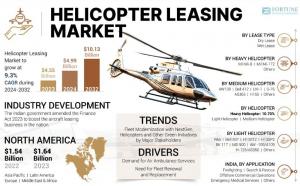

Helicopter Leasing Market Insights: 9.3% CAGR Driving Growth to USD 10.13 Billion by 2032

Key companies covered in the helicopter leasing market are Waypoint Leasing, Lobo Leasing, Macquarie Rotorcraft Leasing, Milestone Aviation, & others.

NEW YORK, NY, UNITED STATES, April 21, 2025 /EINPresswire.com/ -- The global helicopter leasing market size was valued at USD 4.55 billion in 2023. The market is projected to grow from USD 4.99 billion in 2024 to USD 10.13 billion by 2032, exhibiting a CAGR of 9.3% during the forecast period.Helicopter leasing is an agreement between the owner and lessor, where the owner permits the lessor to use the helicopter. There are two primary types: a dry lease (helicopter rental without crew, maintenance, or insurance, with the lessee responsible for operations) and a wet lease (helicopter rental with crew, maintenance, and insurance included, but the lessee still retains control). As older helicopters reach the end of their operational life, demand for newer, more efficient models is driving this leasing market. Advanced helicopters with improved fuel efficiency, avionics, and safety systems are becoming increasingly attractive for lease, supporting market growth.

Fortune Business Insights™ provides this information in its research report, titled “Helicopter Leasing Market Size, Share, 2024-2032”.

Get A Free Sample PDF:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/helicopter-leasing-market-111129

List of Key Players Mentioned in the Helicopter Leasing Market Report:

• Waypoint Leasing (Ireland)

• Lobo Leasing (Ireland)

• Lease Corporation International (LCI) (Ireland)

• Macquarie Rotorcraft Leasing (Australia)

• Milestone Aviation (Ireland)

• Nova Capital (U.K.)

• AerCap Holdings N.V. (Ireland)

• Air Lease Corporation (U.S.)

• BBAM US LP (U.S.)

• Savback Helicopters (Sweden)

Segmentation:

Technological Advancements and Innovation Led to the Dominance of Light Helicopter Segment

As per helicopter, the helicopter leasing market is classified into light helicopter, medium helicopter, and heavy helicopter. The introduction of advanced light helicopters, such as the AC332 with improved design features and high-temperature operational capability, enhances their appeal, supporting the dominance of light helicopters.

H125/AS350 Segment Dominated Due to Proven Reliability and Experience

By light helicopter, the helicopter leasing market is classified into H125/AS350, Bell 407, R66, AW109/A109, H130T2, H135P2, BK 117, MD 500, and others. The H125/AS350 segment captured the highest market share and is slated to be the fastest-growing during the study period. The H125/AS350 series, with over 36 million flight hours and more than 40 years of service, is favored for its established reliability, supporting strong segment growth.

AW139 Segment Dominated, Driven by Strong Market Presence of Key Companies and Fleet Usage

Based on medium helicopter, the market is fragmented into AW139, Bell 412, UH-1, S-76, AS365, H155, and others. With over 1,100 units sold and widespread use by major corporations such as CHC Helicopter and Gulf Helicopters, the AW139 maintains an apex market position, driving continued segment growth.

Mil Mi-8 Segment to Dominate On Account of Continuous Technical Upgrades

As per heavy helicopter, the market is fragmented into Mil Mi-8, Mil Mi-172, and others. The Mil Mi-8 segment is poised to capture the largest market share during the forecast period. Ongoing technical enhancements to the Mil Mi-8, including newer versions such as the Mi-8AMTSH-VN, increase its versatility and sustainability for a wide range of operations, driving segment growth.

Cost Saving Benefits of Dry Lease Led to its Dominance

In terms of lease type, the market is bifurcated into dry lease and wet lease. The dry lease segment captures the highest helicopter leasing market share in 2023, offering cost savings by allowing operators with the necessary resources to handle maintenance, insurance, and crew, fostering continued growth in the segment.

Others Segment Led due to Expansion of Operators Into Diverse fields

In terms of application, the market is fragmented into offshore commercial operations, Emergency Medical Services (EMS), firefighting, Search and Rescue (SAR), and others. The others segment, encompassing various industries such as media, tourism, and utility operations, is poised for the largest market share due to increasing demand and operator expansion into their diverse fields.

In terms of region, the market is categorized into Europe, North America, the Asia Pacific, Latin America, and the Middle East & Africa.

Get A Quote Now:

https://www.fortunebusinessinsights.com/enquiry/get-a-quote/helicopter-leasing-market-111129

Drivers and Restraints:

Surge in Demand for Air Ambulance Services to Augment Market Progress

The growing need for rapid patient transportation and access to remote areas is driving the expansion of the air ambulance sector. This surge in demand for air medical devices, supported by advancements in medical technology, boosts the market as organizations invest in modern, specialized fleets. Healthcare organizations, private entities, and governments are expanding heavily to expand and modernize air ambulance fleets. This increase in investment supports the helicopter leasing market growth as more operators require up-to-date helicopters for emergency and interfacility medical transport.

However, economic fluctuations, such as changes in fuel prices, increase operating and maintenance costs, creating financial pressures that can hinder market expansion.

Regional Insights:

North America Dominated the Market Owing to Technological Advancements and Infrastructure Development

North America captured the highest helicopter leasing market share and stood at USD 1.64 billion in 2023. Leasing companies in North America, such as Victoria Helicopters, serve international clients, leveraging their expertise and fleet to strengthen their market position globally.

In 2023, Europe ranks second in terms of market share. The region’s geographic position as a hub for international business and travel enhances its role in global helicopter leasing, supporting a diverse range of leasing needs.

Ask For Customization::

https://www.fortunebusinessinsights.com/enquiry/ask-for-customization/helicopter-leasing-market-111129

Competitive Landscape:

Key Players Focus on Securing Government Contracts to Expand Service Offerings

Helicopter leasing companies, such as Skyco International Leasing, are securing contracts for advanced models such as the Airbus H175, which will be used for critical public service missions, bolstering their market presence and expanding service offerings.

Key Industry Development:

November 2024 – Helicopter leasing firm GDHF has entered into a framework deal for 10 Leonardo AW189 super medium helicopters to assist the offshore oil-and-gas industry, with deliveries scheduled from 2027 to 2029. The deal, revealed on the first day of the European Rotors trade exhibition in Amsterdam, the Netherlands, will increase GDHF’s AW189 fleet to 13 aircraft.

Read Related Insights:

Sustainable Aviation Fuel Market Size, Share, 2032

Green Airport Market Size, Growth, 2032

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Levin & Perconti Secures $4.975M Settlement for Septic Shock That Lead to Patient's Death

Trident Wealth Partners Expands National Reach with Virtual Financial Advisory Services

Metro Building and Remodeling Group Rebrands as Metro Design Build Group

Kalendarium

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Prawo

KE proponuje nowy Fundusz Konkurencyjności. Ma pobudzić inwestycje w strategiczne dla Europy technologie

W środę 16 lipca Komisja Europejska przedstawiła projekt budżetu na lata 2028–2034. Jedna z propozycji zakłada utworzenie Europejskiego Funduszu Konkurencyjności o wartości ponad 400 mld euro, który ma pobudzić inwestycje w technologie strategiczne dla jednolitego rynku. Wśród wspieranych obszarów znalazła się obronność i przestrzeń kosmiczna. Na ten cel ma trafić ponad 130 mld euro, pięciokrotnie więcej niż do tej pory.

Firma

Były prezes PGE: OZE potrzebuje wsparcia magazynów energii. To temat traktowany po macoszemu

Choć udział odnawialnych źródeł energii w miksie energetycznym Polski jest stosunkowo wysoki i rośnie, to ten przyrost jest chaotyczny i nierównomiernie rozłożony miedzy technologiami – wskazuje Forum Energii. Dodatkowo OZE potrzebują wsparcia magazynów energii, a zdaniem Wojciecha Dąbrowskiego, prezesa Fundacji SET, ten temat jest traktowany po macoszemu. Brak magazynów powoduje, że produkcja energii z OZE jest tymczasowo wyłączana, co oznacza marnowanie potencjału tych źródeł.

Infrastruktura

Wzrost wynagrodzeń ekip budowlanych najmocniej wpływa na koszty budowy domu. Zainteresowanie inwestorów mimo to nieznacznie wzrasta

Budowa metra kwadratowego domu w Polsce kosztuje od 5,55 do 6 tys. zł w zależności od województwa – wynika z najnowszych analiz firmy Sekocenbud. Najdrożej jest w Warszawie, gdzie cena za metr kwadratowy domu przekroczyła już 6,2 tys. zł. Na przyrosty kosztów budowy domu wpływają zarówno drożejące materiały budowlane, jak i wyższe wynagrodzenia pracowników. Inwestorzy nie rezygnują jednak z budowy domów jednorodzinnych, co ma związek m.in. z wciąż wysokimi cenami mieszkań czy też obniżką stóp procentowych.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|