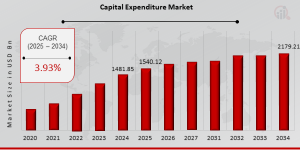

Capital Expenditure Market to See Stunning Growth: 2179.21 Billion by 2034

Capital Expenditure Market Research Report By, Industry, Type of Expenditure, Source of Funding, Size of Organization, Regional

DE, UNITED STATES, April 17, 2025 /EINPresswire.com/ -- The Capital Expenditure (CapEx) Market has shown steady growth in recent years and is poised for consistent expansion over the next decade. In 2024, the market size was valued at USD 1481.85 billion and is projected to grow from USD 1540.12 billion in 2025 to USD 2179.21 billion by 2034, reflecting a compound annual growth rate (CAGR) of 3.93% during the forecast period (2025–2034). The growth is primarily driven by increasing infrastructure development, modernization of industrial facilities, and strategic investments in technology and energy sectors.Key Drivers of Market Growth

Infrastructure Development Across Emerging Economies

Governments and private entities are increasing investments in transportation, energy, and urban infrastructure, especially in Asia-Pacific, the Middle East, and Africa. These large-scale infrastructure projects are major contributors to CapEx spending.

Modernization & Automation of Manufacturing Facilities

Industries are shifting towards advanced manufacturing systems, including Industry 4.0 technologies. Investments in robotics, IoT-enabled systems, and smart factory upgrades are driving capital outflows for long-term productivity gains.

Expansion in Renewable Energy Projects

The global push toward clean energy is prompting significant capital expenditures in solar farms, wind parks, energy storage, and grid infrastructure. Countries are channeling funds into sustainable energy infrastructure to meet net-zero targets.

Technology-Driven Capital Investments

Enterprises are allocating substantial capital towards data centers, cloud infrastructure, and AI-driven platforms. Digital transformation across sectors such as banking, telecom, and healthcare is fueling demand for tech-oriented CapEx.

Mergers, Acquisitions, and Capacity Expansion

To maintain competitive advantage, companies are increasingly investing in mergers, acquisitions, and the expansion of existing facilities, especially in chemicals, pharmaceuticals, and consumer goods manufacturing.

Government Incentives & Policy Support

Subsidies, tax benefits, and public-private partnerships (PPPs) are encouraging capital investments in sectors like transportation, housing, logistics, and defense. Policy support is especially impactful in emerging markets aiming to boost GDP growth.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/29115

Key Companies in the Capital Expenditure Market Include:

• Berkshire Hathaway Inc.

• Amazon

• AT Inc.

• Verizon Communications

• Saudi Aramco

• BP Plc

• Apple Inc.

• Intel Corp.

• Chevron Corp.

• Samsung

• Toyota Motor Corp.

• Alphabet Inc.

• Exxon Mobil

• Google LL.C

• TSMC

Browse In-Depth Market Research Report – https://www.marketresearchfuture.com/reports/capital-expenditure-market-29115

Market Segmentation

To provide a comprehensive analysis, the Capital Expenditure Market is segmented based on type, industry vertical, and region.

1. By Type

• Equipment & Machinery

• Buildings & Facilities

• IT & Technology Infrastructure

• Vehicles & Transportation Assets

2. By Industry Vertical

• Manufacturing

• Energy & Utilities

• Telecommunications

• Healthcare

• Retail & Consumer Goods

• Construction & Infrastructure

• Transportation & Logistics

• Government & Defense

3. By Region

• North America: Stable growth driven by technological upgrades and energy projects.

• Europe: Focus on sustainability, smart infrastructure, and digital CapEx.

• Asia-Pacific: Fastest growing region due to industrial expansion and urban development.

• Rest of the World (RoW): Growth supported by strategic investments and regional development programs.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=29115

The global Capital Expenditure Market is expected to witness resilient growth, backed by strong industrial momentum, infrastructure evolution, and digitization. As companies seek long-term value creation through strategic asset investments, the focus will remain on balancing growth with sustainability and operational efficiency.

Related Report –

Banking as a Service Market

https://www.marketresearchfuture.com/reports/banking-as-a-service-market-10717

Digital Banking Market

https://www.marketresearchfuture.com/reports/digital-banking-market-1986

Mobile Banking Market

https://www.marketresearchfuture.com/reports/mobile-banking-market-2906

Core Banking Solution Market

https://www.marketresearchfuture.com/reports/core-banking-solutions-market-3208

Biometric Banking Market

https://www.marketresearchfuture.com/reports/biometric-banking-market-11821

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

97%富豪默默在做的風水佈局!『富過三代 - 財富傳承風水規劃』揭密:為何你的豪宅始終缺了這1%關鍵?

Wealth Legacy Feng Shui Planning Explains the Key Element Missing in Luxury Home Design

Professional Garage Door Technicians Reveal Time-Saving Repair Techniques

Kalendarium

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Handel

Ważą się losy wymiany handlowej między Stanami Zjednoczonymi a Unią Europejską. Na wysokich cłach stracą obie strony

Komisja Europejska przedstawiła w poniedziałek propozycję ceł na import z USA o wartości 72 mld euro, co ma być odpowiedzią na nałożenie 30-proc. stawek na import z UE zapowiedziane przez Amerykanów w poprzednim tygodniu. Przedstawiciele KE wciąż widzą jednak potencjał kontynuowania negocjacji. Zdaniem europosła Michała Koboski brak porozumienia lub uzgodnienie stawek wyższych niż 10-proc. nie tylko zaszkodzi obydwu stronom, ale i osłabi ich pozycję na arenie międzynarodowej.

Handel

Nie tylko konsumenci starają się kupować bardziej odpowiedzialne. Część firm już stawia na to mocny nacisk

Kwestie równoważonych zakupów stają się elementem strategii ESG. Dostawy energii, zamówienia surowców i materiałów do produkcji czy elementów wyposażenia biur – na każdym etapie swoich zakupów firmy mogą dziś decydować między opcjami bardziej i mniej zrównoważonymi. Dotyczy to także zamówień rzeczy codziennego użytku dla pracowników czy środków czystości – wskazują eksperci Lyreco, e-sklepu, który prowadzi sprzedaż produktów do biur, pokazując ich wpływ na środowisko czy efektywność pracy.

Prawo

Unia Europejska wzmacnia ochronę najmłodszych. Parlament Europejski chce, by test praw dziecka był nowym standardem w legislacji

Parlament Europejski chciałby tzw. testu praw dziecka dla każdego aktu prawnego wychodzącego z Komisji Europejskiej. – Każda nowa legislacja Unii Europejskiej powinna być sprawdzana pod kątem wpływu na prawa dziecka – zapowiada Ewa Kopacz, wiceprzewodnicząca PE. Jak podkreśla, głos dzieci jest coraz lepiej słyszalny w UE i jej różnych politykach. Same dzieci wskazują na ważne dla siebie kwestie, którymi UE powinna się zajmować. Wśród nich są wyzwania w obszarze cyfrowym i edukacyjnym.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|