Accounts Receivable Outsourcing Services Reinforce USA Real Estate Revenue Stability

U.S. real estate companies adopt accounts receivable outsourcing services to handle complex receivables with confidence.

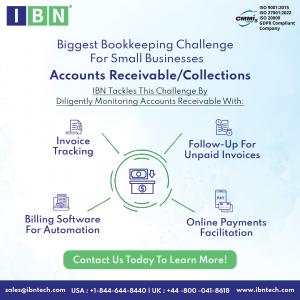

MIAMI, FL, UNITED STATES, July 29, 2025 /EINPresswire.com/ -- Amid rising borrowing costs, inflation concerns, and unpredictable rental payments, property management firms across the United States are turning to Accounts Receivable Outsourcing Services to preserve financial control and stabilize operational cash flow. These services enable prompt collection, improve compliance, and reduce the burden on in-house finance teams. The growing adoption reflects a strategic movement across sectors toward receivables solutions that deliver dependable results. With access to real-time accounts receivable report, real estate companies are also gaining sharper visibility into revenue trends.For real estate businesses handling vast portfolios, maintaining consistent income while scaling operations has become more important than ever. By leveraging Accounts Receivable Outsourcing Services, these firms are empowered to manage substantial transaction volumes, stay responsive to market conditions, and gain faster insights into financial status. Companies such as IBN Technologies help real estate firms streamline their billing and account receivables lifecycle, supporting cash flow stability and resilience in a competitive landscape. This structured approach is also proving vital for organizations facing continued accounts receivable cash flow pressures.

Take the first step—discover receivables solutions tailored for real estate

Schedule your free consultation: https://www.ibntech.com/free-consultation-for-ap-ar-management/

Traditional AR Recovery Slows Financial Momentum in Real Estate

Even as tenants are served and property functions remain uninterrupted, finance departments across the real estate industry are experiencing bottlenecks caused by legacy receivables systems. Delayed rent recovery and sluggish reimbursement timelines are hampering financial reporting and impacting revenue flow.

• Simplifies high-volume real estate transactions with systematic control

• Sustains financial flow and debt resolution for capital-intensive developments

• Offers continuous visibility into project-level profitability

• Tracks rental revenue and operating expenses with improved accuracy

To overcome inefficiencies and support consistent revenue intake, real estate firms are increasingly adopting accounts receivable outsourcing. Outsourced support helps improve collection speed, optimize financial oversight, and ensure seamless revenue cycle performance from start to finish.

IBN Technologies Delivers Structured Receivables for the Real Estate Sector

IBN Technologies works with property management firms to establish clear and compliant receivables processes, improving billing accuracy, lowering payment delays, and enhancing financial transparency. Their domain-specific expertise ensures that receivables functions are aligned with internal controls and tax regulations through well-defined accounts receivable procedures.

✅ Generates invoices for rent, leases, and related property charges

✅ Executes consistent follow-up for pending tenant payments

✅ Allocates payments against correct agreements and account entries

✅ Analyzes aged receivables and flags overdue balances

✅ Supports receivables forecasting to manage financial planning

✅ Reconciles transactions with banking data for accuracy

✅ Keeps all financial records compliant and ready for audits

✅ Supports global currency processing and tax-compliant reporting

IBN strengthens its Accounts Receivable Outsourcing Services in California through robust tools and workflows tailored to real estate operations. These systems support invoice accuracy, timely collections, and transparent financial reporting—ensuring firms in California operate with confidence across each stage of the AR lifecycle.

Strategic Gains Realized Through IBN’s Receivables Management

Through a reliable receivables framework, IBN Technologies helps real estate firms improve revenue consistency, lower administrative strain, and sharpen financial planning.

✅ Increases available cash by up to 30% via faster receivables cycles

✅ Elevates on-time payment performance by 25%

✅ Frees up more than 15 internal hours weekly from AR-related work

✅ Reduces write-offs with enhanced tracking and reporting

✅ Lowers processing costs by up to 60% compared to internal teams

Real Estate Client Outcomes Reflect Performance Improvements in California

IBN Technologies has delivered measurable success to rental and leasing firms in California seeking better financial outcomes through receivables support.

• One California-based rental equipment business achieved a 35% improvement in financial clarity after outsourcing its AR function.

• A regional leasing provider in California reported a 40% reduction in payment lag times due to centralized billing and timely follow-ups enabled by IBN Technologies.

The Future of Real Estate AR Lies in Scalable, Transparent Partnerships

With economic volatility affecting payment consistency, real estate firms are prioritizing Accounts Receivable Outsourcing Services to reinforce revenue operations. IBN Technologies continues to lead the way, helping clients streamline receivables, improve payment timelines, and gain enhanced financial clarity. These services have proven vital for firms needing agility in collections and financial reporting.

As firms brace for increased operational complexity, the value of reliable, transparent, and efficient receivables handling becomes even more apparent. Companies across the industry are turning into experienced accounts receivable companies for consistent AR support and scalable infrastructure. IBN Technologies stands out for delivering effective integrations, including advanced features such as accounts receivable financing, and broader accounts payable and receivable management capabilities—enabling complete financial visibility and better planning across all property segments.

Related Services:

Outsourced Finance and Accounting

https://www.ibntech.com/finance-and-accounting-services/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 26 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022 and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Extreme Bike Tours Launches Longer Epic Journeys: The Grand Tour of Sri Lanka & The Indian Odyssey

Smart Electricity Meter Market to Hit $34.3 Billion by 2033 | Driven by Smart Grid & Energy Monitoring Demand

100 Years After Tragedy, International Arrivals Soar in Japan's Tattoo-Friendly Hot Spring Town Kinosaki Onsen

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Problemy społeczne

Ślązacy wciąż nie są uznani za mniejszość etniczną. Temat języka śląskiego wraca do debaty publicznej i prac parlamentarnych

W Polsce 600 tys. osób deklaruje narodowość śląską, a 460 tys. mówi po śląsku. Kwestia uznania etnolektu śląskiego za język regionalny od lat wzbudza żywe dyskusje. Zwolennicy zmiany statusu języka śląskiego najbliżej celu byli w 2024 roku, ale nowelizację ustawy o mniejszościach narodowych i etnicznych zablokowało prezydenckie weto. Ostatnio problem wybrzmiał podczas debaty w Parlamencie Europejskim, ale zdaniem Łukasza Kohuta z PO na forum UE również trudna jest walka o prawa mniejszości etnicznych i językowych.

Motoryzacja

Polacy z niejednoznacznymi opiniami na temat autonomicznych pojazdów. Wiedzą o korzyściach, ale zgłaszają też obawy

Polacy widzą w pojazdach autonomicznych szansę na poprawę bezpieczeństwa na drogach i zwiększenie mobilności osób starszych czy z niepełnosprawnościami. Jednocześnie rozwojowi technologii AV towarzyszą obawy, m.in. o utratę kontroli nad pojazdem czy o większą awaryjność niż w przypadku tradycyjnych aut – wynika z prowadzonych przez Łukasiewicz – PIMOT badań na temat akceptacji społecznej dla AV. Te obawy wskazują, że rozwojowi technologii powinna także towarzyszyć edukacja, zarówno kierowców, jak i pasażerów. Eksperci mówią także o konieczności transparentnego informowania o możliwościach i ograniczeniach AV.

Prawo

70 proc. Polaków planuje wyjazd na urlop w sezonie letnim 2025. Do łask wracają wakacje last minute

Ponad 70 proc. Polaków planuje wyjechać na urlop w sezonie letnim, czyli między końcem czerwca a końcem września – wynika z badania Polskiej Organizacji Turystycznej. 35 proc. zamierza wyjechać tylko raz, a 30 proc. – co najmniej dwa razy. Z grupy wyjeżdżających jedna trzecia wybierze się na wyjazd zagraniczny. Jak wskazuje Katarzyna Turosieńska z Polskiej Izby Turystyki, po kilku latach ponownie do łask wracają oferty last minute, a zagraniczne kierunki pozostają niezmienne – prym wiodą m.in. Grecja, Tunezja, Egipt czy Hiszpania.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

![Nestlé w Polsce podsumowuje wpływ na krajową gospodarkę. Firma wygenerowała 0,6 proc. polskiego PKB [DEPESZA]](https://www.newseria.pl/files/1097841585/fabryka-nesquik_1,w_85,r_png,_small.png)

.gif)

|

| |

| |

|