Electronic Conformal Coatings Market is Estimated to Reach USD 5.3 Billion by 2035 | Fact.MR

The Acrylic segment is projected to grow at a CAGR of 5.4%, whereas another segment Silicone is likely to grow at 6.7%.

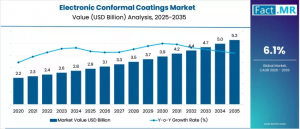

ROCKVILLE, MD, UNITED STATES, July 24, 2025 /EINPresswire.com/ -- The Electronic Conformal Coatings Market, valued at USD 2.8 billion in 2024, is projected to reach USD 5.3 billion by 2035, growing at a compound annual growth rate (CAGR) of 6.1%, according to industry analysis. The market’s expansion is driven by the increasing demand for moisture-resistant, compact electronics across consumer, defense, and energy sectors, with innovations in acrylic, silicone, and parylene formulations providing robust environmental and mechanical resilience.For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=7471

Drivers of the Electronic Conformal Coatings Market

The surge in demand for smartphones, tablets, laptops, and wearable devices, with global smartphone users projected to reach 7.7 billion by 2027, necessitates advanced protective coatings to ensure reliability in high-humidity and polluted environments. Conformal coatings safeguard printed circuit boards (PCBs) from moisture, dust, and corrosion, enhancing durability. Miniaturization trends, with component spacing shrinking by 30-40%, require coatings like acrylic, urethane, and parylene that maintain performance under thermal and mechanical stress. In aerospace and defense, mission-critical equipment demands coatings with superior dielectric properties and chemical resistance, such as parylene and fluorinated formulations, to withstand extreme temperatures, altitude changes, and corrosive environments. The rise in renewable energy installations, particularly solar panels and LEDs, further drives demand for UV-resistant, thermally stable coatings like silicone and hybrid chemistries, which protect against UV radiation, thermal cycling, and ozone exposure. Regulatory pressures for low-VOC coatings and advancements in UV-curable and nano-coatings also propel market growth.

Regional Trends

Asia-Pacific dominates with a 52% market share in 2024, driven by its role as a global hub for consumer electronics, semiconductors, and automotive manufacturing. China, Japan, South Korea, and emerging economies like India, Vietnam, and Thailand fuel growth through rapid industrialization and export-oriented production. China’s semiconductor independence policies and India’s “Make in India” initiative boost demand, with the region projected to grow at a CAGR of 7.5% through 2035.

North America, led by the U.S., holds a 25% market share, driven by aerospace, defense, and medical electronics. The U.S. Department of Defense and DARPA fund innovations like self-healing fluoropolymer coatings and AI-driven diagnostics, supporting a CAGR of 5.8%. Applications in automotive electronics and telecommunications further contribute.

Western Europe, with Germany, the UK, and France, is propelled by automotive electronics and industrial automation, holding a 20% share. Germany’s focus on parylene and EMI-shielding coatings for autonomous vehicles and aerospace supports a CAGR of 5.5%. Strict EU regulations on VOCs drive adoption of eco-friendly coatings.

Latin America and Middle East & Africa are emerging markets, with Brazil leading in Latin America due to automotive and electronics assembly growth. The Middle East & Africa, driven by infrastructure investments in power and transport, is projected to grow at a CAGR of 6.2%, supported by industrial diversification.

Challenges and Restraining Factors

Miniaturization poses challenges in achieving uniform coating thickness on high-density interconnects and surface-mount components, risking bridging or shadowing. This necessitates costly selective coating techniques and automated dispensing systems, increasing capital and operational complexity. Regulatory restrictions on volatile organic compounds (VOCs), such as RoHS and EPA guidelines, push manufacturers toward water-based or UV-cured coatings, which may underperform in harsh conditions compared to traditional options like coal tar enamel. Rework and repair difficulties with coatings like parylene and epoxy, which form hard-to-remove layers, deter adoption in cost-sensitive or rapidly evolving applications, as removal risks damaging components. Supply chain disruptions, with raw material shortages reported by the U.S. Geological Survey, and geopolitical tensions further elevate costs, impacting profit margins.

Country-Wise Insights

China: China’s market thrives on semiconductor independence policies and a robust electronics export industry. Research in Shenzhen and Suzhou focuses on nano-coatings, UV-curable silicones, and hybrid acrylic-polyurethane formulations for high-frequency PCBs, driven by demand in telecommunications and EV battery systems. The market is projected to grow at a CAGR of 6.8%.

United States: The U.S. market benefits from defense-funded R&D at institutions like MIT and Sandia National Labs, developing UV-curable nano-coatings and self-healing fluoropolymers for avionics, satellites, and medical devices. A CAGR of 5.9% is driven by mission-critical applications requiring dielectric strength and moisture resistance.

Germany: Germany’s market is fueled by automotive-aerospace convergence, with BMW and Airbus exploring parylene coatings for autonomous driving and lightweight electronics. Startups in Stuttgart and Dresden scale plasma-based pre-treatment equipment, supporting a CAGR of 5.7%.

Buy Report – Instant Access: https://www.factmr.com/checkout/7471

Category-Wise Analysis

Acrylic Coatings: Acrylics dominate with a 46.8% share in 2024 due to their moisture resistance, dielectric strength, and reworkability. Their thermoplastic flexibility and programmable curing suit multi-level PCBs, with a projected CAGR of 5.9%.

Silicone Coatings: Silicone coatings, growing at a 6.7% CAGR, are favored for their UV resistance and thermal stability in renewable energy and automotive applications, offering flexibility in high-vibration environments.

Automotive Electronics: This segment leads applications with a 35% share, driven by electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Coatings protect against vibration, salt exposure, and temperature fluctuations, with a CAGR of 7.2%.

Dipping Method: Dipping ensures uniform coverage for full-surface protection, widely used in automotive and industrial applications. Its scalability and compatibility with acrylics and solvent-based coatings drive adoption.

Competitive Landscape

The market is highly competitive, with key players like Shin-Etsu Chemical Co., Ltd., MG Chemicals, Chemtronics, KISCO, Dymax, Europlasma NV, Henkel AG & Co. KGaA, and Dow leading through innovation in UV-curable, nano-coatings, and low-VOC formulations. Vertically integrated firms with in-house R&D gain an edge through customized solutions and rapid prototyping. Strategic alliances with PCB manufacturers and EMS suppliers enhance market positioning. Recent developments include Dow’s DOWSIL CC-8000 Series (July 2024) for renewable energy and SMART Modular Technologies’ DDR5 RDIMMs with conformal coatings for liquid immersion servers (August 2024). Compliance with standards like IPC-CC-830 and RoHS remains critical.

Check out More Related Studies Published by Fact.MR Research:

Witness consistent growth in the Anti-Adhesion Coatings Market until 2028

Carbon Fiber Coatings Market to witness steady growth by 2028.

S. N. Jha

Fact.MR

+1 628-251-1583

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Special No-Cost Package for the 2025 Malaysia Ultra Trail by UTMB - Rechallenge Support Tour

Fragrance Meets Function: SaFiSpa Adds Science-Backed Scents to Luxury Candle Range

Timeflik Releases Wear OS 6-Compatible App Update, Offering OS-Specific Versions for Enhanced Watch Experience

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Prawo

Możliwość pozyskiwania danych z ZUS i prowadzenia zdalnych kontroli. Państwową Inspekcję Pracy czeka szereg zmian

Instytucje kontrolujące stopniowo zmieniają swój charakter na bardziej doradczy, informacyjny i edukacyjny – wskazuje Główny Inspektor Pracy. Ta zmiana odpowiada na potrzeby procesu deregulacji prowadzonego przez rząd, który zresztą w pierwszym pakiecie uwzględnił ograniczenie liczby kontroli i ich czasu. Jednocześnie trwają prace nad wzmocnieniem PIP w ramach kamieni milowych przewidzianych w Krajowym Planie Odbudowy, w tym nadaniu jej uprawnień do przekształcania pozornych umów cywilnoprawnych w umowy o pracę.

Prawo

Mikro-, małe i średnie firmy liczą na lepszy dostęp do finansowania. To coraz istotniejszy klient dla sektora bankowego

Sektor MŚP stanowi 99 proc. firm w Polsce i odpowiada za prawie połowę polskiego PKB. Dlatego od jego rozwoju w dużej mierze uzależniony jest wzrost gospodarczy. Ekonomiści wskazują jednak, że poziom inwestycji jest zbyt niski, by budować silne podstawy rozwoju. Jak wskazuje Rzecznik MŚP, przedsiębiorcy liczą na lepszy dostęp do finansowania bankowego. Chodzi nie tylko o wsparcie inwestycji w kraju, lecz również w ekspansji zagranicznej.

Farmacja

E. Kopacz: Róbmy wszystko, by dzieci przyjeżdżające do Polski wchodziły w cykl kalendarza szczepień. Wiele zależy od świadomości matek

Według danych UNICEF poziom wyszczepialności dzieci w Ukrainie wynosi 70 proc. i jest znacząco niższy niż w przypadku dzieci w Polsce. – Róbmy wszystko, żeby dzieci, które do nas przyjeżdżają, wchodziły w cykl kalendarza szczepień i pobierały szczepionki – mówi Ewa Kopacz. Jednocześnie dane Ministerstwa Zdrowia wskazują, że noworodki, które przychodzą na świat w Polsce, są szczepione w prawie 100 proc. Wciąż jest jednak pewien odsetek mam, które mimo obowiązku szczepień dla dzieci nie zamierzają tego robić. Duża w tym wina mitów krążących wokół szczepionek, podsycanych przez ruchy antyszczepionkowe.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|