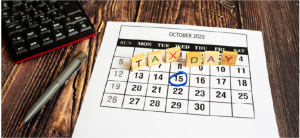

Get Ready: Property Tax Payment Deadlines are Approaching in Metro Atlanta

O'Connor discusses the property tax payment deadlines for the Metro Atlanta area.

CHICAGO, IL, UNITED STATES, July 31, 2025 /EINPresswire.com/ -- For property owners in Atlanta, Georgia, the payment deadline for property taxes is approaching soon and will be here before you know it. Particularly for Cobb, DeKalb, Fulton, and Gwinnett counties, the payment deadlines will be due in early fall. The property tax bills are expected to hit mailboxes in August and September, so homeowners must be diligent about keeping an eye on their mail to avoid missing payment. Once tax bills have been sent out in late July and early September, homeowners have a 60-day window to make payment before penalties and interest kick in.It is important to pay on time to avoid any penalties and late fees that can cause financial strain. Homeowners can stay ahead of the payment deadline by checking their mailboxes in August and September and by keeping an eye on their respective county’s tax commissioner and assessor websites.

Atlanta Metro Area: Payment Deadline Due Dates

Homeowners should be aware that due dates may vary slightly each year and should verify through their county’s website and tax commissioner. Homeowners have a 60-day window to make a payment before penalties and interest start to accrue. If property owners fail to make the payment on time, interest will start building. 120 days after the due date, a 5% penalty is added to the original unpaid tax. An additional 5% penalty will follow every 120 days until a 20% cap is reached.

For counites located outside of the Atlanta metro area, the payment deadline is usually December 20 or 60 days from the bill being issued. Property owners should take action to verify the exact payment deadlines with the county tax commissioner’s office by calling or checking their website.

How Can O’Connor Help?

With offices in Georgia, O’Connor can assist Georgia property owners in meeting their property tax deadlines by offering expert guidance, support, and strategic tools designed to reduce tax burdens. We have been in the business for over 50 years and have a deep understanding of Georgia’s local tax laws and systems. At O’Connor, we provide several services such as:

1.Guidance in tracking your deadline

O’Connor can help homeowners stay informed and up to date about important due dates, including filing deadlines for property tax returns and payment due dates. These due dates can vary across counties, so O’Connor can help property owners monitor specific counites such as Cobb, DeKalb, Fulton, and Gwinnett. Through our client dashboard, O’Connor can send reminders before important deadlines, which helps homeowners plan for their payments.

2.Property tax appeal services

O’Connor can file a property tax protest on the homeowner’s behalf if a home is over-assessed, meaning the appraised value is higher than the market value. O’Connor builds strong cases to lower the appraised value by using top proprietary data, market comparables, and expert appraisers.

3.Exemption support

O’Connor assists with filing available exemptions for homeowners to help reduce their tax liability before bills are even issued. Our team helps to ensure that the paperwork is filed on time to increase the chances of approval.

4.Support with delinquencies and penalties

O’Connor offers consultations on how to address delinquent tax bills or challenge inflated assessments for those who have missed deadlines or are facing penalties.

5.Local expertise

O’Connor tailors its approach for each unique case through our in-depth knowledge of specifics pertaining to the metro Atlanta area.

Tips for Staying Ahead of the Game

The following are tips for managing property taxes and staying ahead of tax payments to avoid deadlines:

Sign up for county tax alerts.

Track key dates carefully and mark typical billing and protest timelines for 2026.

Use assessment notices as a tax-saving opportunity.

File for homestead and other exemptions early.

Double-check mortgage escrow accounts to avoid missed payments.

In Georgia, missing a property tax payment can lead to financial distress due to monthly interest charges and escalating penalties, but O’Connor can help. With a local office in Georgia, our property tax experts are well-equipped and have the necessary knowledge to challenge property taxes for a reduction. Our team will help property owners stay on top of payment deadlines to avoid costly penalties and late fees.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Illinois, Texas, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Luma by Colin Heston Wins Bronze in A' Fashion and Travel Accessories Design Award

Heat Exchanger Market Growth Driven by Industrial Advancements

Intelligent Parcel Locker Market Projected to Reach $2.45 Billion by 2031 | 12.6% CAGR

Więcej ważnych informacji

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Jedynka Newserii

Konsument

Grupa nowych biednych emerytów stale się powiększa. Ich świadczenie jest znacznie poniżej minimalnej emerytury

Przybywa osób, które z powodu zbyt krótkiego czasu opłacania składek pobierają emeryturę niższą od minimalnej. Tak zwanych nowych biednych emerytów jest w Polsce ok. 430 tys., a zdecydowaną większość grupy stanowią kobiety – wskazują badania ekspertów Instytutu Pracy i Spraw Socjalnych. W ich przypadku krótszy okres składkowy zwykle wynika z konieczności opieki nad dziećmi lub innymi osobami w rodzinie. Wśród innych powodów, wymienianych zarówno przez panie, jak i panów, są także praca za granicą lub na czarno oraz zły stan zdrowia.

Media i PR

M. Wawrykiewicz (PO): Postępowanie z art. 7 przeciw Węgrom pokazało iluzoryczność tej sankcji. Unia wywiera naciski poprzez negocjacje nowego budżetu

Przykład Węgier pokazał, że procedura z artykułu 7 traktatu o UE o łamanie praworządności nie ma mocy prawnej z powodu braku większości, nie mówiąc o jednomyślności wśród pozostałych państw członkowskich. Negocjacje nowego budżetu UE to dobry pretekst do zmiany sposobu części finansowania z pominięciem rządu centralnego. Czerwcowy marsz Pride w Budapeszcie pokazał, że część społeczeństwa, głównie stolica, jest przeciwna rządom Viktora Orbána, ale i na prowincji świadomość konsekwencji działań Fideszu staje się coraz większa przed przyszłorocznymi wyborami.

Firma

Blockchain zmienia rynek pracy i edukacji. Poszukiwane są osoby posiadające wiedzę z różnych dziedzin

Zapotrzebowanie na specjalistów od technologii blockchain dynamicznie rośnie – nie tylko w obszarze IT, ale również w administracji, finansach czy logistyce. Coraz więcej uczelni wprowadza programy związane z rozproszonymi rejestrami, które wyposażają studentów w umiejętności odpowiadające wymogom rynku.

Partner serwisu

Szkolenia

Akademia Newserii

Akademia Newserii to projekt, w ramach którego najlepsi polscy dziennikarze biznesowi, giełdowi oraz lifestylowi, a także szkoleniowcy z wieloletnim doświadczeniem dzielą się swoją wiedzą nt. pracy z mediami.

![Nestlé w Polsce podsumowuje wpływ na krajową gospodarkę. Firma wygenerowała 0,6 proc. polskiego PKB [DEPESZA]](https://www.newseria.pl/files/1097841585/fabryka-nesquik_1,w_85,r_png,_small.png)

.gif)

|

| |

| |

|