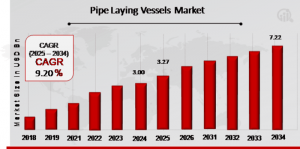

Pipe Laying Vessels Market Forecast Indicates 9.20% CAGR by 2034 | Subsea 7, Saipem, Seacor Marine, Boskalis, Royal IHC

Pipe Laying Vessels Market sees steady growth driven by offshore oil & gas projects and subsea infrastructure development worldwide.

Pipe Laying Vessels Market Overview:

The global pipe laying vessels market has witnessed significant growth in recent years, driven by the increasing demand for offshore oil and gas exploration and production activities. These specialized vessels play a critical role in the construction of subsea infrastructure, enabling the installation of pipelines that transport oil, gas, and other resources from offshore platforms to onshore processing facilities. With technological advancements and a surge in deepwater and ultra-deepwater projects, the demand for high-capacity, efficient, and reliable pipe laying vessels is steadily rising. The market encompasses a wide range of vessel types, including J-lay, S-lay, and reel-lay systems, each designed to suit different water depths and environmental conditions.

Get Free Sample PDF Brochure:

https://www.marketresearchfuture.com/sample_request/8096

Key Players

Subsea 7 (London)

Allseas (US)

Tidewater, Inc (US)

TechnipFMC Plc (New Castle)

Saipem (Milan)

Seacor Marine (Texas, US)

Van Oord (Netherlands)

Boskalis (Netherlands)

Hyundai Heavy Industries (South Korea)

Royal IHC (Netherlands)

Telford Offshore (UAE)

Leighton Offshore (Hing Kong)

Market Dynamics

The pipe laying vessels market is shaped by a variety of dynamic factors that influence its growth trajectory. Among the key factors is the growing investment in offshore energy infrastructure. The transition to cleaner energy sources has not eliminated the need for hydrocarbons; rather, it has prompted countries to tap into more remote offshore reserves, particularly in regions like the Gulf of Mexico, the North Sea, and offshore Africa. This has led to increased demand for advanced pipe laying vessels capable of operating in challenging marine environments.

In addition to oil and gas, the rising focus on offshore wind energy projects is adding a new dimension to the market. Subsea cable laying, a task closely related to pipeline installation, is becoming increasingly relevant as countries expand their renewable energy infrastructure. As a result, companies are diversifying their fleet capabilities to cater to both oil and gas as well as renewable energy sectors.

Technological innovation is another major dynamic shaping the market. The development of dynamic positioning systems, advanced pipe handling equipment, and real-time monitoring systems has significantly enhanced the efficiency and safety of pipe laying operations. Furthermore, automation and digitalization are transforming how these vessels operate, reducing downtime and operational risks while improving precision in pipeline deployment.

However, the market is also subject to several challenges, including high capital and operational costs. Pipe laying vessels are among the most expensive assets in the offshore construction industry, requiring substantial investment in design, construction, and maintenance. Fluctuating oil prices and economic uncertainties can delay or cancel offshore projects, directly impacting demand for these vessels. Additionally, regulatory and environmental concerns pose hurdles, especially in ecologically sensitive marine zones.

Market Drivers

One of the primary drivers of the pipe laying vessels market is the increasing number of offshore oil and gas projects. As shallow water reserves become depleted, energy companies are moving into deeper waters to sustain production levels. This shift necessitates the use of specialized vessels equipped to handle complex and deepwater pipeline installations. Emerging markets, particularly in Africa and Southeast Asia, are also seeing a rise in offshore exploration activities, further fueling market growth.

Another significant driver is the global emphasis on energy security and diversification. Many countries are investing in offshore pipelines as part of their broader energy strategies, aiming to reduce reliance on overland routes that may be politically unstable or environmentally vulnerable. This trend is particularly evident in regions like Europe and the Asia-Pacific, where geopolitical considerations play a crucial role in energy policy.

The rise of floating production storage and offloading (FPSO) units and subsea processing systems is also boosting demand for pipe laying vessels. These innovations require robust pipeline infrastructure to transport extracted resources, thereby creating opportunities for vessel operators and manufacturers.

Buy Now Premium Research Report:

https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=8096

Market Restraints

Despite its growth potential, the pipe laying vessels market faces several restraints. High upfront costs and long payback periods can deter investment, particularly for new market entrants. The industry also suffers from overcapacity in some regions, where supply exceeds demand, leading to underutilization of fleet assets and pressure on charter rates.

Environmental regulations are another significant restraint. Offshore projects are subject to stringent environmental assessments and compliance requirements, which can delay project timelines and increase operational costs. Additionally, public opposition to offshore drilling in certain areas can influence policy decisions and reduce the scope of new developments.

Market volatility, especially fluctuations in crude oil prices, poses a substantial challenge. Price drops can lead to budget cuts, project delays, or cancellations, directly affecting the demand for pipe laying vessels. The cyclical nature of the oil and gas industry means that the pipe laying sector is also subject to boom-and-bust cycles, which can make long-term planning difficult.

Pipe Laying Vessels Market Segmentation

Pipe Laying Vessels Installation Outlook

J-lay Barges

S-lay Barges

Reel Barges

Pipe Laying Vessels Positioning System Outlook

Anchor System

Dynamic Positioning System

Pipe Laying Vessels Depth Outlook

SHALLOW WATER

Deep Water

Pipe Laying Vessels Regional Outlook

North America

US

Canada

Europe

Germany

France

UK

Italy

Spain

Rest of Europe

Asia-Pacific

China

Japan

India

Australia

South Korea

Australia

Rest of Asia-Pacific

Rest of the World

Middle East

Africa

Latin America

Browse In-depth Market Research Report:

https://www.marketresearchfuture.com/reports/pipe-laying-vessel-market-8096

Regional Analysis

North America remains a key player in the pipe laying vessels market, driven by continued activity in the Gulf of Mexico and renewed interest in offshore drilling. The United States, in particular, has seen increased investment in both oil and gas and renewable offshore projects, supporting demand for technologically advanced vessels.

Europe also holds a substantial share of the market, led by countries like Norway and the UK. The North Sea continues to be an important offshore production area, and the region’s push towards offshore wind development is expected to further expand the market. European companies are also at the forefront of technological innovation in pipe laying and subsea construction.

Related Reports:

Small Gas Engines Market: https://www.marketresearchfuture.com/reports/small-gas-engines-market-2335

Temporary Power Market: https://www.marketresearchfuture.com/reports/temporary-power-market-2503

Distribution Transformer Market: https://www.marketresearchfuture.com/reports/distribution-transformer-market-2581

Outage Management System Market: https://www.marketresearchfuture.com/reports/outage-management-system-market-2745

Surge Protection Devices Market: https://www.marketresearchfuture.com/reports/surge-protection-devices-market-2773

Ring Main Unit Market: https://www.marketresearchfuture.com/reports/ring-main-unit-market-2802

Frequency Converter Market: https://www.marketresearchfuture.com/reports/frequency-converter-market-3218

About Market Research Future

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Wytrwal Industries Celebrates 250 years of the U.S. Army

WHAT by Anthony Prebor Expands the Acclaimed ?: QUESTION Mystery Series

DRML Miner Expands Cloud Mining Services with Sustainable Infrastructure and Flexible Contracts

Kalendarium

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Prawo

Trwają dyskusje nad kształtem unijnego budżetu na lata 2028–2034. Mogą być rozbieżności w kwestii Funduszu Spójności czy dopłat dla rolników

Trwają prace nad wieloletnimi unijnymi ramami finansowymi (WRF), które określą priorytety wydatków UE na lata 2028–2034. W maju Parlament Europejski przegłosował rezolucję w sprawie swojego stanowiska w tej sprawie. Postulaty europarlamentarzystów mają zostać uwzględnione we wniosku Komisji Europejskiej w sprawie WRF, który zostanie opublikowany w lipcu 2025 roku. Wciąż jednak nie ma zgody miedzy państwami członkowskimi, m.in. w zakresie Funduszu Spójności czy budżetu na rolnictwo.

Konsument

35 proc. gospodarstw domowych nie stać na zakup mieszkania nawet na kredyt. Pomóc może wsparcie budownictwa społecznego i uwolnienie gruntów pod zabudowę

W Polsce co roku oddaje się do użytku ok. 200 tys. mieszkań, co oznacza, że w ciągu dekady teoretycznie potrzeby mieszkaniowe społeczeństwa mogłyby zostać zaspokojone. Jednak większość lokali budują deweloperzy na sprzedaż, a 35 proc. gospodarstw domowych nie stać na zakup nawet za pomocą kredytu. Jednocześnie ta grupa zarabia za dużo, by korzystać z mieszkania socjalnego i komunalnego. Zdaniem prof. Bartłomieja Marony z UEK zmniejszeniu skali problemu zaradzić może wyłącznie większa skala budownictwa społecznego zamiast wspierania kolejnymi programami zaciągania kredytów.

Problemy społeczne

Hejt w sieci dotyka coraz więcej dzieci w wieku szkolnym. Rzadko mówią o tym dorosłym

Coraz większa grupa dzieci zaczyna korzystać z internetu już w wieku siedmiu–ośmiu lat – wynika z raportu NASK „Nastolatki 3.0”. Wtedy też stykają się po raz pierwszy z hejtem, którego jest coraz więcej w mediach społecznościowych. Według raportu NASK ponad 2/3 młodych internautów uważa, że mowa nienawiści jest największym problemem w sieci. Co więcej, dzieci rzadko mówią o takich incydentach dorosłym, dlatego tym istotniejsze są narzędzia technologiczne służące ochronie najmłodszych.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

.gif)

|

| |

| |

|