorstw, niezależnie od ich wielkości, i rolników, a także inicjatywa ustawodawcza. Ustawą w kolejnych tygodniach ma się zająć rząd.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|