Hidden Regulators: Small Noncoding RNAs Redefine Cardiovascular Disease Mechanisms

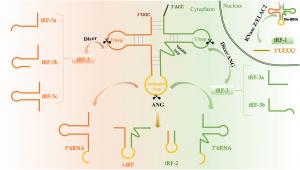

The classification of tsRNAs. tsRNAs include tiRNA and tRF. Under stress, angiogenin cleavage of the tRNA anticodon loop generates tiRNAs that are further categorized as 5′ tiRNA and 3′ tiRNA.

SHANNON, CLARE, IRELAND, April 20, 2025 /EINPresswire.com/ --

In a transformative review, small noncoding RNAs (sncRNAs) have emerged as pivotal regulators in the complex landscape of cardiovascular diseases. These RNA molecules, which do not encode proteins, were long overshadowed by their well-studied counterparts such as microRNAs. However, new insights highlight the substantial biological impact of lesser-known sncRNA subclasses including transfer RNA-derived fragments (tsRNAs), PIWI-interacting RNAs (piRNAs), Y RNAs (yRNAs), small nucleolar RNAs (snoRNAs), and small nuclear RNAs (snRNAs).

Each of these RNA types exhibits unique biological functions in modulating gene expression, cell signaling, and physiological homeostasis. Their roles in cardiovascular health are particularly significant as they engage in processes like inflammation, apoptosis, vascular remodeling, and cardiac hypertrophy. For example, tsRNAs influence myocardial cell survival and proliferation, regulate endothelial cell functions, and have been linked to disorders such as myocardial infarction, hypertension, and diabetic cardiomyopathy. They serve as critical responders to cellular stress, modulating gene transcription and mitochondrial pathways that can protect cardiac tissue.

Meanwhile, piRNAs have advanced from their original association with reproductive biology to being recognized as influential actors in cardiovascular systems. These molecules orchestrate cell apoptosis, manage oxidative stress, and mediate gene methylation, impacting disease processes like heart failure, aortic dissection, and pulmonary hypertension. Notably, specific piRNAs such as HAAPIR and CHAPIR are involved in promoting or mitigating cardiac damage through transcriptional and epigenetic mechanisms.

The regulatory potential of yRNAs lies in their interplay with immune responses and cell death pathways. They are enriched in extracellular vesicles, suggesting utility as biomarkers and therapeutic agents, particularly in conditions like coronary artery disease and hypertrophic cardiomyopathy.

Equally compelling are the roles of snoRNAs and snRNAs, which modulate ribosomal function, RNA methylation, and mRNA splicing. Dysregulation of these molecules correlates with adverse cardiovascular events, from vascular remodeling to electrophysiological imbalances in myocardial tissue.

Collectively, these findings open new frontiers in cardiovascular medicine. The distinct expression patterns and mechanisms of sncRNAs underscore their diagnostic and therapeutic potential.

# # # # #

Genes & Diseases publishes rigorously peer-reviewed and high quality original articles and authoritative reviews that focus on the molecular bases of human diseases. Emphasis is placed on hypothesis-driven, mechanistic studies relevant to pathogenesis and/or experimental therapeutics of human diseases. The journal has worldwide authorship, and a broad scope in basic and translational biomedical research of molecular biology, molecular genetics, and cell biology, including but not limited to cell proliferation and apoptosis, signal transduction, stem cell biology, developmental biology, gene regulation and epigenetics, cancer biology, immunity and infection, neuroscience, disease-specific animal models, gene and cell-based therapies, and regenerative medicine.

Scopus CiteScore: 7.3

Impact Factor: 6.9

# # # # # #

More information: https://www.keaipublishing.com/en/journals/genes-and-diseases/

Editorial Board: https://www.keaipublishing.com/en/journals/genes-and-diseases/editorial-board/

All issues and articles in press are available online in ScienceDirect (https://www.sciencedirect.com/journal/genes-and-diseases ).

Submissions to Genes & Disease may be made using Editorial Manager (https://www.editorialmanager.com/gendis/default.aspx ).

Print ISSN: 2352-4820

eISSN: 2352-3042

CN: 50-1221/R

Contact Us: editor@genesndiseases.com

X (formerly Twitter): @GenesNDiseases (https://x.com/GenesNDiseases )

# # # # # #

Reference

Hemanyun Bai, Fanji Meng, Kangling Ke, Lingyan Fang, Weize Xu, Haitao Huang, Xiao Liang, Weiyan Li, Fengya Zeng, Can Chen, The significance of small noncoding RNAs in the pathogenesis of cardiovascular diseases, Genes & Diseases, Volume 12, Issue 4, 2025, 101342, https://doi.org/10.1016/j.gendis.2024.101342

Funding Information:

Zhanjiang Science and Technology Plan Project 2022A01143

Zhanjiang Science and Technology Plan Project 2023E0005

Zhanjiang Science and Technology Plan Project 2022A01149

Zhanjiang Science and Technology Plan Project 2021A05094

Discipline Construction Project of Guangdong Medical University GDMXK2021001

Research Project of Guangdong Provincial Bureau of Traditional Chinese Medicine 20232213

Postdoctoral Research Project of the Second Affiliated Hospital of Guangdong Medical University 22H01

Genes & Diseases Editorial Office

Genes & Diseases

+86 23 6571 4691

editor|genesndiseases.com| |editor|genesndiseases.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Foundry512 Expands Talent Roster, Hiring for Key Roles Across Media, Accounts, Projects, and Creative

Turner Home Team Expands Home Buying Services Statewide: We Buy Houses Across North Carolina fast for cash.

Sullivan’s Castle Island and Castle Island Brewing Co. Launch 'Rickey Business' Lager to Celebrate James Beard Award

Kalendarium

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Prawo

KE proponuje nowy Fundusz Konkurencyjności. Ma pobudzić inwestycje w strategiczne dla Europy technologie

W środę 16 lipca Komisja Europejska przedstawiła projekt budżetu na lata 2028–2034. Jedna z propozycji zakłada utworzenie Europejskiego Funduszu Konkurencyjności o wartości ponad 400 mld euro, który ma pobudzić inwestycje w technologie strategiczne dla jednolitego rynku. Wśród wspieranych obszarów znalazła się obronność i przestrzeń kosmiczna. Na ten cel ma trafić ponad 130 mld euro, pięciokrotnie więcej niż do tej pory.

Firma

Były prezes PGE: OZE potrzebuje wsparcia magazynów energii. To temat traktowany po macoszemu

Choć udział odnawialnych źródeł energii w miksie energetycznym Polski jest stosunkowo wysoki i rośnie, to ten przyrost jest chaotyczny i nierównomiernie rozłożony miedzy technologiami – wskazuje Forum Energii. Dodatkowo OZE potrzebują wsparcia magazynów energii, a zdaniem Wojciecha Dąbrowskiego, prezesa Fundacji SET, ten temat jest traktowany po macoszemu. Brak magazynów powoduje, że produkcja energii z OZE jest tymczasowo wyłączana, co oznacza marnowanie potencjału tych źródeł.

Infrastruktura

Wzrost wynagrodzeń ekip budowlanych najmocniej wpływa na koszty budowy domu. Zainteresowanie inwestorów mimo to nieznacznie wzrasta

Budowa metra kwadratowego domu w Polsce kosztuje od 5,55 do 6 tys. zł w zależności od województwa – wynika z najnowszych analiz firmy Sekocenbud. Najdrożej jest w Warszawie, gdzie cena za metr kwadratowy domu przekroczyła już 6,2 tys. zł. Na przyrosty kosztów budowy domu wpływają zarówno drożejące materiały budowlane, jak i wyższe wynagrodzenia pracowników. Inwestorzy nie rezygnują jednak z budowy domów jednorodzinnych, co ma związek m.in. z wciąż wysokimi cenami mieszkań czy też obniżką stóp procentowych.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|